Home buyers tend to have a lot of questions about the mortgage underwriting process in…

California DSCR Loans: The Debt Service Coverage Ratio Explained

If you’re a real estate investor in California exploring your financing options, you’ve probably encountered the term “debt service coverage ratio,” or DSCR.

These specialized loans allow real estate investors to finance income-generating commercial and rental properties based on the property’s cash flow — rather than relying on personal income and creditworthiness.

But what is a DSCR loan exactly, and how do they work? What kinds of properties are eligible? What are the requirements, benefits, and potential downsides to this strategy?

You’ll find answers to these questions and more in our California DSCR loan guide.

What Is a DSCR loan?

A debt service coverage ratio (DSCR) loan is a type of loan that’s based on the income generated by the rental or investment property being financed, instead of personal income.

The debt service coverage ratio itself is a financial calculation lenders use to determine a borrower’s ability to repay a loan. It compares the net operating income (NOI) of the property to its debt obligations. See calculation breakdown below.

In other words: the DSCR measures how well the income generated by a particular property can cover the loan-related costs, including the principal and interest.

A traditional mortgage loan, on the other hand, is typically based on the borrower’s credit score, income, and personal debt situation.

But with a debt service-based loan, lenders are mostly concerned with the income and debts associated with the investment property being purchased. Those are the two most important components.

Calculating the Debt Service Coverage Ratio

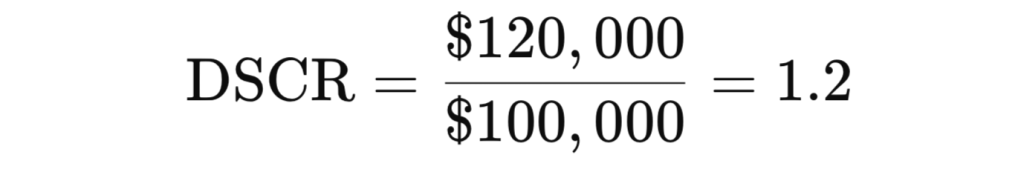

To calculate a DSCR, California lenders will divide the net operating income (NOI) of the property by the debt service (principal and interest payments) on the loan. In other words, the debt service coverage ratio is calculated by dividing the annual rental income by the annual debt obligations associated with the property.

This helps lenders determine whether the property generates enough income to comfortably cover its debt obligations.

Example: If a property has an NOI of $120,000 per year, with an annual debt service of $100,000, the DSCR would be 1.2. The math in this case looks like this: 120,000 ÷ 100,000 = 1.2.

And the formula for calculating the DSCR looks like this:

A DSCR of 1.2 or higher is generally considered to be a good indication that the borrower will be able to repay the loan. It shows that the property generates enough income to cover the loan payments, while also leaving a margin of safety for the borrower.

General guidelines for DSCR acceptability in California:

- A DSCR of 1 means that the property generates just enough income to cover the debt payments.

- A DSCR greater than 1 indicates that the property generates more income than needed for debt payments, suggesting a safer investment.

- A DSCR less than 1 indicates that the property does not generate enough income to cover its debt payments, which can be a red flag for lenders.

This type of analysis can vary from one lender to the next. So don’t be discouraged if your debt service coverage ratio is only slightly higher than 1. It’s still worth having a conversation.

Types of Borrowers Who Use These Loans

DSCR loans provide specialized financing for a specific type of borrower. Because of this, regular home buyers who are buying a house they plan to live in rarely use them.

In California, DSCR loans are most commonly used by real estate investors, commercial property owners, and multi-family property investors.

They are drawn to this product because of the flexible qualification process, which relies more on the property’s income potential than the borrower’s credit history.

Characteristics of These Borrowers

- Income Focused: These borrowers are primarily concerned with the income-generating potential of the property. They look for properties that can produce steady and reliable cash flow.

- Experienced Investors: Many DSCR loan borrowers have experience in real estate investment and are familiar with managing rental properties and the associated financials.

- Long-Term Vision: These borrowers typically have a long-term investment horizon and seek properties that will appreciate in value and generate income over time.

