VA loans allow military members and veterans to buy a home in California with no…

San Francisco Bay Area Jumbo and Conforming Loan Limits for 2024

Note: This article was originally published in 2023 but was updated in June 2024 to offer all of the latest numbers, data, and trends.

- The 2024 conforming loan limit for most of the San Francisco Bay Area is $1,149,825.

- So anything above that level would be considered a jumbo mortgage loan.

- But technically speaking, there is no “jumbo loan limit” for the San Francisco area.

- The maximum financing threshold can vary from one lender to the next.

- We have secured jumbo loans for Bay Area borrowers up to $5 million.

- Larger mortgages often require higher credit scores and larger down payments.

The San Francisco Bay Area is one of the most expensive real estate markets in the U.S. Because of this, a lot of home buyers in the region have to rely on jumbo mortgage loans the provide a higher level of funding.

But what is a jumbo loan exactly? What are the current limits for the San Francisco area? And what does it take to qualify for this kind of financing? This guide answers those questions and more.

Questions? If you don’t find the answers you need in our jumbo loan guide below, please contact our staff. We specialize in multi-million-dollar mortgages and serve the entire Bay Area.

What Is a Jumbo Loan Exactly?

Definition: A jumbo loan is a mortgage that exceeds the conforming size limits established by the Federal Housing Finance Agency and used by Freddie Mac and Fannie Mae.

As you might already know, a lot of mortgage loans end up getting sold to Freddie Mac and Fannie Mae. These government-sponsored enterprises (GSEs) purchase loans from lenders, securitize them, and sell them to investors via the secondary mortgage market.

But they can only purchase loans up to a certain amount, and that maximum amount is referred to as a conforming loan limit. This also limits the amount of risk the GSEs take on.

Here’s the key difference between conforming and jumbo loans:

Conforming: These loans meet the size limits and other parameters used by Fannie Mae and Freddie Mac. The GSEs can purchase and securitize these loans, which makes them appealing to lenders. So the conforming loan limit represents the maximum mortgage size Fannie and Freddie can accept.

Jumbo: This term is used to indicate a mortgage loan that exceeds the conforming limit for the county where the home is located. These “oversized” home loans cannot be sold to Fannie or Freddie. Since they’re not purchased by the GSEs, lenders take on greater risk. They typically have stricter requirements for credit scores, down payments, etc.

There isn’t a standard “jumbo loan limit” for the San Francisco Bay Area. There is a conforming limit for conventional home loans, and these can vary by county. Anything above that would be considered jumbo.

Conforming Limits and Jumbo Threshold for 2024

To recap: A jumbo loan is one that exceeds the conforming size limits used by Fannie Mae and Freddie Mac.

But what are those size limits?

Conforming loan limits typically change from one year to the next, because they’re based on median home prices. They can also vary from one county to another, and for the same reason.

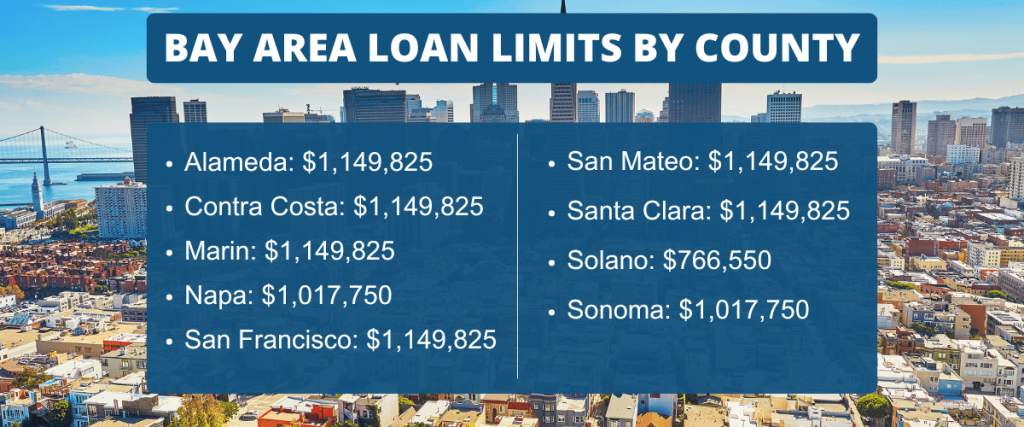

Here’s a snapshot of the 2024 limits for a single-family home:

- The current conforming loan limit for most of the Bay Area is $1,149,825.

