Are you tired of renting a home in California and ready to make the transition…

Buying a House in the Bay Area With Less Than 20% Down

The San Francisco Bay Area is home to some of the most expensive real estate markets in the country. As a result, many home buyers have trouble coming up with a 20% down payment on a mortgage loan.

The good news is you might not have to invest that much. There are ways to buy a home in the Bay Area with less than 20% down. Some mortgage products allow for a down payment in the 3% to 3.5% range.

Some borrowers choose to invest 20%, because it allows them to avoid mortgage insurance and reduces their total interest costs. But it’s possible to get a mortgage loan in the Bay Area with a much smaller investment.

Basic Mortgage Requirements for Bay Area Borrowers

When buying a home in the Bay Area, you don’t necessarily have to put 20% down. That is the most important thing to take away from this guide.

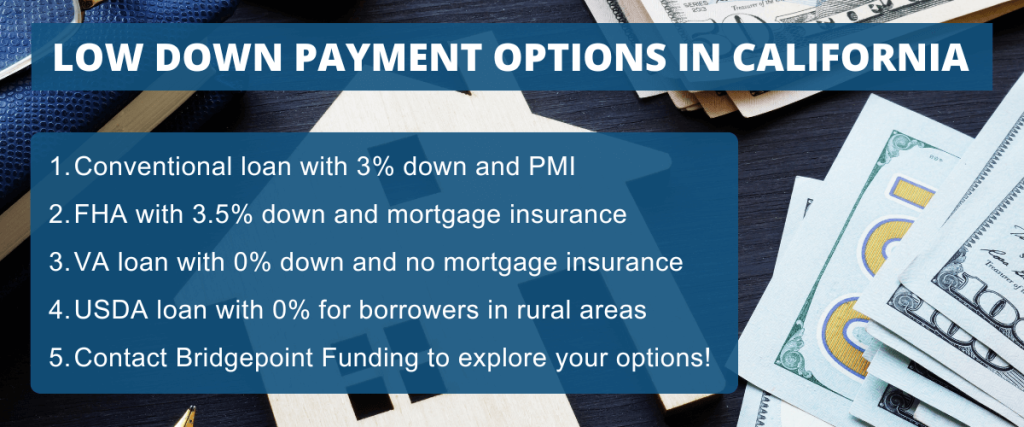

Some loan programs offer smaller down payments, including the following popular options.

1. Conventional Loans with Low Down Payments

Conventional loans, backed by Freddie Mac or Fannie Mae, offer flexibility for first-time homebuyers in California. With as little as 3% down, buyers can purchase a home sooner. However, low down payments usually require Private Mortgage Insurance (PMI), which is added to monthly mortgage payments.

2. FHA Loans: A Government-Backed Option

The Federal Housing Administration (FHA) offers a government-backed loan program that requires a minimal down payment of just 3.5%. This makes it an attractive option for first-time buyers, especially those with limited savings. While FHA loans often have more lenient credit requirements, they do require Mortgage Insurance Premium (MIP) throughout the life of the loan.

3. VA Loans for Veterans and Military Members

Veterans and active-duty military personnel can take advantage of VA loans, which offer the unique benefit of 100% financing. This means eligible borrowers can purchase a home with no down payment. VA loans also typically have competitive interest rates and no requirement for Private Mortgage Insurance (PMI).

Worth knowing: According to the National Association of REALTORS, the average down payment among first-time buyers was 8%. This reinforces our main point, that many people make down payments below 20%.

Expect to Pay Extra for Mortgage Insurance

Mortgage insurance plays a part in all of this. In short, a smaller down payment can result in a higher loan-to-value ratio, which might trigger a requirement for mortgage insurance.

Here are the general requirements for mortgage insurance, based on the loan type:

- FHA: Mortgage insurance is required for all FHA-insured home loans. It helps fund the program and protects lenders from financial losses related to borrower default. But the borrower pays for it, in the form of a monthly premium added onto the mortgage payments.

