Jumbo loans are a popular mortgage option among home buyers in California, due to the…

Credit Score Requirements for California FHA Loans

FHA loans are a popular mortgage financing option among home buyers in California. They’re particularly popular among first-time buyers who don’t have a lot of cash saved for a down payment.

This article explains the minimum credit score requirements for an FHA loan in California and answers common questions from home buyers.

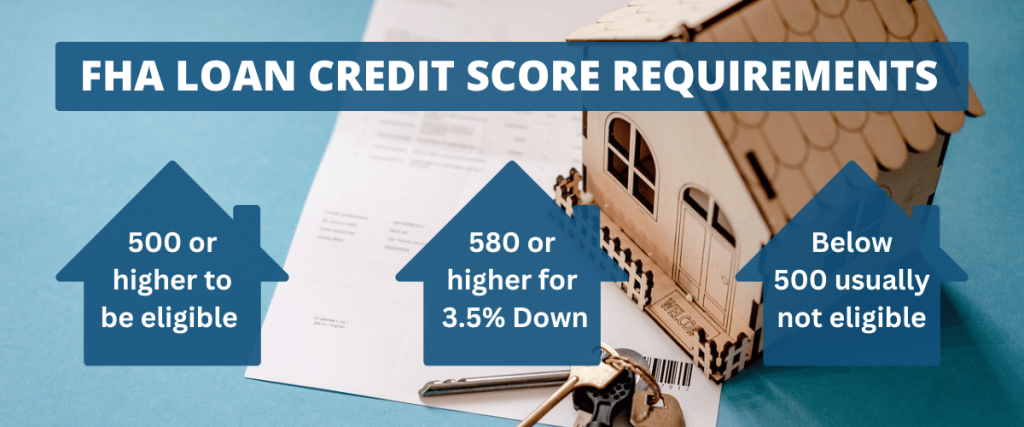

At a glance: According to HUD guidelines, borrowers seeking an FHA loan must have a score of 500 or higher to be eligible. Additionally, you’ll need a 580 or higher to qualify for the minimum 3.5% down payment.

FHA Loans Are Insured by the Government

Unlike a regular or “conventional” home loan, FHA loans are insured by the federal government. This insurance protects lenders from certain financial losses, allowing them to offer more flexible criteria such as a 3.5% down payment.

This program is managed by the Federal Housing Administration, a government agency that falls under the Department of Housing and Urban Development (HUD).

Key point: HUD establishes the minimum credit score requirements for California FHA loans. But individual mortgage lenders can set their own specific requirements as well, and these can vary.

Minimum Credit Score Requirements in California

Most of the borrower requirements for FHA loans can be found in HUD Handbook 4000.1 (a.k.a., the Single Family Housing Policy Handbook). But you don’t have to dig through this 1,000-page document to find the relevant portions. We’ve extracted them for you.

Here’s what you should know about California FHA loan credit score requirements:

- According to official guidelines, borrowers need a Minimum Decision Credit Score (MDCS) of 500 or higher to be eligible for an FHA-insured mortgage loan.

- If you want to enjoy the low 3.5% down payment option associated with this program, you’ll probably need a score of 580 or higher.

- The MDCS is the “score reported on the borrower’s credit report when all reported scores are the same,” as the handbook states.

- When three different scores are reported, the middle score becomes the MDCS and will be used for FHA loan qualification purposes. Where two differing scores are reported, the MDCS is the lowest score.

Key point: So there’s a two-tiered requirement in place, with 500 and 580 being the key thresholds for program eligibility and the 3.5% down payment, respectively.

Why Do These Scores Matter for Lenders?

Credit scores are three-digit numbers derived from information found within a person’s credit reports.

In the U.S., these reports are maintained by three companies: Experian, TransUnion and Equifax. They contain information relating to a person’s borrowing history (personal loans, credit cards, etc.).

The information compiled within your credit reports gets run through a computerized algorithm to produce a three-digit score that ranges from 300 to 850.

Your credit score shows how you have borrowed and repaid money in the past.

- A higher number indicates that a person typically pays his or her bills on time.

- A lower number suggests that a person has had some difficulty repaying debts in the past.

This is why HUD has established minimum credit score requirements for FHA loans. They do it for risk-management purposes and to limit their losses.

Note: A higher credit score could also help you secure a lower interest rate on your loan, saving you money on long-term interest costs.

Frequently Asked Questions From Borrowers

As a quick-reference resource, we have compiled and answered some of the most common questions people ask about FHA loans and credit scores.

1. What is the minimum credit score required for an FHA loan?

The Federal Housing Administration mortgage program requires borrowers to have a credit score of 580 or higher when making a down payment of at least 3.5%. If your score falls between 500 and 579, you could still qualify but would need to put down 10% or more.

2. Can I get an FHA loan with a credit score below 500?

Borrowers with scores below 500 typically do not qualify for this program. The FHA uses this threshold as the baseline for approval. Plus, most lenders will not approve loans for borrowers with a score this low. But there are proactive steps you can take to improve your credit score.

3. Does my score also affect the interest rate I receive?

Yes, your credit score can influence the interest rate you receive on your FHA loan (or any type of mortgage for that matter). Generally, the higher your score, the more likely you are to qualify for a lower interest rate. But there are other factors that influence the rate as well.

4. Can I qualify for an FHA loan with no credit history?

It’s possible to qualify for an FHA loan with no credit history. But borrowers might have to provide alternative documents that prove their ability to repay the loan. For instance, a borrower could document their timely payments on rent, utilities, or other bills.

5. What can I do to improve my score, if it’s too low?

According to experts, consumers who want to improve their credit scores should focus on paying down their existing debts and making sure all bills are paid on time. Try to avoid opening new credit lines, and review your credit report for errors that might be lowering your score. Improving a score can take time, so it’s best to start sooner rather than later.

6. What other factors do mortgage lenders consider?

Credit scores are an important part of the FHA mortgage qualification process. But there are other factors as well. Mortgage lenders will also consider your income, employment history, debt-to-income ratio, and the property you intend to buy. The goal is to ensure that you can afford the loan and are likely to repay the debt.

7. How do lenders calculate my score if I have more than one?

Official guidelines require lenders to use the median or middle of three scores to determine borrower eligibility. When only two scores are available, the lower number will be used. The FHA handbook refers to this as the Minimum Decision Credit Score (MDCS). The borrower’s MDCS must be 500 or higher for eligibility, and 580 or above for the 3.5% down payment option.

8. Is there a benefit to having a score higher than the minimum?

A strong credit profile could benefit you in several ways. While the FHA only requires a score of 580 to qualify for the 3.5% down, a higher number could be advantageous. It might help you qualify for a lower interest rate, reducing your monthly payments and saving you money over the long term.

9. Do all mortgage lenders have the same requirements?

While the FHA sets minimum guidelines, individual lenders can establish their own stricter requirements. For example, some lenders may require a higher credit score or additional documents to reduce risk. This can vary from one mortgage company to the next.

Ready to Explore Your Mortgage Options?

For some home buyers in California, the FHA loan program offers a flexible and beneficial path to homeownership. It’s one of the most popular mortgage options for this very reason.

But it might not be the best option for all borrowers.

For example, home buyers with excellent credit and a down payment of 20% or more might save money by using a conventional loan.

This is why it’s so important to get professional guidance from a qualified and knowledgeable mortgage professional. It’s the best way to explore your options.

Have questions? We serve borrowers all across the state of California with a wide variety of loan options. Please contact our staff with your financing questions or to apply for a loan!