Are you tired of renting a home in California and ready to make the transition…

Average Down Payment for a California Home Purchase, 2024 Update

Update: This guide was updated in the summer of 2024 to include the latest down payment averages among California home buyers.

Home prices continue to climb steadily across the state of California, as we move into the second half of 2024. As a result, the typical down payment among home buyers has risen as well.

Here’s a snapshot based on current prices and typical investment amounts:

- The average down payment among first-time buyers is 7%.

- The average among all buyers is 13%, according to a recent survey.

- 7% down on a median-priced ($787,000) California home = $55,090.

- 13% down on a median-priced house would come to $102,310.

- But some conventional loans allow for as little as 3% down.

- A 3% down payment in California would average around $23,610.

Keep in mind these are just averages based on the current statewide median home price. Your down payment amount could vary due to a number of factors, including the type of loan you use.

Most Borrowers Put Less Than 20% Down

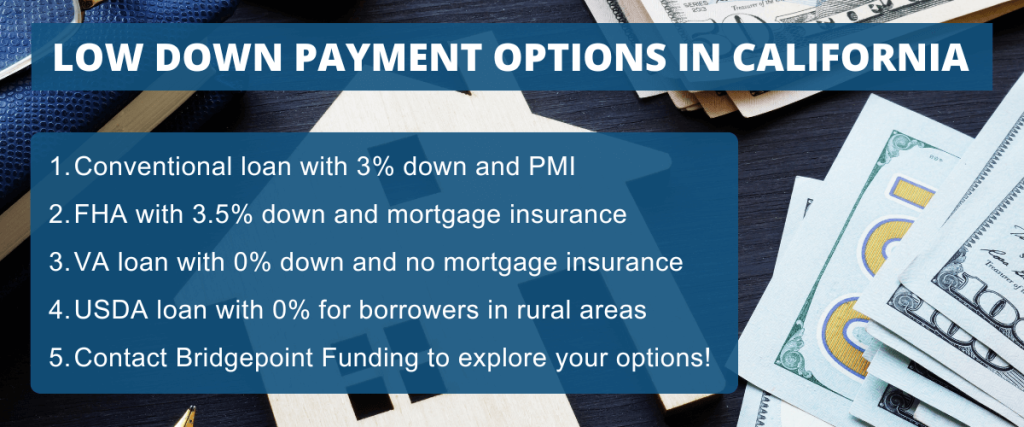

There’s a common misconception among home buyers that you have to put down 20% when buying a house in California. But that’s usually not true. Many home loan options available these days allow for a smaller upfront investment.

A survey conducted by the National Association of Realtors found that the average down payment among first-time buyers in California and nationwide was 7%. The average among all buyers, including previous homeowners, was 13%.

(Repeat buyers tend to put more money down, on average, because they often have proceeds from a previous home sale to put toward their next purchase.)

But there’s a big difference between the average down payment in California, and the minimum investment that’s required for different mortgage programs.

Some of the conventional loans that get sold to Freddie Mac and Fannie Mae can have a down payment as low as 3%. The FHA program allows borrowers to invest as little as 3.5%, and VA loans offer 100% financing with no down payment whatsoever.

Now that we have some percentages to work with, let’s look at what the average down payment might be in dollar amounts, using recent home price data.

Average Down Payment Among California Home Buyers

According to recent data from Zillow, the statewide median home price in California is currently around $787,000. We used that figure to determine what the average down payment might look like, at several different thresholds:

- 3% (the minimum down payment for a standard conventional loan)

- 7% (the average down payment among first-time buyers)

- 13% (the average down payment among all home buyers)*

- 20% (the amount needed to avoid paying mortgage insurance)

* Based on the National Association of Realtors “Profile of Home Buyers and Sellers”

3% Down Would Equal a $23,610 Investment

For a conventional home loan that’s not backed by the government, the minimum down payment for most borrowers is 3%. Some borrowers might be required to put down more than that amount, depending on the loan size and other parameters.

But for the most part, the minimum investment comes to 3% of the purchase price.

Applying that percentage to the current median home price in California ($787,000) would equal a down payment of around $23,610. So by that measurement, we might consider this to be the minimum down payment for a “typical” home purchase in California, as of summer 2024.