Why They Choose DSCR Loans

Home buyers and investors choose the debt service coverage ratio loan strategy for a wide variety of reasons. But it usually comes down to one or more of the following factors.

- Qualification Based on Property Income: Loan approval largely depends on the property’s projected rental income and the Debt Service Coverage Ratio (DSCR), as explained above.

- Less Emphasis on Personal Finances: The borrower’s personal income and debt-to-income ratio (DTI) play a lesser role in qualification, when compared to traditional mortgage loans.

- Suitable for Non-Owner Occupied Properties: This is a significant advantage for California real estate investors who focus on purchasing income-generating rental properties.

- Flexibility for Experienced Investors: DSCR loans can be a valuable tool for investors with complex financial situations or those seeking to expand their portfolios. Some lenders even offer portfolio DSCR products that allow investors to finance multiple properties under a single loan.

In short: California DSCR loans are also a good option for borrowers who want to purchase an investment property based on the merit of the rental, rather than their personal financial or credit situation.

Types of Properties That Are Eligible

Debt service coverage ratio loans are typically used to finance income-producing commercial properties. This can include apartment buildings, office buildings, retail centers, warehouses, and industrial properties. Properties ranging from 1 to 8 units are typically acceptable, but this can vary.

These properties are typically purchased by investors and businesses with the intention of generating rental income or operating income from the property.

When it comes to DSCR loans, property eligibility can depend on a variety of other factors. This includes the property’s location, condition, type, and size. The lender will also consider the property’s cash flow and net operating income (NOI), as mentioned above. In some cases, they might also look at the borrower’s creditworthiness.

As with other aspects of the DSCR loan, the specific types of properties that are eligible can vary from lender to lender. However, most lenders will require that the property be in good condition and that it meets applicable zoning and building codes, at a minimum.

Potential Benefits of a California DSCR Loan

We touched on some of the main benefits already, when covering the types of borrowers who use DSCR loans. Here’s a recap of the primary benefits:

- Easier qualification: DSCR loans are typically easier to qualify for than traditional loans, as lenders do not need to verify the borrower’s personal income.

- More flexible terms: This type of financing can offer more flexible terms, when compared to traditional property loans. This might include longer repayment terms and lower interest rates.

- Access to capital: DSCR loans can provide investors with access to capital they might not be able to obtain through other means.

The Basic Requirements for Borrowers

The requirements for a DSCR loan will vary from lender to lender, but some common requirements include:

- Minimum ratio: Many lenders in California require a minimum debt service coverage ratio of 1.1x to 1.25x. This means the property’s income should be at least 10% to 25% higher than the debt payments. But this requirement can vary from one lender to the next.

- Property Type: DSCR loans are typically available for residential investment properties, including single-family homes, condos, and multi-family buildings (2-4 units). Some lenders may also offer loans for larger multi-family properties or even commercial properties.

- A down payment: A down payment is typically required for a DSCR loan, although the amount will vary from lender to lender. Many require at least 20% for these products.

- Property appraisal: The property will probably have to be appraised at a value that’s sufficient to secure the loan.

Note: Working with a mortgage broker like Bridgepoint Funding can increase your chance for approval. We work with multiple lenders instead of just one, to give you more options.

Potential Drawbacks and Disadvantages

As with any type of loan, there are some potential downsides associated with DSCR loans. So you’ll have to weigh the pros and cons to determine if it’s the right financing strategy for you.

Potential drawbacks for debt service coverage ratio loans:

- Higher interest rates: DSCR loans often have higher interest rates than traditional loans, as lenders are taking on more risk. When it comes to property lending, anything that increases the level of risk also increases the interest rate.

- Prepayment penalties: DSCR loans may have prepayment penalties, which can be costly if the borrower needs to pay off the loan early.

- Loss of income: If the property’s income declines, the borrower may not be able to make the loan payments, which could lead to foreclosure.

Ready to Explore Your Options?

Bridgepoint Funding can provide debt service coverage ratio loans for investors and borrowers all across California. We work with a number of different lenders, which gives us the ability to match the right product to each individual client.

If you have questions about using a DSCR loan to purchase a rental or investment property, please contact our knowledgeable staff. We look forward to helping you!