In the San Francisco Bay Area, home buyers often find themselves caught up in multiple-offer…

Steps in the California Real Estate Closing Process

In California, the real estate closing process represents the final step in the home buying journey. And as a home buyer, you need to understand how it all works so you can prepare accordingly.

This guide explains the steps that take place before, during, and after the closing. We’ll also answer some of the most frequently asked questions about this subject.

What Does It Mean to ‘Close’ on a Home?

We have found that many home buyers in California only have a vague notion of what it means to “close” on a home. They know that it concludes the home buying process and finalizes the sale, but they aren’t sure exactly how.

So let’s start with some basics before we break down the process.

Definition: Closing refers to the final step in a real estate transaction. This is when ownership of the property legally transfers from the seller to the buyer, effectively ending the process.

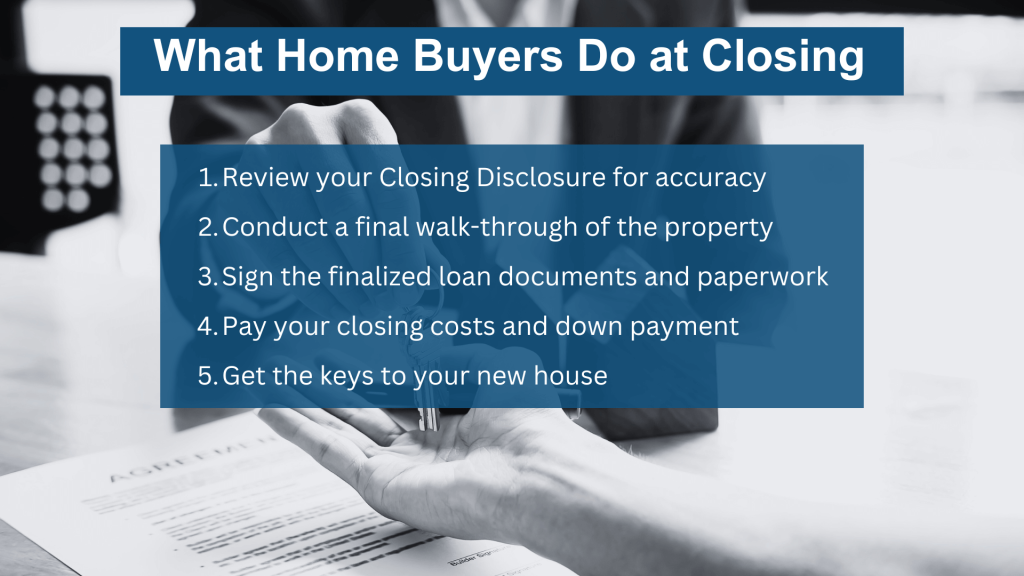

During the closing, you’ll review and sign all of the finalized loan documents and other paperwork. You’ll pay whatever closing costs and down payment are due. The property deed will be recorded with the county. And you’ll come away with the keys to your new home.

How the Closing Process Works in California

In California, the real estate closing process can vary a bit from one home buyer to the next. But it usually follows a logical sequence of events that includes the following steps:

- Pre-approval and house hunting: The home buyer gets pre-approved for a specific loan amount and begins shopping for a home within that price range.

- Offer and negotiations: The home buyer negotiates with the seller, agrees on the sale price and other important terms, and signs a purchase agreement.

- Escrow begins: The buyer deposits their earnest money into an escrow account, which is managed by a neutral third party. This account will be used up until the final closing stage.

- Underwriting and approval: The home will be appraised to determine its value, and the mortgage company’s underwriter will make sure all loan requirements have been met.

- Clear to close: When the underwriter decides that the deal is sound, he or she will label the buyer as “clear to close.” This means the loan can move on to the final closing and funding process.

- Title search: A title company conducts a title search to make sure the home doesn’t have any other liens or ownership claims against it.

- Closing Disclosure: A few days before they’re scheduled to close, the home buyer will receive a standardized “Closing Disclosure” form that outlines the final loan terms and costs.

