Are you tired of renting a home in California and ready to make the transition…

Buying a Home in California With a 3% Down Payment

A lot of home buyers don’t realize it’s possible to buy a home in California with 3% down. But it’s true.

These days, there are several mortgage programs available for borrowers with limited funds in the bank. Some of them allow eligible home buyers to buy a house in California with a down payment as low as 3%.

We’ll get to those loan programs in a moment. First, let’s debunk a common myth regarding mortgage loans and minimum down payments.

It’s Possible to Buy a House in California with 3% Down

Numerous surveys have shown that a lot of home buyers in California think they have to put down 20% when purchasing a home. But that’s actually far from the truth.

As mentioned above, there are mortgage programs available that allow borrowers to buy a house in California with a down payment in the 3% – 3.5% range.

Last year, a study conducted by National Association of Realtors found that the typical down payment among first-time buyers was 6%. And that’s just the average. Some buyers put down even less.

So much for that 20% myth!

Now that we’ve cleared that up, let’s look at some of the mortgage options that allow borrowers to buy a home in California with as little as 3% down.

Option 1: HomeReady® Offered by Fannie Mae

Fannie Mae is one of the two government-sponsored corporations that buy mortgage loans from lenders. They also establish guidelines and requirements for the types of home loans they can purchase.

Fannie Mae works with mortgage lenders to offer a 3% down payment mortgage option known as HomeReady. This product is designed for borrowers with relatively low income, and it offers financing of up to 97% of the purchase price.

But you have to meet certain income restrictions. Specifically, the borrower’s total annual income should not exceed 80% of the median income in the local area.

California home buyers who use this program can buy a house with 3% down.

HomeReady is designed for first-time and repeat buyers. While the program is popular among first-time purchasers, it is not limited to that audience. Even those who have purchased a home in the past could qualify for this mortgage option.

According to Fannie Mae, borrowers need a credit score of 620 or higher to qualify for the program. Borrowers with scores of 680 or higher might be able to qualify for better pricing.

Option 2: Fannie Mae’s Standard 97% LTV Loan

Fannie Mae supports another loan product with a 3% down payment option.

Their standard 97% LTV loan is similar to the HomeReady product mentioned above, but two key differences:

- There are no income limits or restrictions.

- At least one borrower must be a first-time home buyer.

Important: With this program, Fannie Mae defines a “first-time buyer” as someone who has not owned a home within the past three years (at the time of application).

Here’s how Fannie Mae clarifies the difference between their 3% down programs:

“Our HomeReady mortgage does not require that borrowers be first-time home buyers. Fannie Mae standard transactions using 97% LTV financing, however, must have at least one borrower who is a first-time home buyer.”

Option 3: Home Possible® Offered by Freddie Mac

This is another option that allows people to buy a home in California with a 3% down payment. Freddie Mac is the other government-sponsored mortgage buyer.

This program is very similar to the HomeReady loan program mentioned, and the qualification requirements are nearly identical.

The borrower does not have to be a first-time buyer. But the qualifying income is limited to 80% of Area Median Income (AMI), as with Fannie Mae’s HomeReady.

Additionally, if all of the borrowers who plan to live in the home are first-time buyers, at least one has to attend a home buying education course.

California home buyers typically need a credit score of 660 or higher to qualify for the Home Possible program. But exceptions might be possible in some cases.

Option 4: Freddie Mac’s HomeOne® Product

FreddieMac’s HomeOne loan product also allows for a 3% down payment on a California home purchase.

This program is similar to the “Home Possible” mentioned above, but without the income restriction. You do not have to be a low- or moderate-income borrower to qualify.

However, if all borrowers are first-time buyers, at least one of them must complete a home buying education course from a qualified provider.

With this program, at least one of the borrowers has to be a first-time buyer. Freddie Mac defines this as someone who has had “no ownership interest in a residential property during the three-year period preceding the date of the purchase.”

