This article is part of an ongoing series that answers common questions about different types…

Getting Pre-Approved for a VA Loan in California

Are you eligible for a California VA home loan? Do you plan to buy a home in the near future? If so, it would be wise to get pre-approved for a VA mortgage loan before you start shopping for a house.

The pre-approval process can help you narrow your housing search to a specific price range, while demonstrating to sellers that you have your finances in order.

Here are 5 things to know about getting pre-approved for a VA loan:

- You’ll need to start by obtaining a Certificate of Eligibility (COE) from the VA.

- After that, you can apply for a loan through a VA-approved mortgage lender.

- The lender will request pay stubs, bank statements, W-2s, and other documents.

- Pre-approval determines if you’re qualified for a loan and how much you can borrow.

- It can also make your home search more efficient by narrowing the price range.

We can help! Bridgepoint Funding specializes in the VA home loan program and serves the entire state of California. So please don’t hesitate to reach out if you need assistance.

VA Loan Pre-Approval Explained

So, what is mortgage pre-approval exactly?

Pre-approval is when you work with a mortgage lender before shopping for a home, to find out how much you are able to borrow. The “pre” part distinguishes this process from the final approval, which happens later.

When you get pre-approved for a VA loan in California, the lender will review your financial situation including your income, debts, and credit history. They’ll also request certain documents to verify your financial situation.

The pre-approval process helps determine two things:

- if you’re a good candidate for a VA home loan, and…

- how much you are able to borrow toward a home purchase.

To begin the process, you’ll want to speak to a California mortgage lender that is approved to offer these loans — like us! Bridgepoint Funding is proud to participate in the VA home loan program.

How It Benefits You as a Home Buyer

As a home buyer, you can benefit from the mortgage pre-approval process in several ways:

1. A more efficient home search

How much can you afford to pay when buying a home in California?

To answer this, you first need to determine how much you are able to borrow from the lender. And this is one of the pieces of information you’ll receive during the VA mortgage pre-approval process.

With a maximum price range in mind, you’ll be able to narrow your housing search to the kinds of homes you can actually afford. This can save you time and energy.

If you don’t get pre-approved for a loan, you might spend time looking at properties that are above your price range, without even realizing it. That would be time wasted.

The bottom line: VA loan pre-approval can make your house hunting process more efficient, which is a necessity in a competitive real estate market like California.

2. Identifying and resolving issues

Some home buyers in California sail through the mortgage process without a hitch. Others encounter certain issues that have to be resolved before they can close on their homes.

Which camp do you fall into? This is another benefit of VA loan pre-approval. It helps you identify and resolve potential roadblocks to financing, such as a low credit score, too much debt, etc.

You could be well-qualified for a mortgage loan right now, without any issues. But if you do have an area that needs to be improved in order to qualify for a VA loan, pre-approval will help you identify it early on.

3. Making a stronger offer

When you make an offer on a house in California, the seller will want to know if you have your financing lined up yet.

If you’re a cash buyer, they’ll want to see bank statements verifying that you have the funds. If you’re using a mortgage, they’ll probably ask to see a pre-approval letter.

Getting pre-approved for a VA loan before entering the real estate market will increase the likelihood of your offer being accepted. It shows the seller that you’ve been screened by a lender and found to be a good candidate for a loan.

The takeaway: VA mortgage pre-approval is a logical first step in the home buying process. It helps you identify your target price range and makes you more competitive as a buyer.

Documents Needed to Get Pre-Approved

When you get pre-approved for a mortgage loan (whether it’s VA, FHA or conventional), you’ll be asked for a variety of documents. Most of these documents relate to your finances, for obvious reasons. The documents needed for California VA loan pre-approval will vary slightly from one lender to the next.

At a minimum, you’ll probably need the following documents:

- Certificate of Eligibility (COE). This is a standardized document provided by the Department of Veterans Affairs that tells the mortgage lender you are eligible for a VA-guaranteed home loan. You can request this document online, or we can help you.

- Federal tax returns for the last couple of years. Lenders use these to verify your income history, including self-employment income, deductions, and tax liabilities, providing a comprehensive picture of your financial situation.

- W-2 statements for the last two years. These forms document your wage earnings from employers, allowing lenders to confirm your employment and income stability over the past two years.

- Recent bank statements. These statements verify your current account balances, demonstrate your ability to manage finances, and provide evidence of funds available for a down payment and closing costs.

- Recent pay stubs. These provide a current snapshot of your earnings, allowing lenders to calculate your current income and ensure it aligns with your W-2s and tax returns.

- Retirement account statement, if applicable. These statements show the value of your retirement assets, which can be considered as reserves and contribute to your overall financial strength, potentially influencing loan approval.

Note: This is a partial list of the most commonly requested documents. You might have to provide additional items not listed above, as part of the application and pre-approval process.

We Can Help You, Every Step of the Way

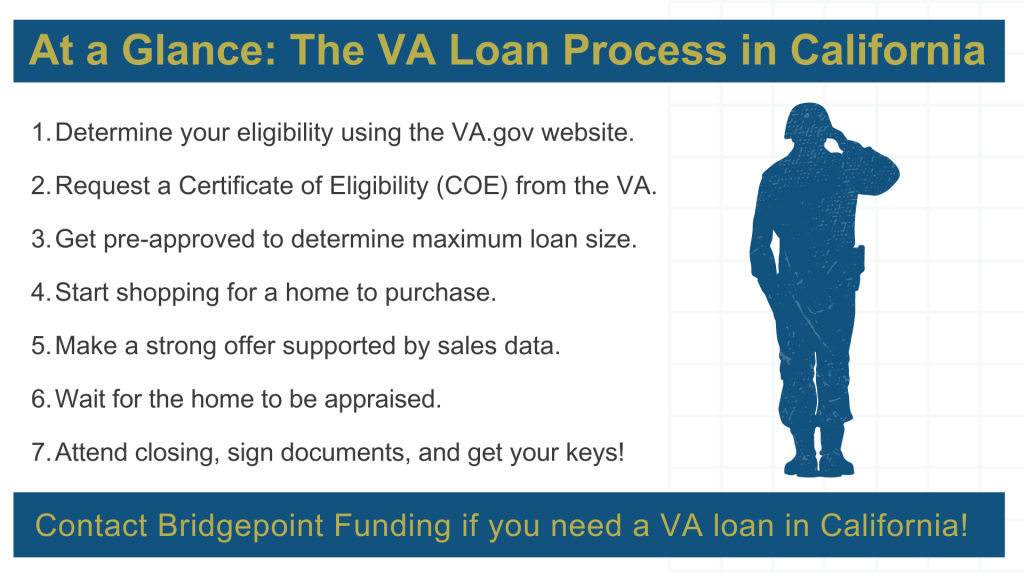

Do you want to use a VA loan to buy a home in California? We can help you with every step of the process. Bridgepoint Funding specializes in the VA home loan program and serves the entire state of California.

Here are some of the ways we can assist you throughout your home buying journey:

- Help you determine your eligibility for the program.

- Help you obtain your Certificate of Eligibility from the VA, to expedite the process.

- Pre-approve you for a specific loan amount to help narrow your search.

- Guide you through the home appraisal and mortgage underwriting process.

- Work closely with other parties to ensure a smooth and timely closing process.

- Deliver your funds on time and in full so you can complete your purchase.

Please contact us if you have questions about the VA loan program or want to get pre-approved.