Are you planning to move into the San Francisco Bay Area in 2024? Do you…

California Dream For All Program Offers Loans for First-Time Buyers

The California Housing Finance Agency (CalHFA) has rolled out a new program to help first-time home buyers in California cover the cost of a down payment and closing costs.

Eligible home buyers who meet all of the program requirements could qualify for a loan of up to 20% of the purchase price. This money can be put toward the down payment and closing costs and repaid years later, once the homeowner sells or refinances the property.

There are limited funds dedicated to this program, which means it will likely be short-term in nature. So we are doing everything we can to put the word out about this unique and helpful first-time home buyer program.

Below, we have provided an overview of the requirements, features, and other pertinent details. Feel free to contact us if you have questions about qualifying for this program.

Introducing the California ‘Dream For All’ Program

The California Housing Finance Agency (an independent California state agency within the state’s Department of Housing and Community Development) recently announced a new loan program for first-time home buyers. The program is officially known as the “Dream For All Shared Appreciation Loan Program” — or the Dream for All loan program for short.

This program is designed to help first-time home buyers in California overcome the upfront hurdles associated with a home purchase. Specifically, it offers financing that buyers can put toward their down payment and closing costs.

The California Dream For All program offers eligible first-time buyers a “shared appreciation loan” equaling up to 20% of the home’s purchase price. It’s referred to as a shared appreciation loan, because the homeowner would later repay the loan through property appreciation and the proceeds earned from selling the house.

This is a pretty big deal, and for two reasons:

- California is an expensive real estate market. Because of this, first time home buyers often have a hard time saving up enough money for their down payment and closing costs. So this program could make homeownership available to people who wouldn’t otherwise be able to achieve it.

- The 20% loan amount issued to buyers could add up to a sizable amount of money. The current median home value in California is around $700,000, as of spring 2023. A home buyer receiving 20% of that amount (through the Dream for All program) would end up with another $140,000 for the down payment and closing costs.

Basic Requirements for This Program

CalHFA has issued a detailed handbook that explains the minimum requirements for first-time home buyers who wish to receive a Dream For All loan. The basic requirements are as follows:

- The borrower must be a first-time home buyer in California (as defined in the next section).

- The borrower can either be a citizen or other national of the United States, or a “qualified alien” as defined by section 1641 of the U.S. code.

- The borrower must also meet certain credit score and income requirements outlined in CalHFA’s first mortgage loan program.

- Home buyers must also undergo an approved education course. These programs are designed to educate buyers about mortgage loans, homeownership, and the Dream For All program in particular.

Definition of a ‘First-Time’ Home Buyer

Within the context of this program, the term “first-time home buyer” can be a bit misleading. Most people think of a first-time buyer as someone who has never purchased a house in the past. But that’s not the case here. In fact, this program has a much looser definition of the term.

The Dream for All Loan Program defines a California first-time home buyer as someone “who has not had an ownership interest in any principal residence or resided in a home owned by a spouse during the past three years.”

So, for example, a person who has owned a home in the past but has been renting for the past three years could potentially qualify for this program. Technically speaking, they are not a first-time buyer since they’ve owned a property in the past. But they would meet the three-year rule for this particular program, allowing them to qualify for a loan. That’s an important point, so we wanted to clarify.

There are also some owner occupancy requirements for the program. To qualify for a Dream For All first-time buyer loan, the borrower must occupy the property as their primary residence within 60 days of closing. In other words, it cannot be used for a vacation home you won’t actually reside in full-time.

Additionally, non-occupant co-borrowers and co-signers are not allowed under this program.

When You Would Repay the Loan

The great thing about this program is that home buyers do not have to repay it while they are living in the home. They could repay the debt later on, based on the equity they have gained during their time of homeownership.

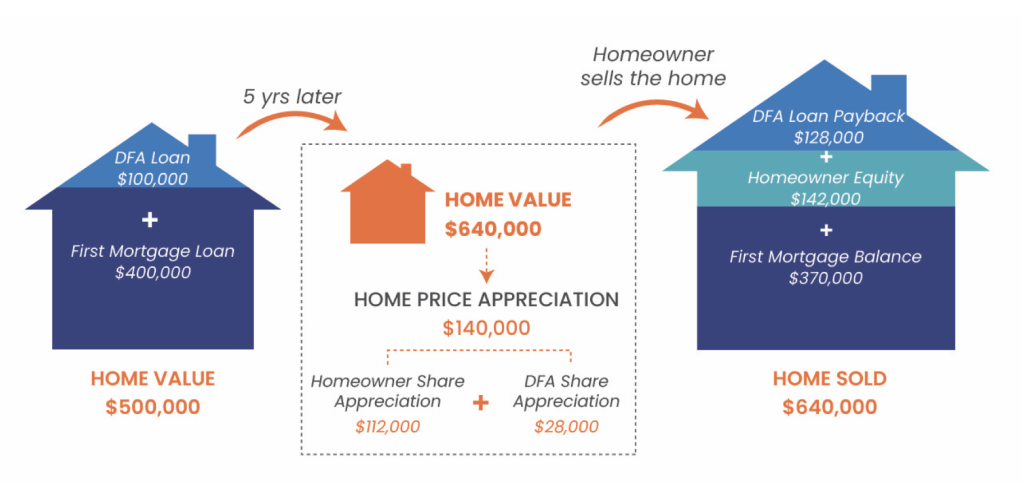

The graphic below was provided by CalHFA to illustrate how the repayment process works, based on appreciation earned during the time of homeownership.

As the Dream For All loan program handbook explains, repayment of the principal loan amount (and any share of the appreciation) would be due at the earliest of the following events:

- Transfer of title

- Sale of the property

- Payoff of the first loan

- Payoff of the subordinate loan principal balance

- Refinance of the first loan – see Refinance and Re-subordination section

- The formal filing and recording of a Notice of Default (unless rescinded)

Have Questions About the Program?

We are excited about this program, because it could help many first-time buyers in California who wouldn’t otherwise be able to make a purchase. We have reviewed all of the program requirements and can answer any questions you have about it.

Bridgepoint Funding is located in the Bay Area but serves the entire state of California. We offer a broad range of home loan options and can help you choose the best financing strategy for your situation. We can also help you determine if you are qualified for the California Dream For All loan program. Please contact our staff for assistance.