Self-employment offers a lot of freedom and flexibility. But it can also pose some unique…

California Down Payment Requirements: Conventional, FHA, VA and USDA

Do you plan to use a mortgage loan to buy a home in California sometime in the near future? If so, there’s a good chance you’ll have to make a down payment of some kind.

This guide explains the minimum down payment requirements for some of the most popular mortgage programs in California. We’ll be covering conventional financing, FHA, VA and USDA home loan requirements.

Minimum Down Payment Requirements in California

The minimum down payment for a mortgage loan in California can range from 0% to 3.5% in most cases.

VA mortgage loans for military members and veterans allow 100% financing. The same goes for the USDA home loan program, which is limited to rural borrowers within a certain income range.

FHA loans allow for a down payment as low as 3.5%, while conventional or “regular” mortgage loans typically require 3% or more depending on the parameters.

Here’s a more detailed breakdown based on the type of financing being used:

Conventional Loans: 3% or More for Most Borrowers

A conventional home loan is one that is not insured or guaranteed by the government. The “conventional” label differentiates them from government-backed mortgages offered through the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), and U.S. Department of Agriculture (USDA).

In other words: a conventional loan is a regular mortgage product that’s not directly backed by the government.

If you’re going to use a conventional home loan to buy a house in California, you’ll probably have to make a down payment of at least 3% of the purchase price or appraised value.

Fannie Mae and Freddie Mac, the two government-sponsored corporations that buy home loans from lenders, will purchase mortgage loans with up to 97% of the home value. That’s usually the highest they’ll go in terms of the maximum loan-to-value (LTV) ratio.

In certain scenarios, a home buyer might have to put down more than 3% when using a conventional loan. This is often true for “jumbo” mortgages that exceed the conforming loan limits for the county where the home is located. Borrowers seeking this level of financing might have to put down 10% or even 20%.

Bottom line: The minimum down payment requirement for a conventional loan in California is usually set at 3%, though some borrowers might have to invest more than that.

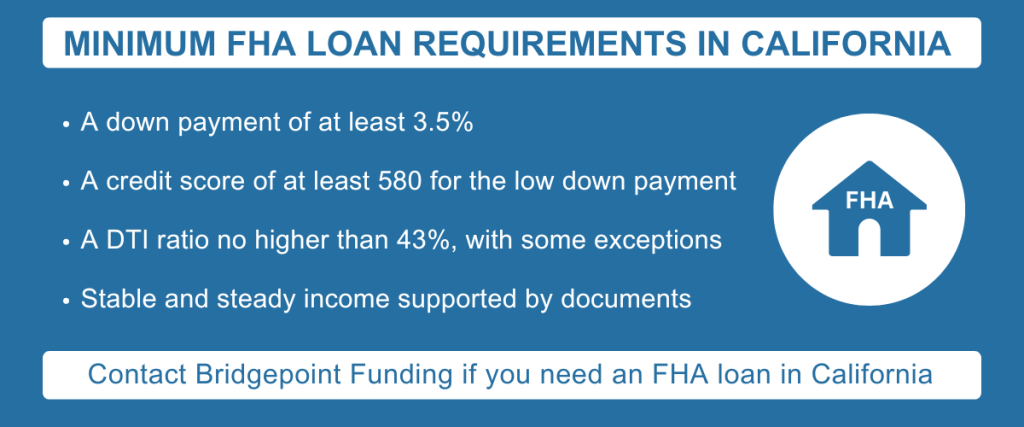

FHA Loans: 3.5% With Credit Score Stipulations

The Federal Housing Administration (FHA) home loan program is popular with home buyers who have limited down payment funds and/or past credit issues. This is a form of government-backed mortgage program where lenders receive some degree of insurance coverage from the government.

As for the down payment requirements, California home buyers who use the FHA loan program usually have to make a down payment of 3.5% or more. That’s the minimum investment required for this particular program.

But there’s a credit score stipulation as well. To qualify for the 3.5% down option mentioned above, borrowers must have a credit score of 580 or higher. Otherwise, they might be required to make a larger investment on an FHA loan, equaling 10% or more.

VA Program Offers 100% Financing for Most Borrowers

VA loans (which are available for military members and veterans) typically offer 100% financing. This means there is no down payment requirement for a California home buyer who uses a VA-guaranteed mortgage loan. That’s a huge benefit for those who are eligible for this particular program.

Here at Bridgepoint Funding, we specialize in VA loans and are always happy to help our military service members and veterans. So be sure to reach out to us if you have questions about this particular program.

