This article is part of an ongoing series that answers common questions about different types…

California VA Home Loan Requirements Explained

The VA home loan program is incredibly popular among California military members and veterans, and for good reason. It offers a number of impressive benefits, including zero down payment and no mortgage insurance.

But like other government-backed mortgage programs, VA loans have specific requirements relating to income verification, debts, supporting documents, and more.

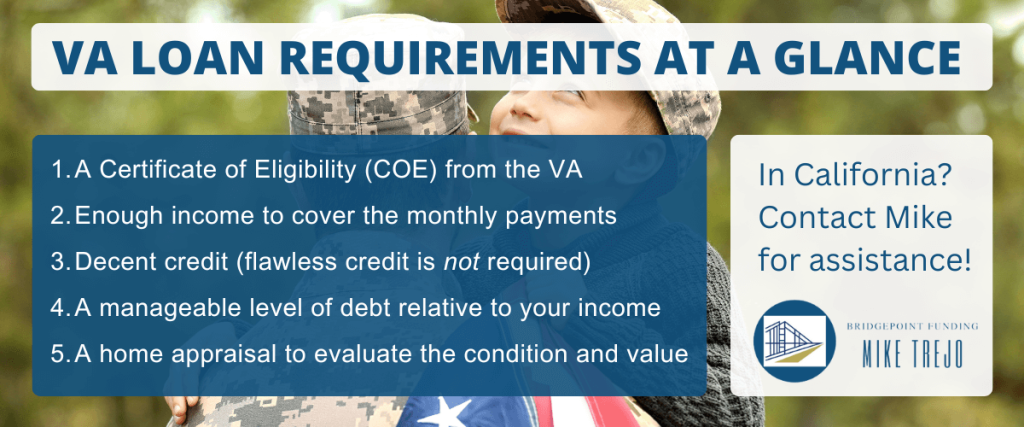

At a glance: To qualify for a VA loan in California, you’ll need to meet the basic eligibility requirements for time in service. It also helps to have a decent credit score, a manageable level of debt, and enough income for your monthly payments.

We can help! Bridgepoint Funding specializes in the VA home loan program and serves borrowers all across the state of California. Please contact us if you have questions about any of these guidelines.

Minimum Requirements for a California VA Loan

VA loans are partially guaranteed by the federal government, through the U.S. Department of Veterans Affairs. This government backing gives participating mortgage lenders an added layer of protection against borrower default.

Because of this, VA-guaranteed home loans have some of the most flexible requirements of any mortgage program. You don’t need to have perfect credit or a huge income to qualify for this program.

Here are some of the things you do need when applying for a VA loan in California:

1. A Certificate of Eligibility from the VA

One of the first things you’ll need to do is obtain your Certificate of Eligibility (COE) from the Department of Veterans Affairs. This official document shows lenders that you are eligible for the program, based on your current or prior military service.

This requirement applies to all borrowers in California who want to use a VA loan, whether you are purchasing or refinancing a home.

The following groups may be eligible for this program:

- Active-duty military who have served for at least 90 days

- National Guard and Reserve members who have completed at least six years of regular service or 90 days of active duty

- Surviving spouse of a military person who died in the service or due to a service-related disability

You can request your COE on your own, through the VA.gov website, or have the lender do it for you. Requesting this document electronically (instead of through the mail) can help to expedite the process. Please contact us if you have questions about this requirement or need help.

2. Sufficient Income to Cover Your Monthly Payments

This next requirement should come as no surprise. To qualify for a VA loan in California, you need to have enough income to cover your monthly mortgage payments along with all other recurring debts.

This requirement protects all parties involved, including the borrower, the lender, and the VA itself. The last thing you want is to end up in a situation where you struggle to cover your debts.

When you apply for a loan, you’ll be asked for a variety of financial documents including proof of income. The lender will use your pay stubs, tax returns, and bank statements to verify both the amount and the overall stability of your income.

Ideally, you’ll have a pattern of stable and consistent income for at least the past two years. This is a general requirement for VA and conventional mortgage loans alike. But there are exceptions to this guideline, especially if there’s a strong likelihood of continued employment going forward.

3. A Good (But Not ‘Perfect’) Credit Score

Having a decent credit score is another requirement for VA loans. But you don’t necessarily need perfect credit in order to qualify for this particular program.

