Jumbo loans are a popular mortgage option among home buyers in California, due to the…

How the FHA Loan Process Works in California, and How Long It Takes

This is the latest in a series of articles designed to educate California home buyers on the FHA loan program. In previous articles, we looked at the basic document requirements for this program and the minimum down payment.

Today, we will zoom out and look at the broader FHA loan process in California. We’ll cover all of the major steps, from the initial loan application to the final closing.

Summary: This guide is arranged into two parts. Part 1 explains how the FHA loan process works. Part 2 explains how long the process takes and other timeline-related matters.

Part 1: The FHA Loan Process in California

In most regards, the FHA loan process is similar to what borrowers go through when using a conventional or non-government-backed loan. Here are the basic steps that take place during the FHA mortgage process in California, from a buyer’s perspective:

1. The borrower submits a loan application.

The loan application is usually one of the first steps in this process. The borrower will fill out and submit a standard loan application form. This is actually the same form used for conventional mortgages. You can find examples online by doing a search for “Uniform Residential Loan Application.”

The FHA loan application asks for a variety of information about the borrower and their financial situation, along with property details. It’s one of the first documents a borrower will submit during the FHA loan process in California.

2. The home buyer gets pre-approved for an FHA loan amount.

Pre-approval is typically the next step in the FHA loan process. In some cases, it happens in conjunction with the application mentioned above.

Mortgage pre-approval occurs when a bank or lender reviews a borrower’s financial situation and tells them how much they are able to borrow. The lender will then issue a pre-approval letter that you can use when making an offer on a house.

Pre-approval is an important step in the FHA loan process in California, and for multiple reasons. For one thing, it allows you to tailor your housing search to a specific price range.

A pre-approval letter might also improve the chances of you getting your offer accepted. In fact, most sellers will request to see a pre-approval letter from a potential buyer who is using a mortgage loan.

3. The house hunting process begins.

After getting pre-approved for an FHA loan, you can begin shopping for a house that meets your needs. House hunting can involve many different search methods, including property listing websites, mobile apps, neighborhood tours, and searches conducted through the Multiple Listing Service (MLS).

4. You make an offer on a house.

Once you’ve found a home that meets your needs and falls within budget, you can make an offer to purchase it.

The purchase agreement usually indicates the type of financing being used. So in this case, it would inform the seller that the buyer is using an FHA-insured home loan to finance their purchase.

This is where it helps to have an experienced real estate agent on your side. A savvy agent will be able to evaluate the asking price and advise you on the best path forward based on local market conditions.

5. The home gets appraised to determine its value and condition.

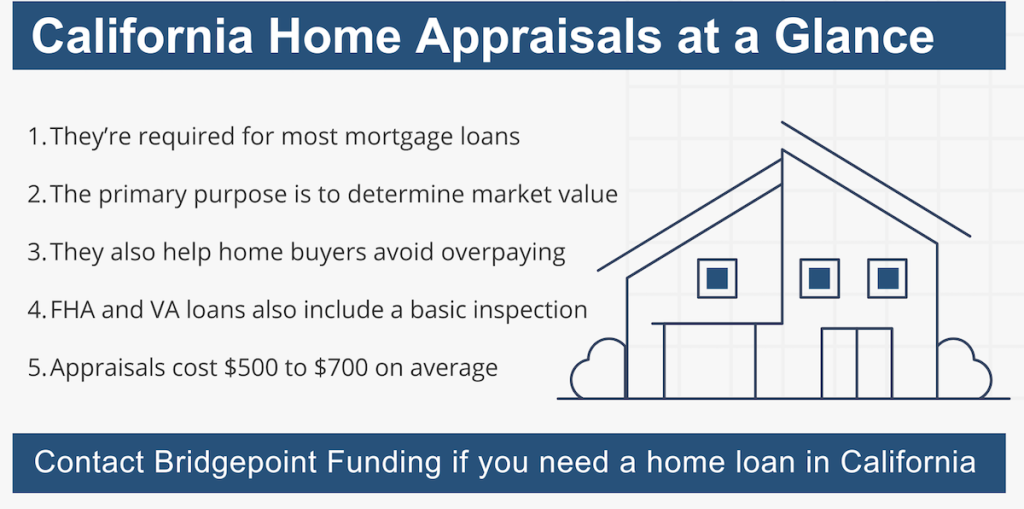

Here’s where the FHA loan process in California differs slightly from conventional mortgage financing. In both cases, the mortgage lender will have the home appraised to determine its current value. But the FHA appraisal goes a step further.

