This article is part of the Bridgepoint Funding "City Series," where we explore key cities…

Our 2023 Year in Review for the California Real Estate Market

With the new year only three weeks away, we thought it would be a good time to take a look back at how the California real estate market has changed during 2023.

By analyzing and reviewing housing market trends of the past year, we can gain a better sense of what the market might be like in 2024. This kind of knowledge could help home buyers make better informed decisions along the path toward homeownership.

With that in mind, here is our “2023 Year in Review” for the California real estate market.

California Real Estate Market Year in Review 2023

A lot of the changes we have seen over the past year or so came in response to the pandemic-fueled home buying frenzy of 2021 and 2022. During 2023, the California real estate market cooled down and settled into a kind of “new normal.”

Along the way, mortgage rates rose to a 20-year high, home prices declined a bit, and the overall pace of home sales slowed considerably.

Now, as we wrap up 2023, we are seeing some rays of light for home buyers across the state of California. These include lower mortgage rates and the prospect of more inventory coming onto the market in 2024.

Here is a look back at some of the most noteworthy trends of 2023, which could also affect the market going forward:

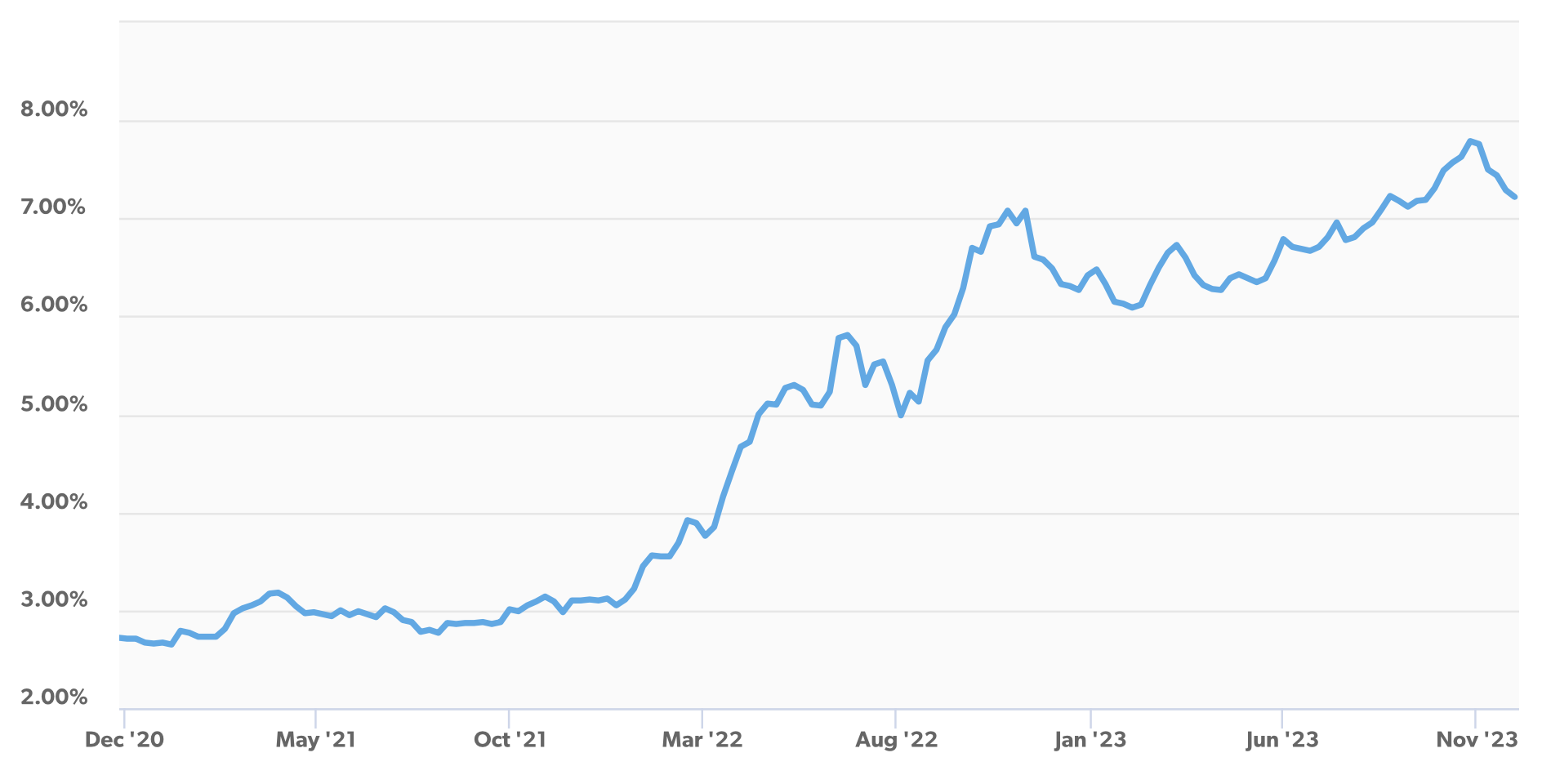

1. Mortgage rates peaked in 2023 but are now easing.

In late October of this year, the average rate for a 30-year fixed mortgage loan peaked at around 7.79% according to Freddie Mac. That was the highest average for mortgage rates in more than 20 years.

This was one of the most important housing market trends of 2023, because it had a significant cooling effect here in California and elsewhere across the nation.

But there’s a ray of light here as well.