USDA Offers 100% Financing for Certain Rural Borrowers

Like the VA program mentioned above, the USDA home loan program also allows eligible home buyers in California to buy a house with no down payment. But the eligibility criteria are fairly strict, limiting this program to a specific group.

In short, you have to live in a designated rural area and meet certain income requirements.

Officially known as the “Section 502 Direct Loan Program,” USDA home loans help low-income borrowers obtain housing in select rural areas. According to the USDA: “No down payment is typically required. Applicants with assets higher than the asset limits may be required to use a portion of those assets.”

To learn more about this unique program, refer to the USDA’s direct home loans page.

Frequently Asked Questions Home Buyers

First-time home buyers in California typically have a lot of questions about down payment requirements and related topics. It’s often one of their biggest concerns. And that’s understandable, given the size of the average down payment in the state of California.

Below, we’ve provided answers for some of the frequently asked questions we receive from buyers:

1. What is a down payment exactly?

As mentioned above, the down payment is money paid in advance toward a home purchase. It is usually paid at closing along with the buyer’s other closing costs. In other words, it’s a percentage of the purchase price that you pay up front.

This will make more sense with an actual example:

Let’s say you are buying a house in California that costs $500,000. You decide to make a down payment of 10%, which comes to $50,000 of the total purchase price. That leaves $450,000 left over. You use a mortgage loan to cover that remaining $450,000.

In the scenario, the home buyer’s investment totals 10% of the purchase price, while the mortgage loan accounts for the remaining 90%. So the loan-to-value (LTV) ratio ends up being 90% in this case.

2. How much of a down payment is required in California?

In the example above, the home buyer chose to make a down payment of 10% on a house purchase in California. But that’s not a hard-and-fast rule.

Some mortgage programs allow borrowers to put down as little as 3% of the purchase price. The VA loan program, which is designed for military members and veterans, allows for 100% financing and zero down payment. And then there’s the FHA home loan program, which requires home buyers in California to make a minimum investment of 3.5% or more.

Key takeaway: Despite common misconceptions, a 20% down payment is rarely needed. Borrowers can often get by with a much smaller investment. It can even be gifted from a family member or some other approved donor.

3. Can I use another loan to cover it?

Generally speaking, you cannot use a loan for the down payment on a house in California. That defeats the purpose. The goal here is for the home buyer to make some level of upfront investment in the property, which reduces the risk for the lender.

Additionally, statistics show that home buyers who make some kind of down payment are less likely to default on their mortgage loans down the road. So it wouldn’t make sense for someone to borrow the money to cover their upfront investment, through a personal loan.

With that being said, there are many different acceptable sources of down payment funds when buying a house in California. You could use money from your personal savings account, your 401(k) or other investments, profits from selling a vehicle, and a number of other sources.

In short, if it’s money or assets you already have, you can probably put it toward the down payment on a home purchase.

You could also use gift money from an approved third-party donor, such as a family member. This is a great way to offset the burden of making a down payment on a house in California. We’ve covered the gift money concept in a separate blog post. So be sure to read that if you want to learn more about this strategy.

4. When do I actually pay it?

In nearly all cases, California home buyers pay their down payment funds on or near the actual closing day. Closing is when you sign all of your documents, pay your closing costs, and eventually receive the keys to your new house. This is usually how the process works, but there can be exceptions to the rule.

5. Does it count toward the purchase price?

Yes. As explained above, whatever amount of money you put down at closing is applied to the overall purchase price. You are literally investing in your own home when you make a down payment on a house in California.

And the more money you invest up front, the less you have to borrow from a bank or lender (and the less interest paid over time).

6. What if I can’t afford the down payment on a house in California?

Most FHA and conventional mortgage loan products require some kind of down payment. The VA and USDA loan programs are an exception to this rule, as they allow for 100% financing. But in a typical home-buying scenario in California, the buyer is required to make some kind of upfront investment.

But what if you can’t afford to put any money down? We’ve mentioned one “workaround” above. For most loan programs, home buyers are allowed to use gift money from a relative, a close friend, or another approved source. So that’s one strategy for borrowers who can’t afford to make a down payment.

There are also some grant programs available through federal and state housing agencies, along with other forms of down payment assistance. But that’s a subject we will be covering in a future blog post.

Mortgage questions? Located in the Bay Area, Bridgepoint Funding serves borrowers across the state of California. We offer a broad range of financing options including conventional, FHA and VA loans. Please contact us if you have mortgage-related questions or would like to start the home loan application process!