In a previous article, we explored some of the scenarios where a home buyer in…

California Home Buying Process: A Beginner’s Guide

This guide provides a detailed walk-through of the home buying process in California and is geared toward first-time buyers in particular. We’ll start with the basic steps that occur during this process, followed by some frequently asked questions.

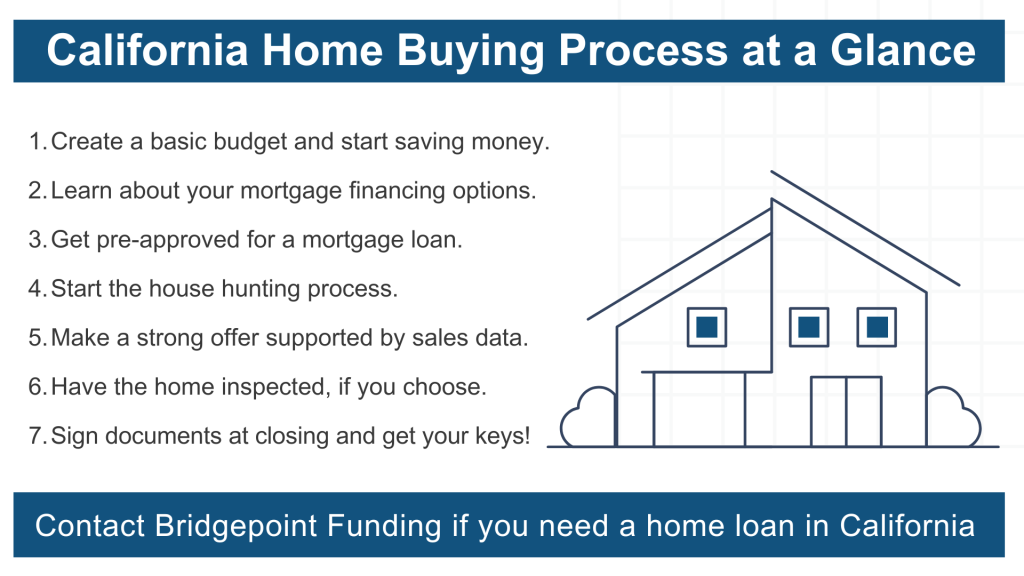

California Home Buying Process at a Glance

In California, the home buying process can vary from one buyer to the next. After all, individual buyers have different circumstances, goals, and priorities. But despite those differences, the journey usually includes the following steps.

Step 1: Create a budget and start saving money.

When buying a home in California, you’ll likely have to pay for closing costs. These costs include a variety of mortgage-related and third-party fees, and can easily add up to thousands of dollars.

So one of the best things you can do right now is to start saving money. You’ll also want to create a basic home-buying budget, to identify the maximum monthly payment you’re comfortable with.

Step 2: Research your local real estate market.

Real estate market conditions can change dramatically from year to year, and also from one city to the next. Some markets might favor sellers, while others are more “buyer-friendly.”

So, before attempting to buy a home in California, you’ll want to conduct some local housing market research. Use the internet to research local home prices, inventory levels, sales activity, etc. This will pay off later, when you’re ready to start the house hunting process.

Step 3: Learn about your mortgage options.

For those buyers who have to rely on mortgage financing, home loan research is the next step in the home buying process.

Fixed-rate vs. adjustable. Conventional vs. government-backed. Conforming vs. jumbo. You have a lot of options! And they all have certain pros and cons you need to know about.

To learn more, check out our guide to the different types of mortgage loans.

Step 4: Get pre-approved for a mortgage loan.

Mortgage pre-approval can help prepare you for the house hunting process, which is step #5 below.

During pre-approval, you’ll find out how much you’re able to borrow with a mortgage loan. This knowledge can help you tailor your home search to a specific price range, making the process more efficient.

Having a pre-approval letter from a mortgage company could also make sellers more inclined to accept your offer. It shows that you’ve been screened by a lender and will likely be approved for a loan.

