When buying a home in California, or even when simply researching the process, you'll eventually…

Average Closing Costs for California Home Buyers in 2024

In California, home buyers typically pay closing costs that range from 1.5% to 5% of the purchase price. But this can vary due to a number of factors, including the type of loan you use and where you live.

This guide explains (1) what closing costs are, (2) where they come from, and (3) how you could reduce your out-of-pocket expenses when buying a home in the Golden State.

Average Closing Costs for California Home Buyers

Mortgage loans usually come with closing costs. This is true for most people who buy a home in California, and also for homeowners who are refinancing an existing mortgage.

These costs include such things as loan origination fees, title and escrow fees, local taxes, as well as any discount points you choose to pay at closing.

On average, home buyer closing costs in California usually fall somewhere between 1.5% and 5% of the purchase price. But that’s just a general range. Some buyers end up paying more than this.

Here are some factors that can determine the amount you pay in closing costs:

- Loan Type: Different loan programs can have different fees. For example, borrowers who use VA loans usually pay a funding fee, while those with FHA loans pay an upfront insurance premium. Both of these can be rolled into the closing costs or financed into the loan.

- Purchase Price: In California, closing costs are partly influenced by the home’s purchase price. So a more expensive home will generally result in higher closing costs. Home buyers in the more expensive coastal markets typically pay more in closing costs than those in the Central Valley or Inland Empire.

- Local Government: Buyers usually have to pay a transfer tax and a recording fee when purchasing a home. These are charged by local governments, so they can vary from one California county to the next.

- Paying Points: Some home buyers choose to pay mortgage discount points in exchange for a lower rate, while others do not. Each point costs 1% of the total loan amount, so they can greatly influence the amount you have to pay at closing. You can also buy points in smaller increments, like a quarter or a half.

- Escrow Services: Escrow and title companies help manage the closing process and charge a fee for those services. These fees can vary depending on the company you’re using and the complexity of the transaction.

- Prepaid Expenses: Home buyers also have to pay for “prepaids” at closing. This can include prepaid interest, property taxes, and homeowners insurance. But this can vary based on the timing of the purchase and terms of your loan.

As you can see, there are many variables that can affect your closing costs when buying a home in California. That’s why most articles that cover this subject use an average range instead of a specific number. It varies from one borrower to the next.

Closing Costs at Different Price Points

As mentioned, the average closing costs for home buyers usually ranges from 1.5% to 5% of the purchase price. As of summer 2024, the median home price in California was around $780,000. A purchase at that level might bring closing costs anywhere from $11,700 to $39,000.

Here’s what those costs might look like at different home-price thresholds:

| Home Price | Closing Cost Range (1.5% – 5%) |

|---|---|

| $500,000 | $7,500 – $25,000 |

| $600,000 | $9,000 – $30,000 |

| $700,000 | $10,500 – $35,000 |

| $800,000 | $12,000 – $40,000 |

| $900,000 | $13,500 – $45,000 |

| $1,000,000 | $15,000 – $50,000 |

These ranges give you a ballpark idea of what you might pay when buying a home in California.

But there’s really no need to guess. During the mortgage process, you’ll receive a couple of documents that show exactly what you’ll have to pay. So let’s talk about that next.

The Loan Estimate and Closing Disclosure

Home buyers in California usually receive an estimate of their closing costs shortly after applying for a mortgage loan. It comes in the form of a standardized three-page form known as the Loan Estimate (LE).

This document contains a lot of important information about your loan, including the estimated interest rate, monthly payment, and the total closing costs you’ll likely pay.

Home buyers receive a second and related document shortly before closing. It’s known as the Closing Disclosure, or CD. This five-page form includes some of the same information as the LE. But it also provides a finalized list of the closing costs that must be paid.

