We all know the San Francisco Bay Area real estate market can be pricey. That's…

How Low Rates & Telecommuting Saved California’s Housing Market in 2020

The California real estate market, and those who depend on it for their livelihood, owe thanks to record-low mortgage rates and remote work opportunities. Those two factors turned 2020 into a banner year for the California housing market, at a time when it could have headed south.

When the coronavirus outbreak took root in the U.S., back in February and March of 2020, some people feared that the real estate market would experience a major downturn. There was a lot of “crash” talk in those days, as we entered uncharted territory.

And for the most part, those concerns were justified. Not since the Spanish Flu had we seen a public-health crisis of that magnitude. It quickly became obvious that the economy would suffer as well, with people staying home and businesses being forced to close.

Who would have imagined that the California housing market would not only survive the pandemic outbreak of 2020, but have one of its biggest years on record? More than anything else, telecommuting and record-low mortgage rates made this happen.

California Housing Market Soared in 2020, Despite COVID

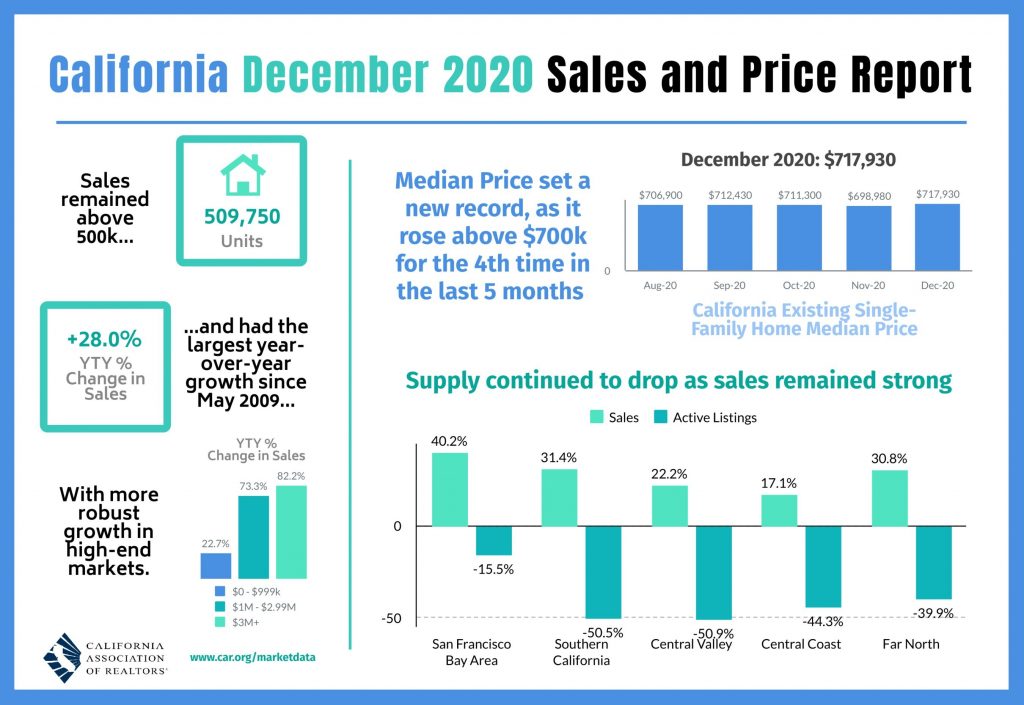

A January 2021 report from the California Association of Realtors (C.A.R.) showed that the state’s real estate market performed surprising well in 2020. Home sales were strong throughout the summer, fall and winter months, and the statewide median home price hit an all-time high.

According to a recent statement from current C.A.R. president Dave Walsh:

It’s a testament to the strength of the market that even after the pandemic effectively shut down the spring home-buying season in 2020, the market still was able to recover the substantial sales lost in the first half of the year and even top 2019’s levels.

Last month (December 2020), home sales in California were up by 28% compared to a year earlier. To put it differently, the state’s real estate market performed just as well in 2020 — when a pandemic was ongoing — as it did in 2019.

There was a slowdown in the spring, when state governments first began issuing lockdowns. But for the rest of the year it was up, up, and away.

The infographic above comes from a recent C.A.R. news release. It shows home sales and price trends during the month of December 2020. It also shows how strong the California housing market was last year, in terms of both sales and price growth.

Hard to believe all of this was occurring during a pandemic and economic downturn!

Low Rates Led to a Record Year for Mortgage Volume

Home sales trends and mortgage loan volume tend to go hand-in-hand. After all, most people who buy a house use a mortgage loan to help cover the cost. So it’s no surprise that 2020 was also a big year for the mortgage industry.

In fact, 2020 was bigger than any previous year, in terms of total loan origination volume.

According to a January 14 report from the research team at Freddie Mac:

The low mortgage rates, increasing home sales, and increasing house prices have also given a boost to mortgage originations. Total mortgage originations are forecast to hit a historical high of $4 trillion in 2020, with refinance originations projected to hit nearly $2.6 trillion and purchase originations to hit $1.4 trillion.

The “low mortgage rates” part of this quote is something of an understatement. The average rate for a 30-year fixed mortgage loan dropped steadily throughout 2020, setting record after record.

And rates are still very low. In fact, they hit an all-time record low during the first week of January, when the average rate for a 30-year home loan sank to an incredibly low 2.65%.

This partly explains how the California housing market was able to survive the coronavirus pandemic during 2020. Record-low rates encouraged home buyers to get off the sidelines and into the market.

Remote Work and Telecommuting Helped Sustain the Market

There’s another important part of this story. Telecommuting. Many of the buyers who purchased homes in California during 2020 were able to do so because of remote work. The ability to work remotely kept a lot of people employed during the pandemic, at a time when they might have otherwise been out of work.

The rise of remote working also gave a lot of people the newfound freedom to relocate to other areas. Companies across California found they were able to continue operations by allowing their employees to work from home. This is especially true for the tech, financial services, marketing, and other computer-based industries that don’t require as much “hands-on” work.

The California housing market got a big boost in 2020 from people buying homes that were better suited to a remote-working lifestyle. Additionally, many home buyers fled crowded downtown areas in favor of more suburban and rural areas.

Suddenly, a lot of people wanted home offices and yards, along with more square footage. This boosted sales activity and helped the California housing market avoid a major downturn in 2020.

According to the Freddie Mac report mentioned above:

These low interest rates and the ability to work remotely have continued to support the demand for housing, which is reflected in home sales reaching levels not seen since 2006.

It was these two factors — historically low mortgage rates and the increased ability to work from home — that shielded the California real estate market from the coronavirus pandemic in 2020. And to end on a positive note: We will probably see more of the same in 2021.

Mortgage rates are expected to remain fairly low for most of this year. Remote working isn’t going anywhere anytime soon. And people are still putting a premium on homeownership. So 2021 could be another strong year for the California housing market.