This article is part of an ongoing series that answers common questions about different types…

VA Loan Home Buying Process In California, Step by Step

The process of buying a home in California with a VA loan is similar to the process when using a “regular” or conventional mortgage. But there are a few additional steps along the way, including some extra paperwork.

This guide walks you through the VA loan process in California, with an explanation of the most important steps along the path to closing. If you have questions, please contact our staff!

The VA Loan Home Buying Process in California

A VA loan is simply a home mortgage loan that receives government backing. They are originated by private-sector banks and lenders, just like “regular” home loans. But they’re guaranteed by the Department of Veterans Affairs.

This government backing is what sets VA loans apart from conventional mortgages.

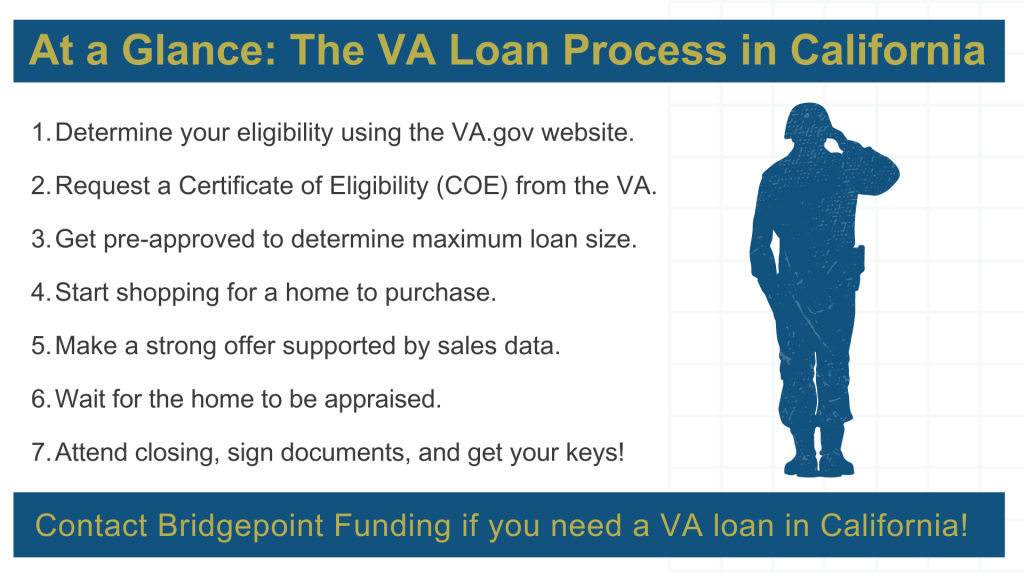

While the VA mortgage process can vary slightly from one borrower to the next, it usually includes the following sequence of events:

- Determine how much of a monthly payment you can afford.

- Determine if you have full or remaining entitlement.

- Obtain your Certificate of Eligibility (COE) from the VA.

- Get pre-approved for a specific mortgage amount.

- Begin the house hunting / home shopping process.

- Make an offer and agree on the purchase price.

- Wait for the home appraisal process to be completed.

- Attend closing, sign documents, and get the keys to your new house!

Step 1: Determine how much of a monthly payment you can afford.

Budgeting is one of the most important parts of the home buying process in California. This is true regardless of what type of mortgage loan you use.

When using a VA loan to buy a home, it’s important to figure out how much of a monthly payment you can afford to make. You want to do this before you even start looking at homes. That’s why we’ve made it step #1.

You don’t have to be a financial planner to establish a home buying budget. All you really need to do is take a close look at your current monthly expenses and monthly income. Subtract your non-housing-related monthly expenses from your monthly income, and work down from there.

Learn more about budgeting for a home purchase

Step 2: Determine if you have full or partial VA loan entitlement.

If you’ve never used the VA loan program before — or you’ve used it but paid off the loan through the sale of your home — you probably have your full entitlement remaining.

In that case, there are no official loan limits that will apply to you.

If you currently have a VA loan that you’re still paying off, you probably have partial or “remaining” entitlement. In that case, you could be limited to the loan limit for your particular county (unless you make a down payment of some kind).

As it states on the Department of Veterans Affairs website:

“If you have remaining entitlement for your VA-backed home loan, find out the current loan limits and how they may affect the amount of money you can borrow without a down payment. As of 2020, if you have full entitlement, you don’t have a VA loan limit.”