Over the past several weeks, mortgage rates in California and nationwide have been trending downward. You can see the start of this more recent trend on the right side of the following chart, provided by Freddie Mac.

When this article was published, during the first week of December 2023, mortgage rates were averaging 7.2% for a 30-year fixed home loan.

(Side note: The 30-year fixed is by far the most popular type of mortgage loan here in California and elsewhere across the U.S. That’s why you see it mentioned so often in housing market news reports.)

According to a November 2023 report from the mortgage buyer Freddie Mac:

“Market sentiment has significantly shifted over the last month, leading to a continued decline in mortgage rates. The current trajectory of rates is an encouraging development for potential homebuyers.”

2. Home sales declined due to rising rates.

In 2023, rising mortgage rates influenced another noteworthy real estate market trend in California. They led to a general decline in the number of home sales that occurred across the state.

Last month, the California Association of Realtors (C.A.R.) reported that existing single-family home sales had declined by nearly 12% over the previous 12 months.

According to C.A.R. President Jennifer Branchini: “A sizable jump in interest rates kept home sales constrained in October and will likely hamper home sales for the remainder of the year.”

Some analysts expect rates to decline further as we move into 2024, which could have a positive effect on the California real estate market next year.

Last month, the Mortgage Bankers Association predicted that the average rate for a 30-year fixed mortgage loan would drop into the mid-6% range by the middle of 2024. If rates continue to ease going forward, it could bring more buyers and sellers into the California real estate market next year.