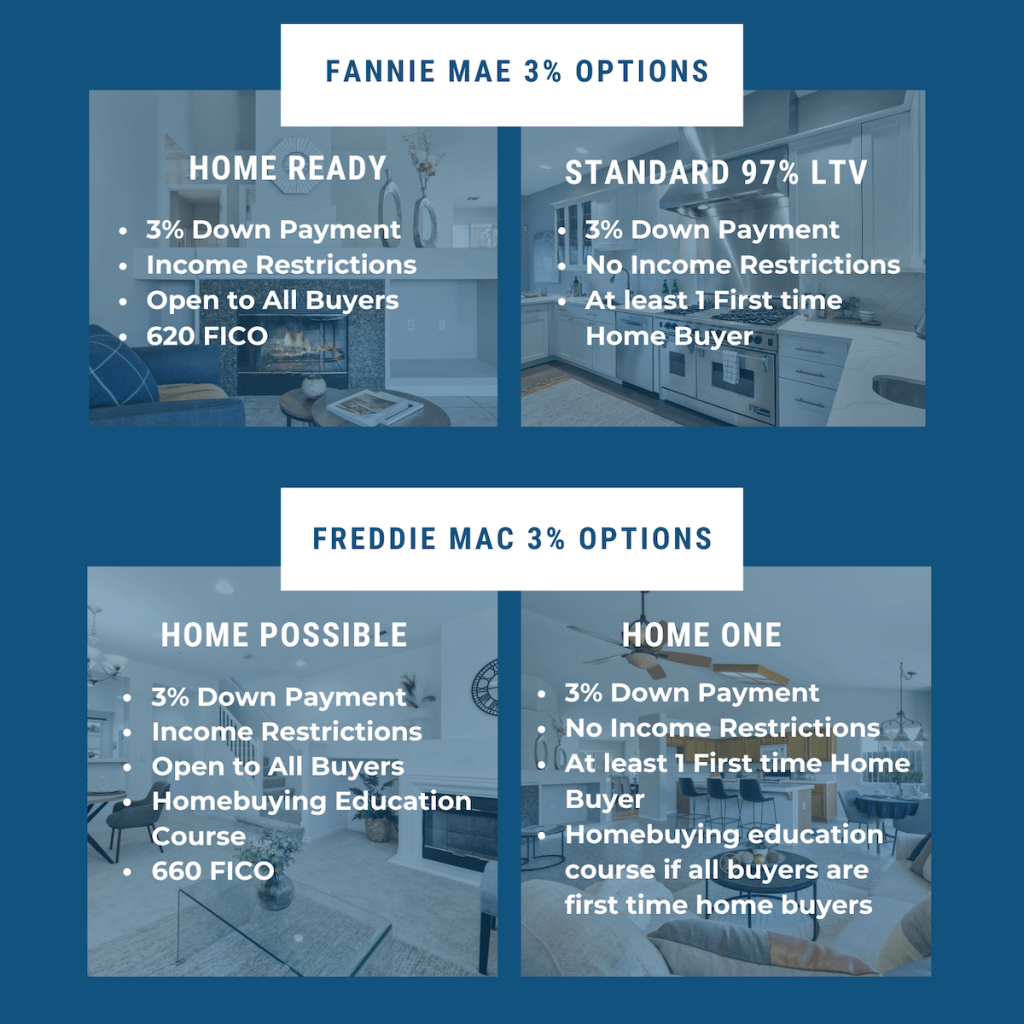

Summarizing the Fannie and Freddie Programs

These programs can be confusing for home buyers. Even mortgage professionals have to refer back to their product sheets once in a while. So let’s summarize their key similarities and differences:

Fannie Mae and Freddie Mac both offer mortgage programs that allow California home buyers to make a down payment as low as 3%. Both organizations offer two different programs:

- One product is open to all home buyers but limits the income to 80% of AMI.

- The second product has a “first-time buyer” requirement with a three-year rule, but no income restrictions.

All four of these products require private mortgage insurance (PMI). PMI is typically required whenever the loan-to-value ratio exceeds 80%. But it can be canceled later on, when your equity reaches a certain level.

If You Don’t Qualify for One of These Programs…

Many home buyers in California can benefit from the 3% down payment programs mentioned above. But some people won’t qualify for any of these options.

For example, a borrower with an income above 80% of the local median who recently sold a home might not qualify for any of these programs. They exceed the income limits of HomeReady and Home Possible. And their recent homeownership would disqualify them from the Standard 97% LTV loan and HomeOne.

In this scenario, a home buyer could look to other low-down-payment mortgage options.

The Federal Housing Administration (FHA) loan program allows for a down payment as low as 3.5%. That makes it comparable to the four programs listed above.

Using Gift Money to Clear the Hurdle

These and other mortgage programs are fairly flexible when it comes to the down payment funds. They allow for a wide variety of fund sources, including gift money from a family member.

So, that 3% down payment requirement mentioned above doesn’t necessarily have to come out of your own bank account. It could be gifted to you from a family member or other approved provider, as long as they don’t expect repayment.

Not a lot of home buyers know about this option. So it’s worth repeating. It’s possible to buy a home in California with a 3% down payment, and some or all of that investment could be gifted to you from a third party.

Pros and Cons of Making a 3% Down Payment

There are pros and cons to buying a home with a low down payment. The upside is that you could purchase a home with less money down, which means you don’t have to wait as long. That’s a major benefit in a pricey market like California.

But there’s a downside as well. Borrowers who put down 3% on a conventional mortgage loan (like those described above) usually have to pay for private mortgage insurance, or PMI.

Private mortgage insurance is a standard requirement across the industry. There are ways to avoid this added cost, and we’ve covered some of them in previous articles. But for those California home buyers who put 3% down, PMI is almost always required.

The good news is that PMI won’t make a huge difference in your monthly payments. Still, it’s something to consider.

Without PMI, most home buyers in California would have to put at least 20% down on a home purchase. So, in a sense, PMI is both a “blessing and a curse.” It increases the size of your monthly payments.

But it also allows home buyers with limited funds to purchase a home sooner rather than later — and with as little as 3% down.

Have mortgage questions? As a mortgage broker, we have access to a variety of lenders and many different loan programs. Please contact us if you want to buy a home in California with a low down payment.