- Conventional: For conventional mortgage loans that are not insured by the government, private mortgage insurance (PMI) is usually required when the loan-to-value ratio exceeds 80%. So a smaller down payment might require you to pay PMI.

This is why some home buyers in the San Francisco Bay Area choose to make down payments of 20% or more, using a conventional loan. It allows them to avoid the additional cost of mortgage insurance, along with the other benefits mentioned below.

Of course, not everyone can afford to put 20% down on a Bay Area home purchase. And for those borrowers, mortgage insurance allows them to buy a house with a smaller upfront investment.

Benefits of Putting 20% Down on a Home Purchase

To recap, a 20% down payment isn’t always required in the Bay Area, and some home buyers put down much less than that.

But there are some benefits to making an upfront investment of 20% or more. These include the following:

1. You might have an easier time qualifying for a mortgage.

If you choose to go with a larger down payment, you could have an easier time qualifying for a mortgage loan. That’s because you are essentially reducing the lender’s risk.

A home buyer who makes a relatively low down payment of, say, 3% has to borrow the remaining 97%. That’s a lot of money for a mortgage company to lend, especially with Bay Area home prices. So the lender might pay closer attention to the borrower’s criteria.

A down payment of 20%, on the other hand, would only require 80% funding from the lender thereby reducing their risk. Because of this, borrowers who put down 20% or more typically have an easier time qualifying for home loans.

2. You could qualify for a lower interest rate.

You might also qualify for a lower interest rate if you put 20% down. And once again, this ties back to the concept of risk reduction.

Banks and mortgage lenders typically offer their best rates for borrowers who are considered to be less of a risk. Having more “skin in the game” makes you less risky, as a borrower.

3. You can avoid paying mortgage insurance.

We touched on this benefit in the previous section. If you use a conventional mortgage loan to buy a home in the San Francisco Bay area, and you make a down payment of 20% or more, you can avoid mortgage insurance entirely. This in turn would reduce your long-term financing costs.

4. You’ll have a smaller monthly payment.

You’ll also end up with a smaller monthly payment, compared to if you had put less money down. A larger down payment reduces the amount you have to borrow from the lender, resulting in a smaller monthly payment. This allows you to put more of your monthly income toward savings, entertainment, travel, etc.

5. The seller might be more inclined to accept your offer.

Lastly, you might have an easier time getting your purchase offer accepted if you put 20% down. Sellers tend to look favorably on buyers with the financial ability to make a larger down payment. This could give you an extra advantage in a highly competitive real estate market, like the San Francisco Bay Area.

What a 20% Down Payment Might Look Like

Surveys have shown that most residents in the Bay Area cannot afford to put 20% down when buying a home. This applies to both first-time and repeat buyers.

The reason is somewhat obvious. We live in one of the most expensive real estate markets in the country, and that makes it hard to come up with 20%.

According to the California Association of Realtors, the median home value in the Bay Area ranges from around $600,000 (in Solano County) up to $2,000,000 in San Mateo. Here’s what a 20% investment would look like at those price points.

| Home Price | 20% Down Payment |

| $600,000 | $120,000 |

| $800,000 | $160,000 |

| $1,000,000 | $200,000 |

| $1,200,000 | $240,000 |

| $1,400,000 | $280,000 |

| $1,600,000 | $320,000 |

| $1,800,000 | $360,000 |

| $2,000,000 | $400,000 |

In some Bay Area markets, a 20% down payment would equal or exceed the full home price in more affordable areas. And that’s cost-prohibitive for a large segment of the population.

This underscores the importance of the low down payment mortgage options mentioned earlier. They make homeownership more accessible for a lot of people, by reducing the upfront investment.

Let’s Explore Your Financing Options

As you can see, there’s a lot to consider when taking out a mortgage loan. That’s why it’s so important to speak with a knowledgeable mortgage professional, like the team at Bridgepoint Funding.

We offer a wide range of mortgage products, including FHA, VA, conventional, jumbo loans and more.

Please contact us if you have questions about financing your home purchase or would like to apply for a loan. We look forward to helping you!