This article is part of an ongoing series that answers common questions about different types…

How to Apply for an FHA loan in California: 5 Steps to Success

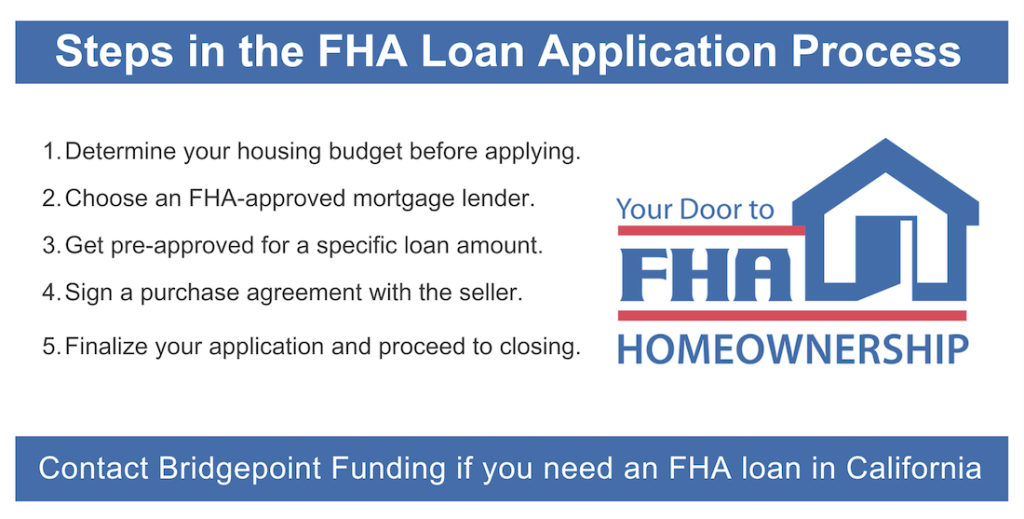

This article explains how to apply for an FHA loan in California, by breaking it down into a series of steps.

The application form itself is straightforward. It contains five pages of fill-in-the-blank information. But there’s a broader process here as well, and that’s what we will explore here today.

FHA Loans: A Government-Backed Mortgage

Definition: An FHA loan is a mortgage loan that gets insured by the government, via the Federal Housing Administration (part of HUD). Mortgage lenders in the private sector originate the loans, and the FHA insures them against borrower default.

This insurance gives the lender additional protection, allowing them to offer loans to borrowers who might not qualify for traditional financing. FHA loans allow for a down payment as low as 3.5% with flexible qualification criteria.

How the Application Process Works in California

For the most part, the mortgage application process works the same for both FHA-insured mortgage loans and conventional loans that are not backed by the government. But the Federal Housing Administration does impose some specific requirements that don’t apply to conventional loans.

Here are the usual steps that take place (or should take place) when a home buyer applies for an FHA-insured mortgage loan in California.

1. Get a housing budget on paper first.

This is an important, but often overlooked, step in the application process. Before talking to a lender or looking at houses, borrowers should examine their current financial situation to determine what they can afford.

Consider how much you earn each month, after taxes, and how much of that goes toward your debts. How much do you have left over each month, after you’ve covered all of your non-housing expenses? This is your starting point.

Having a basic housing budget on paper will help ensure your long-term financial stability. The goal here is to be able to cover all of your recurring monthly debts, including the mortgage payment, and still have money left over each month for savings, lifestyle expenses, etc.

2. Choose an FHA-approved mortgage lender.

To apply for an FHA loan in California, you’ll need to work with a bank or mortgage company that has been approved by the Department of Housing and Urban Development (HUD) to participate in the program.

California is a big state, so you have a lot of choices when it comes to your mortgage company. Bridgepoint Funding has been helping borrowers across the state for nearly 20 years. We have a long track record of solid customer service, and we know the FHA loan program inside and out!

3. Get pre-approved for a loan.

Pre-approval is when a mortgage company evaluates your financial situation (mainly your income, assets and debts) to determine how much they’re willing to lend you. You can actually complete this process before you officially apply for an FHA loan in California. That’s why it’s called “pre” approval.

Getting pre-approved before house hunting offers several benefits:

- Pre-approval helps you narrow your home search to the kinds of properties you can afford, based on your financing.

- Sellers will be more inclined to accept your offer if you have a pre-approval letter from a lender. It shows that you’ve been pre-screened already, and that you will likely obtain financing.

4. Sign a purchase agreement / sales contract.

Before you can fully apply for an FHA loan in California, you’ll need to have a signed purchase agreement (a.k.a., sales contract) for the house you wish to buy.

To be clear, you can get pre-approved by a lender before you have a purchase agreement. That’s the whole point of pre-approval. But the actual loan application (mentioned below) requires information about the property being purchased. So you’ll need to know that information before you can complete the form.

