Are you tired of renting a home in California and ready to make the transition…

A Guide to Earnest Money Deposits in the Bay Area: Updated for 2025

Home buyers in the San Francisco Bay Area typically use earnest money deposits to show sellers they are serious about buying. That’s just one of several ways to make an offer stand out in a competitive housing market.

But what is an earnest money deposit exactly? What’s the typical or average amount for the Bay Area? And what happens to the money if the deal moves forward or falls apart?

In a hurry? Here are the seven most important points covered in this guide:

- Earnest money is a good faith deposit made by the buyer to the seller when submitting an offer.

- The purpose is to show that the buyer is serious about purchasing the property.

- In the Bay Area, earnest money deposits typically range from 1% to 3% of the purchase price.

- Earnest money deposits are usually held in an escrow account by a neutral third party.

- If the deal goes through, the money is applied to the buyer’s down payment or closing costs.

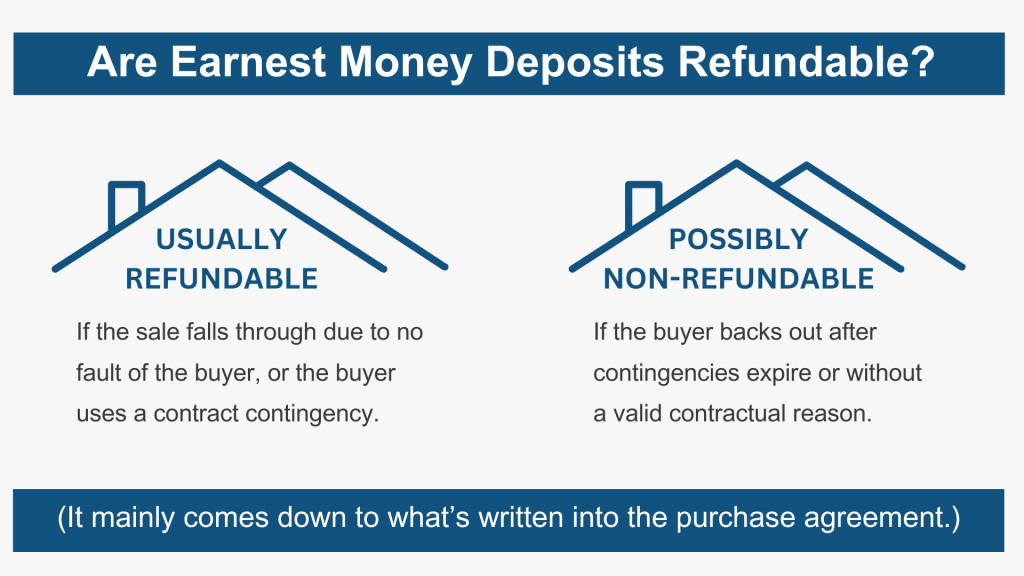

- If the buyer backs out without a reason specified in the contract, they could lose the deposit.

- Buyers can use contract contingencies to avoid losing the earnest money in certain scenarios.

Those are the basics. Now let’s take a deeper dive into this important subject!

What Is an Earnest Money Deposit?

In a related article, we explained the basic concept behind the earnest money deposit. The short version is that home buyers use these deposits to emphasize their willingness (or earnestness) to purchase a property.

In a typical scenario, the funds will be held in a special account managed by a neutral party, such as an escrow company. What happens next will depend on how the real estate transaction unfolds and if it reaches closing.

Here are the three main scenarios that can occur:

- Deal Goes Through: The earnest money is applied toward the buyer’s down payment or closing costs, reducing the amount they need to bring to closing. It becomes an investment in the home.

- Using a Contingency: If the buyer cancels the contract within a valid contingency period (e.g., financing, inspection, or appraisal contingency), they typically get the deposit back with no penalty.

- Losing the Deposit: If the buyer cancels the deal without a valid reason and without a protective contingency in the contract, they could end up forfeiting the deposit to the seller.