- This applies to Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara counties.

- The conforming limit for Solano county is $766,550 due to the lower median home price there.

- Napa County has a 2024 limit of $1,017,750 while Sonoma County is capped at $877,450.

So if you were to borrow more than the maximum conforming amount for your county, you would be using a jumbo mortgage loan product and possibly encounter stricter criteria.

What Does All of This Mean for Borrowers?

We talked about the risk factor above, and how it relates to jumbo mortgage loans. These loans bring additional risk for the lenders who offer them, and for two main reasons.

- The lender is providing a larger amount of money, and that means more risk.

- Jumbo loans are not eligible for GSE purchase, which means the lender bears the full risk of default (unless the loan is sold to investors).

However, a well-qualified borrower with sufficient income should have no trouble borrowing more than the conforming loan limit for their county. Jumbo loans are commonly used in the San Francisco Bay Area, due to our higher home prices.

So don’t let any of these rules or limits discourage you from applying. If you have a sufficient level of income, a good credit score, and a manageable amount of debt, you could be a great candidate for a jumbo mortgage.

How It Stacks Up Against Home Prices

In many counties across the U.S., the official conforming loan limits are set well above median home prices. But here in the San Francisco Bay Area region, the 2024 conforming loan limit is actually slightly below the current median home price.

According to a recent report from the California Association of Realtors, the median sale price for existing single-family homes in the Bay Area was $1,455,000. That’s a bit higher than the 2024 conforming loan limit of $1,149,825 (which applies to all local counties except for Solano).

This explains why the jumbo loan is such a common feature in our real estate market, along with parts of Southern California. More expensive housing markets tend to have a higher percentage of jumbo mortgage products, and that’s the case in our area as well.

Basic Requirements for a Jumbo Mortgage

When you apply for a mortgage loan, the lender will review all aspects of your financial situation to determine if you are a good candidate for a loan. They also do this to determine how much you are able to borrow.

This is true for both conforming and jumbo loans. But when it comes to jumbo mortgage financing here in the Bay Area, lenders often pose stricter criteria.

Borrowers seeking a jumbo loan, typically need to have the following:

- Enough income to cover the monthly payments and all other recurring expenses.

- A better-than-average credit score, though there is some flexibility here.

- A manageable level of debt with the addition of the jumbo loan.

- A larger down payment than a conforming loan, sometimes up to 20%.

Key point: Mortgage brokers like Bridgepoint Funding work with multiple lenders. This gives you access to a broader pool of loans and therefore a better chance of qualifying.

These Loan Limits Could Go Up in 2025

The median home price in the San Francisco Bay Area has increased by around 7% over the past year. And prices continue to climb from month to month, in most cities across the region.

Because of this, we could see higher conforming loan limits and jumbo thresholds in 2025.

These limits are based on median house values and calculated based on a formula outlined in the Housing and Economic Recovery Act of 2008 (HERA). This means they can change from one year to the next, to keep up with rising home prices.

And there’s a good chance the conforming loan limits will rise from 2024 to 2025 due to steady price increases. Federal housing officials typically announce such changes at the end of the year, with revised figures for the following year.

Ready to Explore Your Financing Options?

Bridgepoint Funding is your local mortgage broker! We have roots here in the Bay Area and serve home buyers and homeowners all across the region.

As a broker, we have access to multiple lenders and can therefore offer a wide variety of mortgage options, including “super” jumbo loans up to $5 million.

If you plan to buy a home in the San Francisco area in 2024 and need a mortgage loan to make it happen, now is the time to start planning. Please contact our staff with any financing questions you have or to start the application process.