Of course, not all buyers will end up paying the statewide median price when buying a house.

Those who live in the San Francisco Bay Area, for example, could end up paying a lot more than the $787,000 figure mentioned above. At the other end of the spectrum, home buyers in places like Fresno and San Bernardino could probably get by with a much smaller down payment.

7% Down for First-Time Buyers Would Equal $55,090

The average down payment among first-time buyers is around 7%, according to data published last year. In California, an upfront investment of 7% on a median-priced home would amount to $55,090.

First-time buyers who can’t afford to put that much money down might want to look into the Home Possible and HomeReady products offered by Freddie Mac and Fannie Mae, respectively. These programs allow for a loan-to-value (LTV) ratio up to 97%, for a down payment of just 3%.

These programs are often limited to “first-time” buyers. But the definition is fairly loose. As long as you haven’t owned a home within the past three years, you could be considered a first-time buyer with some of these 3% down programs.

13% on a Median-Priced Home Would Come to $102,310

A couple of years ago, the National Association of Realtors conducted a survey that determined the average down payment among all buyers to be 13%. That includes both first-time and repeat buyers.

Making a 13% investment on a median-priced house in California (as of summer 2024) would equal a down payment of just over $102,000. That’s the closest we can get to determining an average for all home buyers statewide.

Just remember that it’s possible to put less money down when buying a house. As we noted earlier, the minimum investment for a “standard” conventional loan can be as low as 3%.

And the FHA program allows borrowers to put down as little as 3.5%. Eligible military members and veterans can use a VA loan to avoid the down payment altogether.

20% Down Would Bring the Investment Amount to $157,400

Lastly, let’s take a look at the average down payment for home buyers who choose to put 20% down.

By investing this amount (or more) on a purchase, borrowers can avoid the extra cost of private mortgage insurance (PMI). That’s because PMI is usually required whenever the loan-to-value ratio rises above 80%.

Borrowers with sufficient savings sometimes choose to put down 20% or more in order to avoid the additional cost of PMI.

Using the current statewide median home price of $787,000, a down payment of 20% would come to around $157,400. But again, a 20% investment is not always needed!

Using Gift Money From an Approved Donor

Many home buyers in California are able to manage the monthly payments on a mortgage loan, but they have trouble coming up with the down payment. In fact, this is the most common hurdle to homeownership these days.

For these borrowers, down payment gifts can provide a useful workaround.

This is when you receive money from an approved third party, such as a family member, to help cover the investment on a home purchase. It’s a great way to minimize your upfront costs when buying a house. And we’ve written a separate article on the subject to help you learn all about it.

Other Ways to Reduce the Upfront Expense

As we’ve seen, the average down payment on a home purchase in California can add up to a significant sum. Fortunately, there are ways to reduce this upfront expense.

Can’t afford a big down payment? Consider one of the following strategies:

- Purchase a more affordable home: This is the most obvious way to reduce the down payment amount. The lower the purchase price, the smaller the investment. Consider looking in different neighborhoods or for smaller homes to find a property that fits your budget.

- Use gift funds: As mentioned above, many loan programs allow home buyers to use gift funds from family members or close friends towards their down payment. Be sure to check with your lender for specific requirements and documentation.

- Apply for assistance programs: Some federal, state, and local programs offer grants or loans to help cover down payment and closing costs. Many of these programs are limited to first-time home buyers, but that might just mean people who haven’t owned a home within the past three years.

- Consider FHA, VA and USDA: Government-backed loan programs like FHA, VA and USDA have lower down payment requirements than conventional loans. The VA and USDA programs are limited to military members and rural residents, respectively. But the FHA program serves all home buyers in California.

- Negotiate seller concessions: In a buyer’s market, you might be able to negotiate with the seller to pay a portion of your closing costs. This in turn could help free up some cash to put toward the minimum required down payment.

Disclaimer: This article offers insight into the minimum and average down payment for a house in California, based on 2024 price data and mortgage requirements. Every mortgage loan scenario is different because every borrower is different. Therefore, portions of this article might not apply to your particular situation.