The Department of Veterans Affairs does not impose a minimum credit score requirement for California VA loans. They leave it up to the bank or mortgage lender to determine who is “creditworthy.” So there is no hard-and-fast rule as to what credit score you need to have.

VA Pamphlet 26-7, the official handbook for mortgage lenders, explains it this way:

You must meet your lender’s minimum or standards of credit, income, and any other requirements to approve a loan. VA does NOT require a minimum credit score, but most lenders will use a credit score to help determine your interest rate and to lower risk.

A score of 600 or higher is usually sufficient for this program. But different lenders have different standards. Some might set the credit score bar higher, perhaps at 640 and above. Other lenders might be willing to go lower, as long as the borrower is well-qualified in other areas.

You should also know that the VA home loan program is one of the most flexible mortgage programs available to California military members and veterans. This is partly due to the government guarantee mentioned earlier. So don’t hesitate to apply.

4. A Manageable Level of Debt

Your current debt load can also affect your ability to qualify for a VA home loan, or any other type of mortgage for that matter.

To measure your overall debt situation, mortgage lenders use the debt-to-income ratio (DTI). This is the percentage of your gross monthly income that goes toward your monthly debt obligations.

Example: if your monthly debt payments total $1,850 and your gross monthly income is $5,500, your DTI ratio would be 33.6%. This is calculated by dividing your total monthly debt payments by your gross monthly income and then multiplying the result by 100.

The VA doesn’t set an official limit for debt levels. But they do require lenders to give applicants a closer look when their DTI ratio is greater than 41%. Specifically, they encourage lenders to identify and document “compensating factors” that might offset the risk associated with a higher DTI.

In some cases, borrowers with debt ratios above 50% can still qualify for a VA-guaranteed home loan. But the mortgage underwriter would have to scrutinize the borrower’s finances more closely in order to identify compensating factors.

Compensating factors include having a strong credit score, extra money in the bank, previous and successful homeownership experience, etc.

Key point: California VA loans have some of the most flexible DTI requirements of any mortgage program. So don’t assume you’re ineligible because of your debts. Contact Bridgepoint Funding for a personal review!

5. A Home Appraisal With Minimum Property Requirements

If you use a VA loan to buy a home in California, the property will have to be appraised before the loan can be approved. Unlike a conventional home appraisal, which mainly focuses on valuation, the VA home appraisal serves two purposes:

- It determines the current market value of the property being purchased.

- It ensures that the home meets the VA’s minimum property requirements.

Most homes that are in decent condition will clear the appraisal process without any issues, or with only minor repairs needed. But if a house needs serious work just to be livable, it probably won’t qualify for a standard VA purchase loan.

When house hunting, you might want to focus on neighborhoods that have plenty of well maintained homes. This could increase your chance for success.

Learn more about minimum property requirements.

6. A Down Payment Is Not Required in Most Cases

Unlike conventional mortgage products, VA home loans do not require a down payment. This means you could finance the entire purchase price without putting any money down.

It also means you could buy a home sooner, since you won’t have to save thousands of dollars for a down payment.

This is an important distinction that underscores the value of this program. Most mortgage programs require some kind of down payment, which can range from 3% to 20% of the purchase price. Even the popular FHA loan program requires borrowers to make an upfront investment.

Here’s how the Department of Veterans Affairs explains it in their guide for home buyers:

If you are a first-time homebuyer or have sold your previous VA-backed home and paid your loan in full, you can enjoy VA-backing on a home loan regardless of home price and without the need for a down payment.

Of course, if you want to make a down payment on your purchase, you can certainly do so. Putting some money down up front reduces the amount you have to borrow from the lender as well as your interest costs. Just know that it’s not a requirement in most cases.

We Can Answer Your Questions

Like other government-backed mortgage programs, VA home loans have a lot of rules and requirements. We’ve covered the big ones in this guide, but there are other program guidelines as well. (The official handbook for lenders goes on for more than 600 pages.)

This is why it’s so important to work with a mortgage company that’s familiar with the VA loan program. A knowledgeable and experienced mortgage professional can help you check all of the boxes necessary for loan approval.

At Bridgepoint Funding, we have helped many California military members and veterans qualify for this program. We are passionate about VA loans because they reward our brave military service members. We can answer any questions you have about this program and help you decide if it’s the right financing option for you!