FHA loans are a popular financing option among home buyers in California. In 2023, they…

Difference Between VA and Conventional Loans for California Borrowers

In the past, we’ve written about the different types of home loans available to California home buyers. Today, we will offer a side-by-side comparison between VA-guaranteed home loans and conventional mortgage loans.

If you’re a military member or veteran in California, you may have the luxury of choosing between a VA or conventional home loan. And the following information will help you make a smart choice.

Choosing the Right Financing Option

Let’s start with an important clarification. VA loans are only available to military members, veterans, and certain qualifying spouses. So our comparison between VA and conventional loans is only applicable to this particular group.

Here are some definitions that will make this easier to understand:

- A conventional loan is a type of mortgage loan that is not guaranteed or insured by a government agency such as the FHA, VA, or USDA. Conventional loans are often sold to Fannie Mae and Freddie Mac, two government-sponsored entities that buy and sell conventional mortgage loans on the secondary market.

- A VA loan is a type of mortgage loan that is guaranteed by the Department of Veterans Affairs (VA). The VA does not lend money directly to borrowers, but guarantees the loan against default. This guarantee protects the mortgage lender, allowing them to offer flexible criteria such as zero down payment and more lenient credit criteria.

So the VA loan program is limited to certain military borrowers, while the conventional option is open to all types of borrowers.

Option 1: VA Home Loans

The VA loan program was created to reward military members for their service. It provides a number of unique benefits and advantages, when compared to conventional mortgage products.

California home buyers who use a VA loan to purchase a house can finance up to 100% of the purchase price. This means they can avoid making a down payment entirely — a big deal in an expensive state like California.

The VA loan program offers other advantages as well. In addition to avoiding the down payment expense, qualified borrowers can avoid paying for mortgage insurance.

In fact, this is one of the only programs available that allows borrowers to finance 100% of the home price without paying any form of mortgage insurance. It’s a powerful combination of benefits.

Typically, a person who makes a low down payment on a house has to pay for mortgage insurance, to offset the added risk. For example, if you use a conventional loan with a low down payment of around 5%, you would probably have to pay mortgage insurance. But that’s not the case with a California VA home loan.

VA loans are also one of the easiest mortgage programs to qualify for. That’s because the federal government guarantees these loans, giving mortgage lenders a layer of protection they wouldn’t otherwise have. This in turn allows lenders to ease the qualification criteria for borrowers, making it easier to qualify for these loans.

Five things to remember about VA home loans:

- VA loans are only available to military members, veterans, and certain qualifying spouses.

- They allow you to finance 100% of the home purchase price with no down payment.

- They do not require mortgage insurance, which is often required for conventional loans.

- VA loans are generally easier to obtain. You don’t need flawless credit to qualify.

- They offer financing above $1 million, which comes in handy in a market like California.

Option 2: Conventional Loans

We’ve already covered the main difference between VA and conventional loans in California. VA home loans receive government backing, in the form of a guarantee, while conventional loans do not.

This distinction leads to other differences as well. For example, it’s typically harder to qualify for a conventional loan when compared to a VA-guaranteed mortgage.

There’s another big difference when it comes to down payments. Most home buyers in California who use a conventional loan have to make some kind of down payment.

The minimum required down payment can vary based on the amount being borrowed and other factors. In California, the minimum upfront investment for a conventional loan typically ranges from 3% to 5%. In addition, borrowers seeking a larger “jumbo loan” might be required to put down 20%.

Private mortgage insurance is another important consideration here. If you use a conventional loan to buy a house in California, and it accounts for more than 80% of the home’s value, you will probably have to pay for private mortgage insurance (PMI). This recurring expense typically gets added onto the monthly mortgage payments.

According to research by Freddie Mac, borrowers can expect to pay “somewhere between $30 and $70 per month for every $100,000 borrowed,” for a standard private mortgage insurance policy.

Five things to remember about conventional home loans:

- A conventional loan does not receive any government insurance or guarantee.

- They’re available to all borrowers, regardless of military service.

- Conventional is the most popular mortgage option, followed by FHA and VA.

- If you put down less than 20%, you might have to pay for mortgage insurance.