The first path listed above represents the best-case scenario for home buyers, with the deal concluding successfully. The third scenario, on the other hand, should be avoided to prevent financial losses.

What’s the Typical Amount in the Bay Area?

There is no rule or requirement that says how much home buyers should pay for an earnest money deposit. It usually depends on local real estate market customs and trends.

General rule: Home buyers in the San Francisco Bay Area typically make earnest money deposits somewhere between 1% and 3% of the purchase price. But that’s not a hard-and-fast rule.

At the start of 2025, the median home price for the Bay Area was around $1,133,000. So an average earnest money deposit in our real estate market might range from $11,330 to $33,990.

As you can see, these deposits can add up to a sizable amount. That’s because we live in one of the most expensive real estate markets in the country. And pricier homes translate into bigger deposit amounts.

But these are just average and median figures. The size of your earnest money deposit might fall above or below this range, depending on a number of factors.

In a highly competitive real estate market, for example, a buyer might choose to put more money down in order to make their offer stand out above the rest. So let’s explore that angle next.

Making a Larger Deposit in a Competitive Market

The earnest money deposit becomes even more important in a highly competitive real estate market. And as you probably already know, the Bay Area housing market fits into this category.

When sellers receive multiple offers from competing buyers, they can choose what they feel is the strongest and least troublesome offer. They do this by considering the offer amount, the type of financing, the terms of the sale, and the size of the earnest money deposit.

With all other things being equal, a home buyer who makes a bigger earnest money deposit has a better chance of getting the seller’s attention. That makes it an important consideration in a hot housing market.

Here are some other strategies home buyers can use to gain an advantage:

- Above Asking: In a competitive market like the Bay Area, bidding higher than the listing price could make your offer stand out.

- Bigger Deposit: As mentioned above, a larger earnest money deposit shows a stronger commitment to the deal along with financial stability.

- Fewer Contingencies: Reducing or removing contingencies (such as the home inspection or appraisal contingency) can make your offer more attractive. But it also comes with added risk.

- Shorter Timeline: Offering a faster closing period can appeal to sellers who want to move quickly due to relocation, job transfer, or other factors.

- Move-Out Date: Allowing the seller extra time to move can give your offer an edge over others.

- Cash Offers: All-cash offers eliminate financing risks, making the transaction smoother and more appealing to sellers.

Granted, not all of these strategies will apply to your particular situation. Our goal here is to explain how the earnest money deposit ties into the bigger picture, when buying a home in the San Francisco Bay Area.

Using Contingencies to Protect Your Deposit

A typical earnest money deposit in the Bay Area can easily exceed $10,000 and often rises above $20,000. So there’s a certain amount of risk involved with this process.

In some cases, a home buyer might take certain actions that lead to the loss of the deposit, meaning the seller gets to keep it. Many buyers cannot afford such losses. So they use “contingencies” to prevent them from happening.

Definition: A contingency is a condition included in a real estate contract that must be met for the sale to proceed. It shields the buyer from unforeseen issues like financing problems or low appraisals, allowing them to back out with earnest money intact.

For instance, a mortgage financing contingency says that the buyer must be able to obtain financing in order for the deal to go through. If they’re unable to get financing, they can back out of the deal while retaining their earnest money deposit.

In contrast, some home buyers in the Bay Area skip the contingencies in order to make their offers more attractive to sellers. But you’ll want to make sure you understand the risks (lost deposit) before pursuing this strategy.

Have Mortgage Questions?

Bridgepoint Funding has been helping Bay Area home buyers and homeowners with their mortgage needs for nearly 20 years now. Our knowledgeable staff can answer any questions you have related to home financing.

As a broker-based mortgage company, we offer a broad range of home loan options to borrowers. This includes conventional, FHA, VA and jumbo financing.

Let’s talk: Please contact our staff if you have mortgage-related questions or would like to apply for a loan in the San Francisco Bay Area.