Step 3: Obtain your Certificate of Eligibility from the VA.

If you want to buy a home in California with a VA loan, you’ll need to obtain a Certificate of Eligibility (COE). This document comes from the Department of Veterans Affairs, and it does exactly what the name describes.

It certifies to the mortgage lender that you are eligible to apply for a VA home loan, based on your current or prior military service.

You can request a COE on your own, or have the lender do it for you. This process has gotten easier over the years. The VA.gov website now offers a user-friendly portal where you can request this document, just by providing some basic information.

Step 4: Get pre-approved for a specific mortgage amount.

Mortgage pre-approval is typically the next step in the VA home buying process. You can think of it as a kind of pre-screening process. We can review your current financial situation to determine how much you might be able to borrow.

Getting pre-approved for a loan can make your home search more effective and more efficient. It helps you identify a specific and realistic price range. This can prevent you from wasting time shopping for homes that are too expensive for you.

Step 5: Begin the house hunting process.

For most VA loan home buyers in California, house hunting is the most exciting part of the process. This is when you go out and look at houses and imagine yourself living in them.

But notice that house hunting comes after the pre-approval process. This is the logical way to proceed through the VA loan process in California. If you were to skip the previous step, you wouldn’t have a firm price range in mind when shopping for a house.

Step 6: Make an offer and agree on a purchase price.

You’re now ready to put an offer on paper. This is a crucial step in the home buying process, because it determines the sale price, the closing date, and other important terms of the deal.

If you’re not familiar with real estate documents, it’s a good idea to have an agent on your side. An experienced real estate agent can help you make a smart offer based on recent sales activity in the area.

Once you submit an offer, it will go one of three ways:

- The seller might accept your offer as-is.

- The seller might reject your offer, possibly in favor of a stronger one.

- The seller might counter-offer by changing the sale price or other terms.

This is another reason why it’s good to have a real estate agent. Your agent can help you navigate the back-and-forth negotiations that are common during the buying process.

Step 7: Wait for the VA loan home appraisal to be completed.

In California, all homes purchased with a VA loan have to be appraised. This makes an essential step in the process.

The VA-approved home appraiser has two primary objectives:

- He or she will make an educated guess as to the current market value of the home.

- The appraiser must also ensure the property meets the VA’s minimum requirements.

If the home appraises for an amount equal to or greater than the purchase price, the loan will probably move forward. On the other hand, if the appraiser determines the house is worth less than the sale price, the buyer and seller have some things to talk about.

In some cases, a seller might lower the asking price to match the appraisal. In other cases, the seller will refuse to change the asking price, and the buyer might have to move on to another property.

Learn more about the VA home appraisal process

Step 8: Pay your closing costs, sign your documents, and get your keys!

Once you’ve cleared the home appraisal and mortgage underwriting process, you can move on to closing. This represents the final step in the California VA home buying process, from the buyer’s perspective.

Closing is when you pay all of your closing costs and sign all of the loan documents and transfer paperwork. Before the day you close, you’ll receive a document that itemizes all of your costs along with the total amount due at closing.

How Long Does It Take to Close?

Home buyers often ask us: How long does the VA loan process take in California? How long does it take to get approved for a loan, once you’ve submitted an application?

Previous reporting from ICE Mortgage Technology (a company that provides loan processing software) revealed the average “time to close” for different loan types. In this context, the time to close was defined as the length of time from (A) the initial application to (B) the final closing process.

According to their findings, the average time to close for VA loans was 66 days. Again, that’s from the application all the way through to the closing and funding. The average among conventional mortgage loans (that are not backed by the government) was 57 days.

But it can happen much faster than that in some cases, especially if you work with a company that specializes in VA loans like Bridgepoint Funding!

On average, the VA loan process can take a little longer than conventional financing because of the government requirements. But the difference is relatively small in the grand scheme of things. Plus, a well-experienced mortgage team can close loans faster than average.

Your California VA Mortgage Specialist

As a borrower, you could potentially shorten the time from application to closing by working with an experienced lender. And Bridgepoint Funding is a great place to start.

We’ve been helping California home buyers and homeowners meet their financing needs for nearly 20 years. We specialize in the VA loan program and take pride in helping military service members, veterans, and their families.

With our help, you’ll be able to navigate the VA mortgage process with ease. Please contact our team if you have questions about this program, or if you’d like to start the application process.