The purchase agreement / sales contract includes the address of the property being purchased, the agreed-upon sales price, the proposed closing date, and other information relating to the sale of the home.

5. Complete a standard mortgage application.

Once you’ve identified the home you wish to purchase, you can officially apply for an FHA loan. This involves completing the Uniform Residential Loan Application (URLA), also known as Fannie Mae form 1003. This document is needed to begin loan processing and underwriting, which paves the way for the final approval and the disbursing of funds.

Both FHA and conventional loans use the URLA form. It’s an industrywide standard, regardless of the loan type.

Next Steps: Appraisal, Underwriting, and Closing

This article focuses on the FHA application process in particular. But there’s a broader process that takes place as well.

Once you’ve signed a purchase agreement and completed your loan application, you’ll likely encounter the following next steps:

- Home appraisal: All properties purchased with an FHA-insured home loan must be appraised to determine their market value and overall property condition.

- Mortgage underwriting: The mortgage lender’s underwriter will review all aspects of the loan file, appraisal report, and application documents to ensure they meet the FHA’s requirements.

- Conditions: During the underwriting process, you might receive requests for additional information. These are known as “conditions” to final approval. Handling them as quickly as possible can help keep the process on track.

- Closing and funding: Once you clear the underwriting process, you will attend the final closing. You’ll sign all of the finalized loan documents, pay for your down payment and closing costs, and receive the keys to your new house.

So, when you apply for an FHA loan, you are initiating a longer process that involves multiple steps, including a home appraisal and closing. But the application gets the ball moving.

Frequently Asked Questions from Borrowers

We know firsthand that home buyers in California have a lot of questions about the FHA loan application process. Below, we have provided some straightforward answers to some of the most common questions.

1. How is an FHA loan different from a regular mortgage?

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA), a government agency that falls under the Department of Housing and Urban Development (HUD). This program offers a low down payment and more lenient credit requirements compared to some conventional loans.

2. Who is eligible for this program?

Both first-time and repeat home buyers can qualify for an FHA loan in California. Borrowers need a credit score of 500 or higher for eligibility, and a score of 580 or higher for the minimum down payment of 3.5%. You’ll also need steady and sufficient income to cover your monthly payments on top of your other recurring debts.

Related: Overview of FHA loan requirements

3. How do I apply for an FHA loan?

In California, the FHA mortgage loan application process works the same as it does for conventional loans (that are not backed by the government). You’ll need to complete a standard mortgage application and provide financial documents to help the lender determine how much you can borrow.

4. What documents do I need to apply for an FHA loan?

Home buyers applying for an FHA loan in California need to provide a variety of financial documents. These can include (but are not limited to) the following items:

- Pay stubs for the past two months

- Tax returns for the most recent two years

- IRS W-2 forms

- Recent bank statements

- Documents relating to other assets, retirement accounts, etc.

Your lender may request additional documentation based on your financial situation.

Related: Documents needed for an FHA loan

5. Can I apply for an FHA loan with a co-borrower?

Yes, you can apply with a co-borrower, and it might actually strengthen your application. A co-borrower is someone whose name is on the FHA loan documents (along with the primary borrower) and is equally responsible to repay the loan. The co-borrower’s income and assets can be counted and could therefore help you qualify for financing. Both the borrower and co-borrower must meet the FHA loan requirements.

6. Should I apply for a loan before or after I find a home?

We encourage borrowers to get pre-approved prior to house hunting. This benefits you in two ways. First, it allows you to focus your housing search on a specific price range based on the amount you can borrow. It also shows sellers that you’re a serious buyer. Later, once you’ve found a home and made an offer, you can complete the mortgage process with your lender.

7. What happens if my FHA loan application is denied?

If your application is denied, the lender should provide you with a reason. You can also ask them directly. That way you’ll know what you need to improve (increasing a credit score, paying down debt, etc.). You can also seek a second opinion from a different mortgage lender.

8. Can I apply after a bankruptcy or foreclosure?

Yes, but there are waiting periods. For Chapter 7 bankruptcy, you usually need to wait two years after discharge, unless there were extenuating circumstances. For Chapter 13 you can apply while still in the repayment plan, with court approval. After a foreclosure, the waiting period is typically three years.

9. I’m ready to move forward. How do I get started?

If you’re located in California, you can start the FHA loan application process by contacting our staff. Bridgepoint Funding helps home buyers all across the Golden State. Our mortgage experts can help you decide if this program is the best option based on your goals and circumstances.

Questions? Do you have questions about how to apply for an FHA loan in California? We can help. Bridgepoint Funding has been serving borrowers across the Golden State for well over a decade. Our in-house FHA experts can answer any questions you have relating to the application process.