3. California home prices began rising again in 2023.

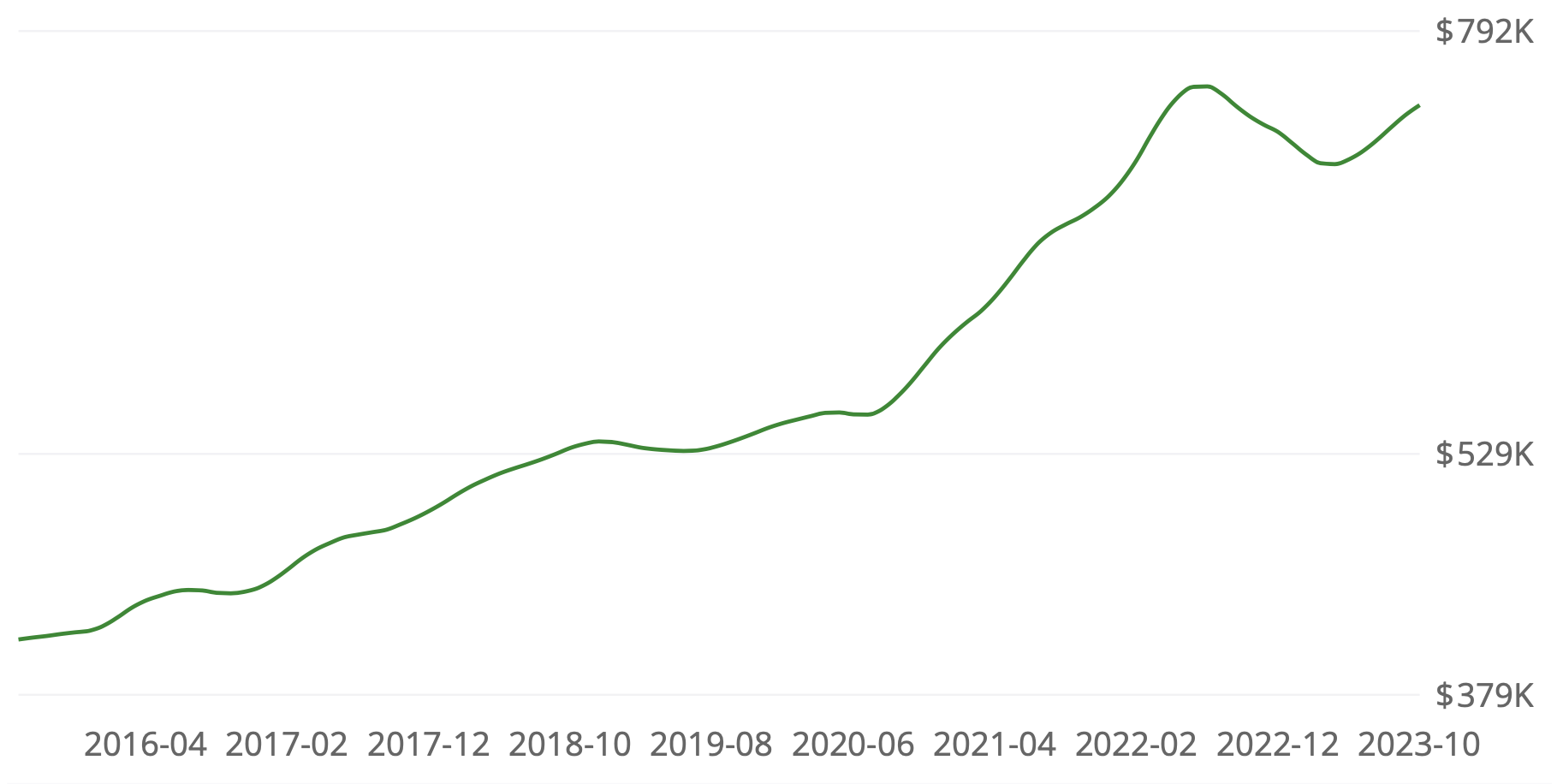

In 2023, we also saw some ups and downs for home prices in California. The statewide median home value declined through the second half of last year and into the first few months of 2023. That same trend played out in other parts of the country as well.

But for the past several months in a row, home prices have been trending upward in most parts of California.

Tight inventory conditions have led to an increase in the number of multiple-offer scenarios, in which competing buyers drive up the final sale price. This trend boosted California home prices during the second half of 2023, pushing the average house value back up to $750,000.

The chart shown above is based on home price data reported by the research team at Zillow. Several trends will jump out at you when viewing this chart:

- Home prices began to rise more quickly during the pandemic years.

- They peaked at an all-time record high during the summer of 2022.

- Prices declined for several months after that and hit “bottom” in April 2023.

- Since then, house values in California have been trending upward again.

4. Some positive signs for home buyers are emerging.

As mentioned above, mortgage rates eased a bit during the latter part of 2023. That’s good news for home buyers who are planning to enter the California real estate market in the near future.

But that’s not the only piece of good news for buyers.

The C.A.R. housing market report mentioned earlier explained that homes are currently taking longer to sell, and fewer of them are selling for more than the list price. This shows that the California real estate market has shifted in a more buyer-friendly direction during the final few months of 2023.

Granted, we are a long ways from a true “buyer’s market” and probably won’t see one anytime soon. But it’s good to see that the California real estate market is creating more opportunities for buyers to succeed, as we wrap up 2023.

5. Housing regulators increased loan limits.

We conclude our 2023 Year in Review for the California real estate market with a summary of the loan limit changes that take effect next month.

Home prices across the United States rose through most of 2023. As a result, federal housing officials increased the official loan limits for both FHA and conventional home loans. In this context, a “loan limit” refers to the maximum amount a person can borrow when using a certain type of loan product.

In California, the loan limits have been increased for FHA-insured mortgage loans as well as the conforming loans that are sold to Fannie Mae and Freddie Mac.

Here are the revised (increased) loan limits for 2024:

As you can see, the California real estate market has undergone many changes during 2023. These changes will affect home buyers and sellers next year as well. As always, we will continue to monitor housing market trends statewide and report them right here on our blog!