Step 5: Start the house hunting process.

You’ve established a budget. You’ve researched the different types of mortgages. You’ve been pre-approved by a lender.

Now it’s time for the most exciting part of the process. It’s time to look at houses!

House hunting is one of the key steps in the California home buying process. It can also be a little intimidating, if you’ve never been through it before. So we’ve created some guides to help you navigate the process.

To learn more, check out our step-by-step house hunting guide.

Step 6: Make an offer on a house.

Once you’ve found a home that meets your needs and falls within budget, you’re ready to make an offer. This is another important step in the California home buying process, and for obvious reasons. It determines how much you’ll pay for the property, along with other details like the closing date, contingencies, etc.

When making an offer, use recent sales data from similar homes and seek advice from your agent. In a competitive market, you might only get one chance to submit an offer on a particular home.

Step 7: Have the home inspected (optional).

Home buyers in California are not required to have an inspection before purchasing a home. But it usually makes sense to do so.

A home inspection will help you understand the true condition of the house you’re buying, as well as potential repairs that might be needed. This can give you peace of mind and help you avoid unpleasant surprises.

As a buyer, you also have the option to include an inspection contingency within your contract. This allows you to back out of the deal if you’re not satisfied with the inspection results, without sacrificing your earnest money.

Step 8: Finalize the closing and move into your house!

From a buyer’s perspective, closing represents the final step in the California home buying process. This is where you sign all of the finalized documents relating to your mortgage loan, property transfer, taxes, etc.

You’ll also pay your closing costs and down payment, usually in the form of a cashier’s check or wire transfer. These days much of this process can be conducted remotely. But you might have to visit the escrow company’s office at some point for notary witnessing.

To learn more, check out our step-by-step guide to the closing process.

FAQs About Buying a Home in California

Now that we’ve explained the home buying process in California, you probably have even more questions about it. If you have questions about mortgage loans, in particular, you can contact our staff for help.

Otherwise, check out these frequently asked questions about buying a home in California.

1. What are the first steps when buying a home?

If you’re planning to use a mortgage loan, you can get pre-approved to find out how much you are able to borrow. This can help you narrow your housing search to a specific price range.

It’s also wise to get a basic home-buying budget on paper, before entering the market. You can do this simply by looking at your current income and debts, to determine how much of a monthly housing payment you can comfortably manage.

Lastly, spend some time researching the local real estate market where you plan to buy a home. Housing market conditions in California can vary depending on the location. Some markets are more competitive than others, while others have more inventory and fewer buyers. So you need to find out what’s happening in your area.

2. How does the rest of the process unfold?

Once you have your financing lined up, you can start the house hunting process.

When shopping for a home, it’s important to be open-minded, flexible and realistic. It’s rare for a home buyer to get everything they want in a house, within their budget. You will likely have to make compromises in terms of the location, features, or other aspects of the home.

Once you find a house that meets your needs, you can submit a purchase offer that includes a specific price and closing date. The seller can either accept your offer, reject it, or make a counteroffer by adjusting the price or other terms.

If the seller accepts your offer, you would go back to your lender with a copy of the purchase agreement. Then you will go through the mortgage underwriting process. The underwriter will ensure that the property and the borrower meet all applicable requirements, based on the type of loan being used.

After all of this, you will move on to the closing stage. You’ll sign all of the finalized documents relating to the sale of the home, pay your closing costs and down payment, and receive the keys to your new home.

3. How much do I need for a down payment in California?

The amount of money you have to put down will vary depending on the type of home loan you use.

For a regular or conventional mortgage, the minimum down payment is usually 3% of the home value. The FHA loan program allows borrowers to put down as little as 3.5%, while VA loans for military members allow for 100% financing.

In some cases, a larger down payment might be required. This is often the case for so-called jumbo mortgages that exceed the official loan limit within a particular county.