- Conventional loans often require higher credit scores, compared to the VA program.

Differences Relating to the Home Appraisal

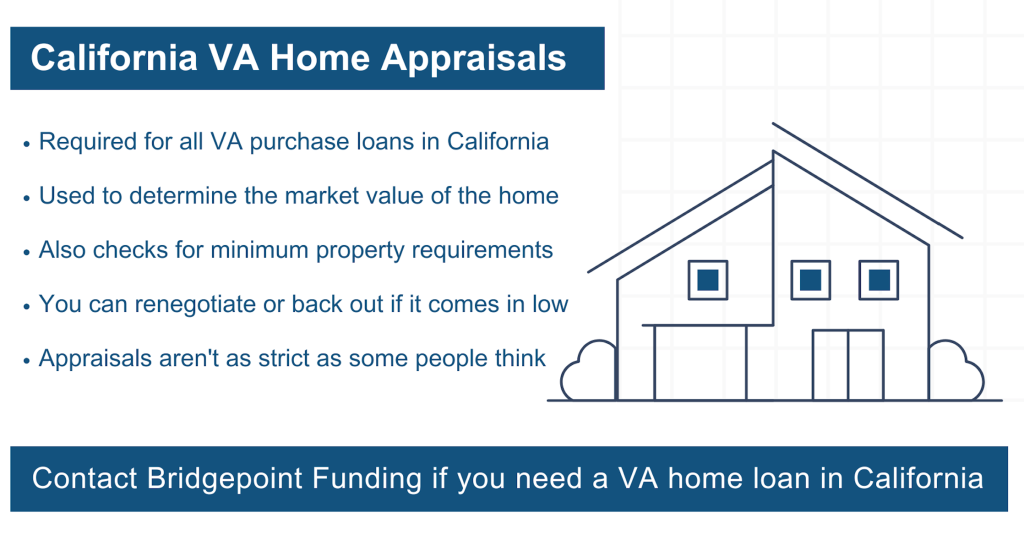

In California, conventional and VA loans also have some key differences when it comes to the home appraisal. VA loans require a more in-depth home appraisal when compared to conventional financing.

A home appraisal is a professional assessment of a property’s market value, conducted by a licensed appraiser. It considers factors like the home’s condition, location, and recent sales of similar properties.

Mortgage lenders usually require an appraisal to make sure they’re not lending more than the home is worth. In most cases, the mortgage amount cannot exceed the appraised value of the home.

This is true for all types of home loans, including VA and conventional. But there are some key differences here as well:

- Conventional: When a regular mortgage loan is being used, the appraisal focuses solely on determining the home’s current market value. That is its only purpose.

- VA: With a VA loan, the home appraiser must perform double duty. He or she will estimate the current market value of the property, while also ensuring that it meets the VA’s requirements for safety and habitability.

The Department of Veterans Affairs also requires VA loan borrowers to have an “escape clause” included within their purchase agreements. This protective clause allows the home buyer to back out of the deal if the appraisal comes in low, while recovering their earnest money deposit.

With a conventional loan, a home buyer can choose to include an appraisal contingency within their contract. But it’s entirely optional. VA loans, on the other hand, must include this type of clause.

Summary: The Key Differences in a Nutshell

We’ve covered a lot of different factors in this article. So let’s wrap up with a simple explanation of the differences between VA and conventional loans, as it relates to borrowers.

- VA loans are limited to military members, veterans, and certain spouses.

- Conventional loans, on the other hand, are available to all types of home buyers.

- VA loans allow borrowers to avoid the down payment, by financing 100% of the price.

- Conventional loans typically require at least 3% down (or more for a larger loan size).

- VA loans are one of the easiest mortgage types to obtain, for the reasons stated earlier.

- Conventional home loans tend to have stricter criteria, by comparison.

- VA loans require a home appraisal with minimum property requirements built in.

- Home appraisals for conventional loans only focus on determining market value.

Want to explore your options? This article provides a basic overview of the differences between VA loans and conventional mortgages in California. If you’re a military member and eligible for the VA loan program, please contact us with any questions you have. We offer both types of loans and serve the entire state of California!