- Final walk-through: The buyer will visit the property one last time to make sure it’s in the agreed-upon condition. This usually happens one to two days before the close date.

- Signing documents: On closing day(s), the home buyer will sign all of the required closing documents, including the mortgage note and deed of trust.

- Recording: The title company records the deed with the county, which makes the buyer the official owner.

- Key handover: With the transaction now complete, the buyer receives the keys to their new home.

In the state of California, an escrow is officially closed the day the Grant Deed is recorded in the official records at the County Recorder’s office. Property ownership transfers from the seller to the buyer when the deed is date-stamped by the County Clerk.

Reviewing the Closing Disclosure Form

You’ll have to review a variety of disclosures and documents as part of the real estate closing process, but also in the days leading up to it.

One document in particular will help you prepare for this process. It’s a standardized, five-page form known as the Closing Disclosure. This form provides important information about your loan, including the interest rate and projected monthly payments.

It also lists the finalized costs you’ll have to pay when you close on the home, with the total amount that’s due and an itemized breakdown. Be sure to carefully review this document and ask questions about anything that’s not clear to you.

A More Detailed Look at the Timeline

Let’s shift gears and talk about how long the closing process takes in California. Understanding the timeline can help ease the stress that’s typically associated with an escrow closing.

After the home has been appraised, and after all of the buyer’s financial documents have been reviewed by the underwriter, the mortgage loan officer or processor will inform all parties of the final loan approval.

At this point, the mortgage lender is ready to draw up the documents for the closing process. This usually includes the deed of trust, the mortgage note, and any disclosures or addendums the buyer needs to sign.

The time it takes to complete this step can vary. But it usually only takes one or two business days for the documents to be delivered to the escrow officer or agent.

The escrow officer is responsible for overseeing the final escrow closing process, including obtaining signatures from the parties involved. This individual will contact the buyer to set up an appointment for signing the documents.

When the mortgage lender receives and reviews all of the signed documents, they will issue funds. This is referred to as the “funding” of the loan. This process usually takes two to three business days, but can sometimes be completed one day after receipt of documents.

Bottom line: Once you’ve cleared the mortgage underwriting process, the closing itself should only take a few business days to a week.

Common Myths and Misconceptions

Home buyers who have never experienced the real estate closing process in California often have inaccurate notions as to how it unfolds and what it includes.

Here are some of the most common myths, misconceptions, and misunderstandings:

- It only takes one day. This is sometimes true, other times not. In California, the closing process might take one business day or several. It can vary depending on the complexity of the transaction, the escrow company’s workload, and other factors.

- The closing date is set in stone. While a real estate closing is usually scheduled for a specific date, it could be delayed due to a number of variables. If this happens to you, don’t panic. Try to remain flexible and patient, and keep in close contact with your escrow company representative.

- The buyer and seller close at the same time. In the “old days,” this used to be true. The buyer and seller would sit together in a conference room, awkwardly waiting to sign their paperwork. Today, the buyer’s and seller’s closing process can occur separately. It can even be handled remotely, due to e-signature platforms and other technologies.

- I’ll be rushed and pressured. You should never feel rushed during the closing process. There’s too much on the line. A reputable and experienced escrow agent will guide you through the process, taking as much time as needed to answer your questions. Don’t sign any documents until you fully understand what they are.

- Home loans frequently fall through at closing. This is actually a rare occurrence. Closing happens after the mortgage underwriting process (an in-depth and comprehensive review). So once you receive a green light from the underwriter, you will likely be able to close successfully. It’s unusual for major problems to arise during the closing.

Contact Us if You Need a Loan

At Bridgepoint Funding, we pride ourselves on our ability to deliver a smooth, problem-free closing process. We know it’s important for you to close on time, so we do everything within our power to make sure that happens. Please contact us if you would like to apply for a loan, get a rate quote, or get straight answers to your mortgage-related questions!