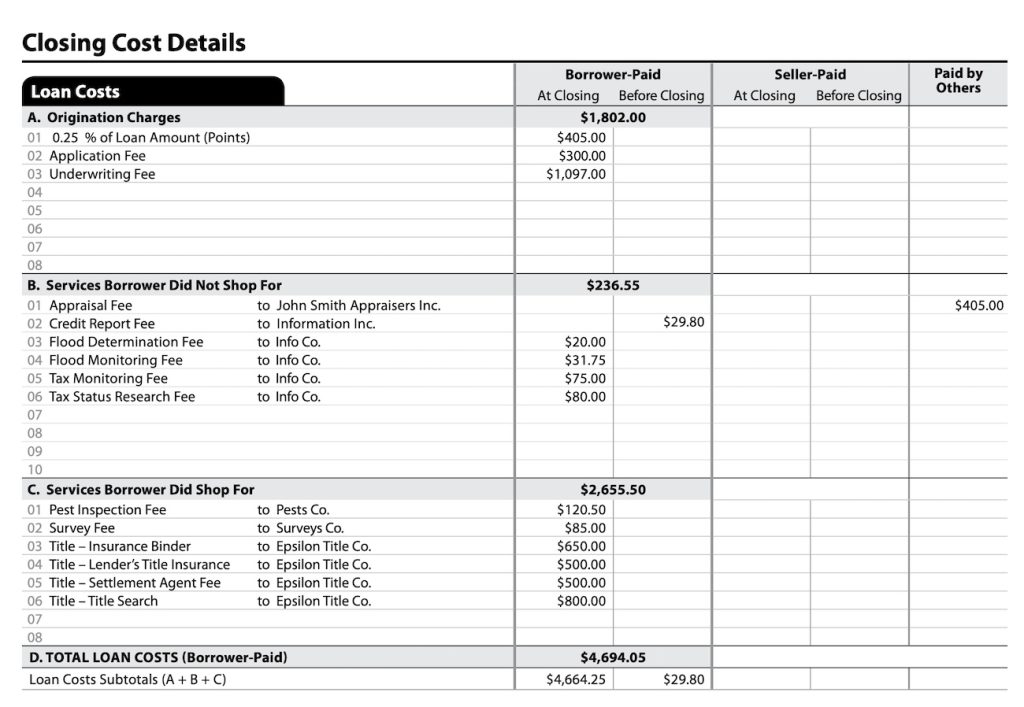

The screenshot above shows the second page of the Closing Disclosure form, where it breaks down the home buyer’s costs item by item.

In addition to the itemized figures, it also shows the grand total down at the bottom. This is the amount the buyer would actually bring to the closing, typically with a cashier’s check or wire transfer.

A List of Common Fees, Taxes and Charges

Earlier, we mentioned some of the individual items that contribute to a home buyer’s closing costs. Here’s a more complete list of those fees and taxes:

- Appraisal fee: To determine the market value of the home being purchased.

- Credit report fee: From when the lender checks your credit history.

- Escrow fee: Charged by the escrow company that manages the closing.

- Title search: To make sure the home doesn’t have any liens or legal claims.

- Property survey: To determine the legal boundaries of the house and lot.

- Courier fee: For shuttling documents around in the days before the closing.

- Homeowners insurance: Usually to cover the first year, but this can vary.

- Recording fees: Paid to the county for recording the transfer of ownership. *

- Transfer taxes: A tax charged when the title transfers from seller to buyer. *

- Mortgage fees: For originating, processing and underwriting the home loan.

- Discount points: Prepaid interest used to get a lower mortgage rate (optional).

* In some parts of California, the seller pays for the transfer tax and recording fees. These customs can vary by location, so you’ll want to ask your real estate agent or mortgage broker how it works in your area.

Many of these items listed above are negotiable. Depending on local real estate market conditions, you might be able to have the seller cover some of your closing costs when buying a home. This is known as a seller concession.

Start Saving Money as Soon as Possible

First-time buyers in California are sometimes surprised to learn that the average closing costs on a home purchase can add up to many thousands of dollars.

In some cases, a buyer might pay nearly as much in closing fees as they pay for the down payment itself. And this underscores the importance of creating a budget and saving money early.

Saving money is one of the best things you can do to prepare for your home purchase. And the sooner you start, the better. You might even want to create a separate savings account for this purpose, with automated deposits each month.

Note: You don’t need to know your exact closing costs in order to establish a savings goal. That can come later. For now, just start saving to get a head start.

Family Member Contributions Are Often Allowed

We’ve talked about the average closing costs for home buyers in California, and how they can add up to a substantial sum of money. Now, let’s end this article with a bit of good news.

Depending on what type of mortgage loan you use, there’s a good chance you could use third-party funds to cover some or all of your closing costs. The third party might be a family member, a close friend, or some other approved provider.

This is commonly referred to as a “down payment gift,” and it’s a topic we’ve covered in a previous blog post. But you can use the donated funds for your closing costs as well, to reduce your own out-of-pocket expense.

Monetary gifts can help California home buyers overcome what is usually the biggest hurdle on the path to homeownership — the upfront expense.

Strategies for Reducing Your Overall Costs

Most home buyers in California who use mortgage loans to finance a purchase incur closing costs, including some of the fees listed earlier. It’s a reality of the real estate world.

And as we’ve seen, the average costs for buyers can be substantial.

But there are things you can do that might reduce the total amount you have to pay when you close. Here are some of those cost-reducing strategies to consider:

- Consider using a lender credit. Borrowers can obtain a lender credit toward their closing costs by taking on a slightly higher mortgage rate. This reduces the amount of cash you have to bring to closing, without the need for discount points.

- Negotiate with the seller. Sometimes, sellers will agree to cover part of the buyer’s closing costs to facilitate the sale. These contributions tend to be more common in slow real estate markets, and less common in a competitive market.

- Close near the end of the month. Closing toward the end of the month can reduce the amount of prepaid interest you need to pay. This interest is calculated from the closing date to the end of the month. So a shorter period of time will reduce your closing costs.

- Skip the discount points. Some California home buyers choose to pay discount points in exchange for a lower mortgage rate. This can deliver long-term savings. But if you’re trying to minimize your upfront closing costs, you might want to avoid this.

- Look for grants. Government housing agencies often partner with non-profits and other groups to provide assistance to home buyers. For example, Neighborhood Partnership Housing Services (NPHS) teamed up with the California Association of Realtors to offer closing cost assistance grants for buyers from certain underserved communities. That’s just one example.

- Roll them into the loan. Some lenders will allow you to roll your closing costs into the mortgage. While this increases the size of your monthly payments, it can greatly reduce your upfront out-of-pocket expenses.

Have questions? As a mortgage broker, we have access to multiple lenders and many loan products. This allows us to find the right product for each individual client. If you have questions about closing costs in California or would like to apply for a loan, please contact our staff!