In accordance with HUD guidelines, the appraiser must also ensure that the home being purchased meets the minimum property requirements. That’s a key distinction when it comes to the FHA loan process.

- When a conventional mortgage product is being used, the appraiser is primarily concerned with the market value of the property.

- With an FHA loan, the appraiser will determine the market value while also examining the overall condition.

6. The buyer has the home inspected, if desired.

As a home buyer, you have the option of hiring your own inspector to perform a more detailed inspection of the property. This is separate from the basic property inspection that’s “built into” the appraisal and mentioned above.

The Federal Housing Administration does not require home buyers in California to have an inspection when using an FHA loan. It’s optional.

But in many cases, it makes sense to have the property inspected before buying it. It gives you better insight into the home’s true condition, including potential repairs.

7. The underwriting process begins.

Underwriting is another important step in the FHA loan process for California home buyers. It involves a thorough review of all loan documents and related information.

The goal here is to ensure that the borrower and the property being purchased meet all applicable guidelines and requirements, including the FHA’s rules.

During the FHA loan process, the mortgage underwriter might need to request additional information from the borrower. For instance, they might need a letter of explanation for a specific bank transaction, a change of employment, etc.

8. The buyer completes the closing and becomes a homeowner.

From the borrower’s standpoint, closing represents the final step in the FHA loan process. During the closing, the home buyer / borrower will sign a lot of documents and pay whatever closing costs they owe.

The closing costs for FHA loans are comparable to those applied to other types of mortgage loans. These costs can vary based on a number of factors, including whether or not the borrower uses mortgage discount points.

Generally speaking, home buyers in California who use an FHA loan can expect to pay anywhere between 2% and 5% of the purchase price in closing costs. You’ll receive an estimate of your closing costs upfront and a finalized list a few days before you close.

Part 2: How Long the Process Takes, on Average

According to data provided by the mortgage software company Ellie Mae (now called ICE Mortgage Technology), the FHA loan process in California and nationwide can take around 45 days.

That’s from the initial loan application to the actual funding, which happens on or near closing day.

The average 45-day timeline applies to buyers who have already found a home and signed a purchase agreement with the seller. House hunting can add time onto the process, as explained below.

When it comes to processing, there are some minor differences between government-backed and conventional home loans. For example, a borrower using a conventional mortgage can choose whether or not they want a property appraisal. But with the FHA and VA loan programs, an appraisal is mandatory.

Despite these variations, all home loans in California take roughly the same amount of time to process. So an FHA-insured mortgage loan won’t necessarily “slow you down,” when it comes to buying a home.

The House Hunting Variable

When it comes to the FHA loan process in California, house hunting is one of the biggest variables. After all, you can’t close the deal and receive funding until you’ve actually found a home to purchase.

Consider the difference in these scenarios:

- If you’ve already found a home and have a signed purchase agreement, you’re ready to move on to the appraisal and underwriting stage. The home will be appraised to determine its current market value. Then, your application file will move along to the underwriter for a thorough review.

- If you haven’t yet found a house (or even begun looking for one), it’s a different timeline altogether. Now you’re adding in the house-hunting process, which could take weeks or months depending on local inventory conditions.

The 45-day time range mentioned earlier is just an average based on years’ worth of mortgage industry data. The process might take longer in some cases, especially if a home buyer has trouble finding a house.

Keeping the Process on Track

In California, the FHA loan approval and closing process can vary from one borrower to the next, for a number of reasons. Variables that can affect the timeline include:

- The amount of time spent shopping for a home

- Additional requests from the mortgage underwriter

- Appraisal-related issues including required repairs

- The amount of documents that are needed

As a borrower, you can expedite the process by working with an experienced lender and providing all requested information in a timely manner. Staying in contact with your loan officer can also help to ensure a smooth transaction.

At Bridgepoint Funding, we go above and beyond to help our clients close on time and with as few hurdles as possible. We’ve been processing FHA loans for nearly 20 years and have a strong record of smooth transactions.