Are you tired of renting a home in California and ready to make the transition…

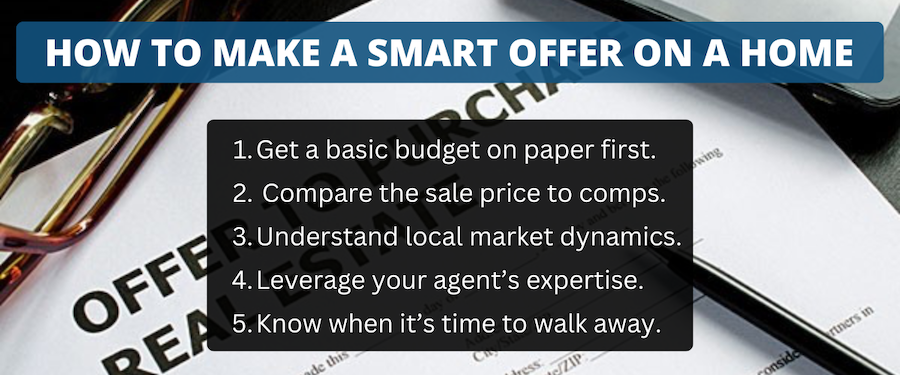

How to Make a Smart Offer on a House in the Bay Area

Making an offer on a house in the San Francisco Bay Area requires careful research, forethought, and planning. A stronger offer can increase the chance of seller acceptance, while a weaker one could cause you to lose the home.

Summary: This guide explains how to validate the seller’s asking price based on recent sales data and create a smart offer based on your findings.

How to Make an Offer on a Home in the Bay Area

The San Francisco Bay Area is a fast-paced, competitive real estate market where bidding wars are a common occurrence. Because of this, home buyers need to present their best and strongest offer the first time around.

Here are five tips and strategies for accomplishing this goal.

1. Have a budget on paper before making an offer.

The purchase offer process can happen quickly, especially in a real estate market like the Bay Area. So you’ll want to make sure you have your financial ducks in a row before taking the plunge.

The last thing you want to do is offer more for a house than you can realistically afford to pay. And that’s where the budget comes into play. It gives you a price “ceiling” when it comes to negotiating with the seller.

Question: What’s the most you’re comfortable spending each month on your total housing costs? Once you identify this number, you’re ready to move on to the next step.

2. Validate the seller’s asking price by using comps.

When making an offer on a house, it’s important to validate the seller’s asking price. The goal here is to determine if the list price is realistic or far-fetched, based on current market conditions.

In other words, it’s a “sanity check.”

To accomplish this, you can look at recent and similar home sales in the area where you are planning to buy. These are also known as comparable sales, or “comps.”

The real estate market determines what a particular house is worth at a particular time. It’s all based on supply and demand. And the best way to measure this is by looking at recent sales or comps.

When reviewing recent sales, pay particular attention to homes that are similar to the one you’re trying to buy. Those are the most accurate and useful comps, when it comes to making an offer on a house in the Bay Area.

Question: What kind of home are you looking for, and in what area? Once you identify this, you can review recent and comparable sales in that same location.

3. Understand current market dynamics.

Does the real estate market where you are planning to buy a home currently favor buyers or sellers? What’s the inventory situation like in the area? How long are homes staying on the market?

This kind of research will help you make a smart offer on a Bay Area home. The goal here is to understand current conditions within the local housing market, and how they affect you as a buyer.

Your real estate agent can answer a lot of these questions for you. (See tip #4 below.) But you can also gain some insight by researching online.

Question: Are you in a buyer’s or seller’s market? This can vary over time, and also from one market to the next. You need to understand this dynamic so you can negotiate accordingly.

4. Leverage your real estate agent’s knowledge.

An experienced and knowledgeable real estate agent can help you make a smart offer on a home.

Agents spend much of their time negotiating back and forth between buyers and sellers. So they usually have a pretty good idea which way the market leans, and how to shape an offer accordingly.

Ultimately, you have to make your own decision as to how much you’re willing to pay for a particular property. But it’s always good to have some professional guidance when making such decisions.

5. Know when to walk away.

Sometimes, a home buyer and seller will negotiate back and forth and eventually find common ground. In other cases, the two sides might be too far apart on the purchase price and other terms.

There might come a time when you make your best offer on a house in the Bay Area, only to be rejected by the seller. This is one of several negotiating scenarios you have to prepare for.

The bottom line is, there may come a time when you simply have to walk away and find another house to purchase. It’s a common occurrence in the Bay Area.

How to Determine the ‘Market Value’

In order to make a smart offer, you must first estimate the fair market value of the home. But where does this figure even come from? Is it the same as the asking price?

Definition: The fair market value of a home is a reasonable price based on current market trends and conditions. It is the price at which the home will sell in a reasonable amount of time.

The fair market value of a Bay Area home is not based on the assessed value of the property. The assessed value comes from the tax assessor’s office, and is assigned for taxation purposes only.

Market values, on the other hand, are based on the forces of supply and demand within the local area. They are determined by what people are willing to pay in the current market. This is the kind of information you need, when shaping your offer.

Here’s an example of how a home buyer can determine the market value:

- The Martinez family are seeking a one-story home in Walnut Creek, California.

- They need three bedrooms and two bathrooms, ideally with about 1,200 square feet of space.

- So they go onto Realtor.com, Zillow, and other listing websites to see what similar homes have sold for recently.

- Within the last couple of months, most of the properties in their desired location with their desired features have sold for $800,000 to $850,000.

- They’ve just determined the fair market value for the type of house they’re seeking.

These buyers could also find a home that they like first, and then determine the fair market value based on comparable sales. Either way, the steps are the same.

How It Differs from the Asking Price

When you make an offer to buy a house in the Bay Area, it should be based on the fair market value of the property as explained above.

It should not be based on the seller’s asking price — at least not entirely.

Consider the difference:

- Some sellers conduct plenty of due diligence when setting their prices. They use comparable sales to determine what their homes might be worth in the current market and price it accordingly.

- Other sellers set their asking prices based on the amount they currently owe on their mortgage, or the amount they paid for the home when they first purchased it. But those two figures might not reflect the current market value of the property.

Home buyers should take the asking price with a grain of salt, because it may or may not be realistic. Base your offer on recent sales data and your understanding of current market dynamics.

That’s the key to success when buying a home in the Bay Area.