When buying a home in California, or even when simply researching the process, you'll eventually…

How to Use Down Payment Gift Money to Buy a Home in California

For most home buyers in California, the down payment represents the biggest upfront obstacle on the path to homeownership.

Fortunately, most home loan programs allow borrowers to use gift money from a third party, to help cover their down payment expense. This can be a huge help for those who have limited funds in the bank.

Here are five things to know about using down payment gift money in California:

- A down payment gift is money given to the borrower by an approved third party.

- Most mortgage programs allow it, and that includes FHA, VA, and conventional.

- The money can also be applied to the home buyer’s closing costs, if necessary.

- But it must truly be a gift, and not a peer-to-peer personal loan.

- The donor must sign a letter stating they do not expect any kind of repayment.

The rest of this guide explains what down payment gifts are and how you can use them when purchasing a home in the state of California.

California Down Payment Gifts Explained

If you can’t afford the minimum required down payment for a home purchase in California, you should consider using gift money. It could give you that extra boost needed to meet the lender’s requirements.

When buying a home in California, you don’t necessarily have to come up with the entire down payment from your own funds. You could obtain a financial gift from a family member or other approved source, reducing your own out-of-pocket expense.

Definition: A down payment “gift” is money given from a third party to a home buyer, intended to be used for the down payment and closing cost expenses.

These days, most of the mortgage products available in California allow for down payment gifts. That includes FHA, VA, and conventional home loans. But the rules can vary from one program to the next, so you’ll need to do some homework.

Many home buyers in California don’t even realize they can use someone else’s money for the minimum investment. As a result, they often think that buying a home is beyond their financial reach.

We are publishing this article to increase awareness regarding down payment gifts in California, and the benefits to using them.

How the Process Works in California

As mentioned above, the specific rules and requirements for down payment gifting can vary among lenders. The type of home loan you’re using also makes a difference.

Despite these minor variations, the gift money process in California usually works like this:

Step 1: Confirm the rules with your lender.

Before accepting any gift money, the buyer should confirm the lender’s requirements for using it as part of the down payment. Lenders often have specific guidelines, including acceptable sources of gift money, supporting letters, etc.

Step 2: Get a gift letter from the donor.

The person giving the money needs to provide a letter that confirms the money is a gift and not a loan. The letter should include the donor’s name, relationship to the buyer, and the exact amount given. It should also state that the donor does not expect or require any form of repayment.

Step 3: Transfer the money into the buyer’s account.

The donor transfers the gift money into the buyer’s bank account. This helps create a record for the lender to verify the origin of the funds. In some cases, the donor might be able to give the money directly to the title company. It varies.

Step 4: Document the transfer, if applicable.

The buyer should keep copies of bank statements or other documents showing the transfer from the donor’s account to theirs. These documents may be needed to prove that the gift money came from an acceptable source.

Step 5: Complete the down payment.

Once the lender verifies everything, the gift money can be used as part of the down payment on the home purchase. In the state of California, buyers typically pay for their closing costs and down payments on closing day or shortly before.

Potential Benefits of Using Gift Money

Home buyers in California can benefit from using a down payment gift in several ways. Here are some of the biggest advantages.

- Lower out-of-pocket costs: Receiving gift money reduces the amount you need to save up for a down payment, making it easier to afford a home purchase in California.

- Increased buying power: Being able to put more money down could help you qualify for a larger loan amount. This in turn would give you more options to choose from when house hunting.

- Avoiding PMI: If you use gift money to put down at least 20% of the purchase price, you could avoid paying private mortgage insurance (PMI). This could save you hundreds of dollars per month.

- Faster homeownership: Gift money could help you buy a home in California sooner rather than later, by reducing the amount you have to save on your own.

Note: The mortgage process can vary from one borrower to another, for a number of reasons. So some of the benefits stated above might not apply to your particular situation.

A Closer Look at the Letter Requirements

If you plan to use a down payment gift to buy a home in California, you’ll probably have to obtain a letter from the person who is providing the funds. This is true for both FHA and conventional mortgage loans. Most loan programs that allow down payment gifts require such a letter.

At a minimum, the donor’s letter must include the following components:

- The actual or the maximum dollar amount of the gift being provided

- The donor’s statement that no repayment is expected

- The donor’s name, address, telephone number, and relationship to the borrower

As mentioned, the purpose of this letter is to clarify that the donor does not expect any form of repayment. In other words, the letter states that the down payment gift money is truly being gifted and does not constitute a short-term loan.

Fortunately, writing such a letter is a simple matter. Your mortgage lender can provide you with a template, which the donor can fill in with the pertinent information. It’s a straightforward but necessary document.

Overcoming Obstacles to Homeownership

In California, there are many financially responsible, hard-working people who are good candidates for a mortgage loan, but with one exception. They don’t have the funds needed for a large down payment.

Fortunately, there are many options and mortgage programs that can help you overcome this obstacle. We just talked about one of them. Down payment gifts give California home buyers a way to purchase a house with less money out of their own pocket.

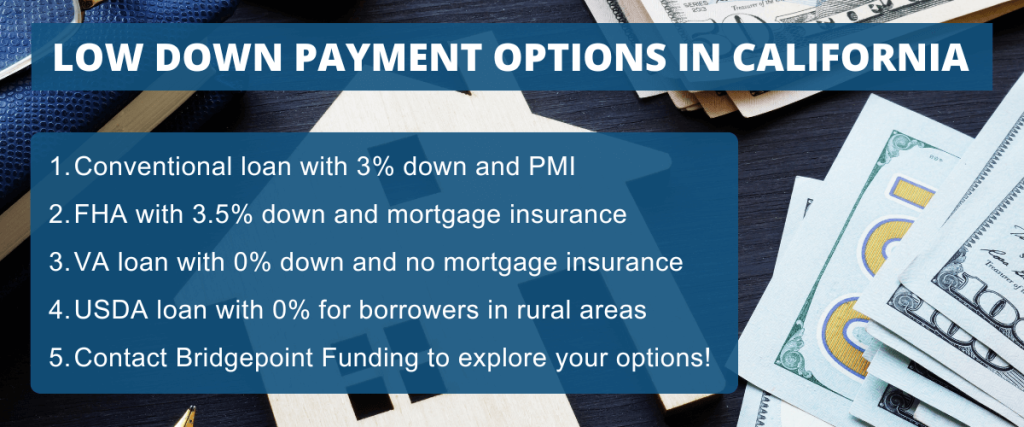

You should also know that certain mortgage loans allow for lower down payments than others:

- With an FHA-insured mortgage, California home buyers can put as little as 3.5% down.

- Some conventional loans offer down payments as low as 3%.

- And then there’s the VA program for military folks, which offers 100% financing.

There is a common misconception that home buyers have to put down at least 20% when buying a home in California. But that’s rarely the case. In most cases, that kind of investment is only needed with jumbo loans used for expensive properties.

The bottom line: By choosing a mortgage loan program with a lower down payment requirement (and possibly combining it with gift money), California home buyers can greatly reduce their upfront, out-of-pocket expense.