Jumbo loans are a popular mortgage option among home buyers in California, due to the…

California VA Loan Funding Fees: Updated for 2025

The VA loan program offers a number of powerful benefits for home buyers in California, including the ability to buy a home with no down payment whatsoever.

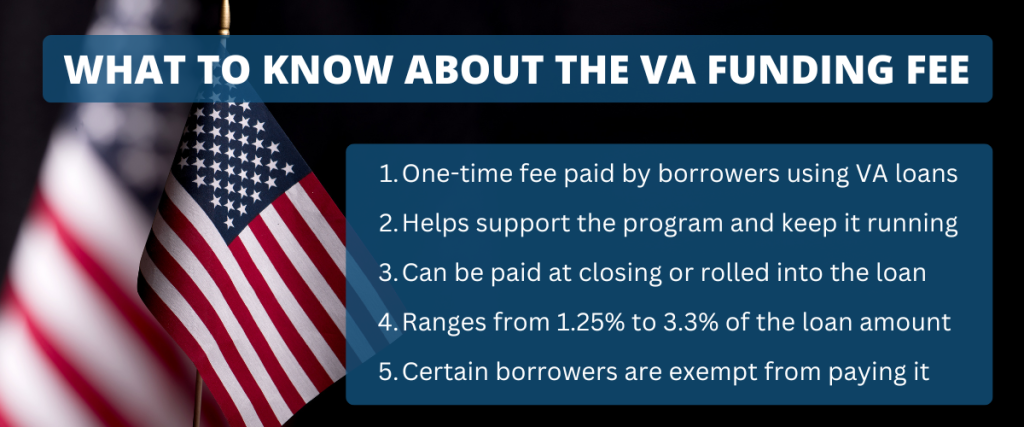

But VA home loans do require borrowers to pay a funding fee, which helps to support the program. For most borrowers, it’s a small price to pay for the many benefits it unlocks.

Here are seven key points you should know about this subject:

- A funding fee is a one-time fee paid by most borrowers who use VA loans.

- These fees sustain the program and eliminate the need for mortgage insurance.

- For most home buyers, this fee ranges from 1.25% to 3.3% of the loan amount.

- The amount depends on the down payment, loan type, and prior VA loan use.

- First-time VA loan users with no down payment typically pay 2.15%, as of 2025.

- The funding fee can be rolled into the loan amount or paid upfront at closing.

- Some borrowers, including disabled veterans, are exempt from paying it.

VA Loans Are Very Popular in California

Last year, more than 13,000 people used a VA loan to buy a home in the state of California. And that was a relatively slow year, due to rising mortgage rates and inflation.

In previous years, California has averaged around 25,000 VA purchase loans per year, with another 6,000 – 7,000 for refinancing homeowners.

VA loans are popular in the Golden State for several reasons:

- They allow borrowers to buy a house with zero down payment (a big deal in California).

- VA loans don’t require mortgage insurance, like other low-down-payment loans do.

- This program is very forgiving, so you don’t need perfect credit to qualify.

- It’s a lifetime benefit. You can use VA loans over and over throughout the years.

A Closer Look: VA Funding Fees in California

As with most types of home loans, there are certain fees and costs associated with VA mortgages in California. The funding fee is one of those costs.

Here’s how the Department of Veterans Affairs defines it:

“The VA funding fee is a one-time payment that the Veteran, service member, or survivor pays on a … home loan. This fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.”

Let’s break down the most important pieces of this quote:

- You’ll notice they describe it as a “one-time payment,” instead of a recurring payment. That’s a key point. If you use a VA loan to buy a home in California, you’ll only have to pay the funding fee once.

- This quote also explains the reason for it. The Department of Veterans Affairs charges these fees to help fund the program, rather than relying exclusively on taxpayer dollars.

- The government partially insures these loans, and that insurance coverage costs money. The funding fee is one of the ways the VA covers their own operating costs, which in turn allows them to keep the program going.

- Lastly, they mentioned that this mortgage program does not require a down payment or monthly mortgage insurance. That’s a huge benefit, from a borrower’s standpoint. And the VA funding fee is partly what makes it possible.

Home buyers in California might not like paying this fee, since it’s more money out of pocket. But they can appreciate the major benefits the program provides, like the ability to finance the entire purchase price.

How Much Do They Cost?

Let’s move on to what you really want to know. How much are VA loan funding fees in California, as of 2025? There are several factors that will determine the size of your funding fee.

Here are the key factors that will determine how much you’ll pay:

- The type of loan being used (e.g., purchase vs. refinance)

- The total amount of money you are borrowing

- The size of your down payment (if any)

- Whether or not you’ve used the VA loan program in the past

In California, these funding fees can range from 1.25% to 3.3% of the total loan amount for home buyers. There’s a range, instead of one standardized fee, due to the variables listed above.

The table below was adapted from the Department of Veterans Affairs website. This quick-reference guide shows how much you might have to pay for a VA loan funding fee in California, in a home-buying scenario.

| If your down payment is… | Your VA funding fee will be… | |

|---|---|---|

| First use | Less than 5% | 2.15% |

| 5% or more | 1.5% | |

| 10% or more | 1.25% | |

| After first use | Less than 5% | 3.3% |

| 5% or more | 1.5% | |

| 10% or more | 1.25% |

As you can see, the amount of your funding fee largely depends on: (A) whether you’ve used the VA loan program before and (B) whether or not you’re making a down payment, which is optional.

Note: Some home buyers and borrowers are exempt from paying these fees. This includes those who are receiving compensation for a service-related disability, among others.

Example Scenarios for Home Buyers

Here are some home-buying scenarios to show how VA loan funding fees work in California. These examples are based on the breakdown table presented above.

- Scenario 1: A borrower who uses the VA loan for the very first time — and wants to put zero money down — will have a fee of 2.15%.

- Scenario 2: A first-time VA loan borrower who plans to make a down payment of 5% or more when buying a home will have a fee of 1.5%.

- Scenario 3: A repeat home buyer who has used this program in the past and plans to put zero down will have a fee equal to 3.3% of the loan amount.

Just note that this information applies to home purchase and construction loans in particular. Other financing options offered through the VA (such as the Interest Rate Reduction Refinancing program) have their own set of funding fees.

The good news is that California VA funding fees can be “rolled into” the loan and paid off over time. Or they can be paid upfront, at the time of closing. So there’s some flexibility as to how you can pay it.

Need a VA Loan in California?

Bridgepoint Funding specializes in the VA loan program and serves all of California. We are passionate about this program because it rewards our military service members and veterans.

We can help you navigate the loan process in the following ways:

- Obtaining your Certificate of Eligibility (COE) document from the VA.

- Determining which type of VA loan works best for your situation.

- Pre-approving you for a specific amount to focus your housing search.

- Guiding you through the home appraisal and underwriting process.

- Ensuring that you close the deal on time and with minimal hassle.

Let’s talk: Please contact our team if you have questions about VA funding fees, down payments, or other topics covered in this guide!