4. What are the closing costs associated with buying a home?

In California, home buyers typically pay somewhere between 1.5% and 5% of the purchase price in closing costs. These costs can include a variety of mortgage-related and third-party fees. They include such things as mortgage application fees, government recording fees, home appraisal fees, and other costs relating to the transfer of property.

5. Are home inspections and appraisals required in California?

If you’re planning to use a mortgage loan when buying a house in California, the lender will likely require a home appraisal to be performed. The appraiser will review the property being purchased, as well as recent sales in the area, to determine the current market value of the home.

The home inspection is a separate process, during which an inspector will evaluate the condition of the property. In California, inspections are not required as part of the home buying process. But it can still be a wise investment.

6. Do I need homeowners insurance to buy a house in California?

All home buyers can benefit from having a homeowners insurance policy. A house is a major investment, so you want to ensure that it’s protected from damages and liabilities.

A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft or vandalism, or damage caused by a weather event such as lightning, wind, or hail.

If you’re using a mortgage loan, the lender will require you to have a homeowners insurance policy in place prior to closing. You will probably be asked to bring a copy of the policy to the closing, for verification.

7. Do I need to use a real estate agent when buying a home?

Home buyers in California are not required to use a real estate agent, and some choose to go it alone. But there are some major benefits for having professional help.

A real estate agent can help you navigate every step of the buying process. They know how to evaluate the list price, put an effective offer on paper, negotiate with the seller, and keep the process on track.

Ultimately, you have to ask yourself if you are comfortable handling these things on your own, or if you would be better off having a professional guide you.

8. Do I need to make an earnest money deposit?

In the California real estate market, it’s common for home buyers to submit an earnest money deposit when making an offer on a house.

This deposit shows the seller that you are serious about buying their property. Having an earnest money deposit could increase the chance that the seller will accept your offer, especially in a competitive market.

If the sale goes through, the earnest money gets applied to the purchase price. If you back out of the sale for some reason, you might put your earnest money deposit at risk.

This is why some home buyers choose to include contingencies within their purchase agreements, such as the appraisal contingency. They do it to protect their deposit money in certain scenarios.

9. What type of mortgage loan should I use?

Home buyers in California have many different mortgage loan options to choose from. To find the best one for you, you’ll need to consider your current financial situation and long-term goals.

Borrowers with limited funds for a down payment often use FHA loans, or a conventional loan with mortgage insurance. Both of these options allow you to make a down payment below 5%.

Military members and veterans can benefit from the VA loan program, which allows them to buy a house with no down payment whatsoever.

If you are buying a more expensive property that exceeds the government-imposed loan limits for your county, you will likely need to use a jumbo mortgage loan. These loans are available in amounts well over $1 million.

10. What are the benefits of buying a home in California, versus renting?

Buying a home in California can have several advantages over renting, especially in the long run.

Owning a home allows you to build equity and invest in an asset that can appreciate in value over time, potentially providing a valuable return on investment.

Renting a property, on the other hand, provides no opportunity for building equity and requires ongoing monthly payments that don’t contribute to any form of ownership.

Additionally, owning a home can offer stability and the ability to personalize your living space. You will have the freedom to make changes and renovations as desired. Homeownership in California might also provide tax benefits, such as deductions for mortgage interest and property taxes.

11. What happens at closing?

The closing process represents the final step in a home purchase. This is when the buyer and seller sign all necessary documents to transfer ownership of the property. It typically takes place at a title company or an attorney’s office and involves several key steps.

First, the buyer will review and sign a variety of legal documents, such as the mortgage agreement, promissory note, and truth in lending statement. Next, the buyer will provide a certified check or wire transfer for the down payment and closing costs, which will be deposited into an escrow account.

Finally, the seller will sign the deed, transferring ownership of the property to the buyer, and the buyer will receive the keys to their new home.

We hope you’ve enjoyed this guide to the home buying process in California. If you have mortgage-related questions or would like to get pre-approved for a loan, please contact our staff!