As a California-based mortgage company, we do our best to educate home buyers about real…

Q&A: Can I Buy a House in California With Just 5% Down?

First-time home buyers in California tend to have a lot of questions when it comes to down payment requirements. We’ve covered some of those questions in the past. Today, we will address another common query:

“Can I buy a house in California with 5% down?”

The short answer is yes, it’s entirely possible to buy a house in California with a 5% down payment.

There are some situations where a larger investment might be required, including borrowers who need to use a “jumbo” loan for a more expensive purchase. But for the most part, a 5% down payment is sufficient.

But First: Busting the 20% Down Payment Myth

We’ll circle back to the 5% down payment options in a moment.

But first, we need to debunk one of the most persistent (and unfortunate) myths relating to down payments in California.

Many surveys over the years have shown that a significant number of home buyers believe that all mortgage loans require at least 20% down.

As you’ll soon see, however, home buyers in California have several financing options that allow for a much smaller upfront investment—less than 5% in some cases.

There are some clear benefits to putting 20% down on a home purchase. They include a smaller monthly payment, a lower interest rate, and the ability to avoid paying mortgage insurance.

But the average home buyer in California doesn’t need to put that much money down.

Buying a Home in California With 5% Down

For most home buyers in California, saving enough money for a down payment is the hardest part about buying a home. This is especially true for first-time home buyers, who do not have profits from a previous sale to put toward their next real estate purchase.

The truth is that most residents in the Golden State cannot afford to make a 20% down payment (the threshold we often see in news reports). To understand why it’s so challenging, we simply have to plug in some numbers.

- Median home value in California as of 2024 = $773,000

- A 20% down payment at that price point = $154,600

Some home buyers have that kind of money in the bank, but most do not. In fact, for an average earner in the state of California, it could take years to save $154,600. And some people could never reach that target.

Fortunately, many home buyers in California can qualify for a mortgage loan with a down payment in the 3% to 5% range. This can be done with both conventional and government-backed financing.

Option 1: FHA-Insured Mortgage With 3.5% Down

The FHA home loan program is one mortgage option that allows home buyers to put down 5% or less. Specifically, this program requires borrowers to make an investment equaling at least 3.5% of the purchase price or appraised value.

FHA loans are a kind of government-backed mortgage program. The lenders that offer them receive some degree of insurance protection from the federal government. As a result, the FHA loan program tends to have more flexible qualification criteria, when compared to regular mortgages.

According to the official handbook for FHA loans:

“In order for FHA to insure this maximum mortgage amount, the Borrower must make a Minimum Required Investment (MRI) of at least 3.5 percent of the Adjusted Value.”

For a standard home purchase transaction, the “adjusted value” is usually the lesser of the purchase price or the appraised property value.

Example: If you were buying a home in California valued at $600,000, you would probably have to put down at least $21,000 for an FHA loan. (The math: 600,000 x .035 = 21,000.)

So that’s one way you could buy a house in California with a 5% down payment. Let’s shift gears now and talk about conventional financing options that offer a low upfront investment.

Option 2: Conventional Financing With 3% – 5% Down

A conventional mortgage loan does not receive any kind of government backing or insurance. That makes it different from the FHA loan program we talked about above.

But these mortgage loans also allow California home buyers to buy a house with 5% down, or less.

Some of the home loans that are purchased by Freddie Mac and Fannie Mae allow for a loan-to-value (LTV) ratio up to 97%. That means the borrower could invest as little as 3%, and still qualify for financing.

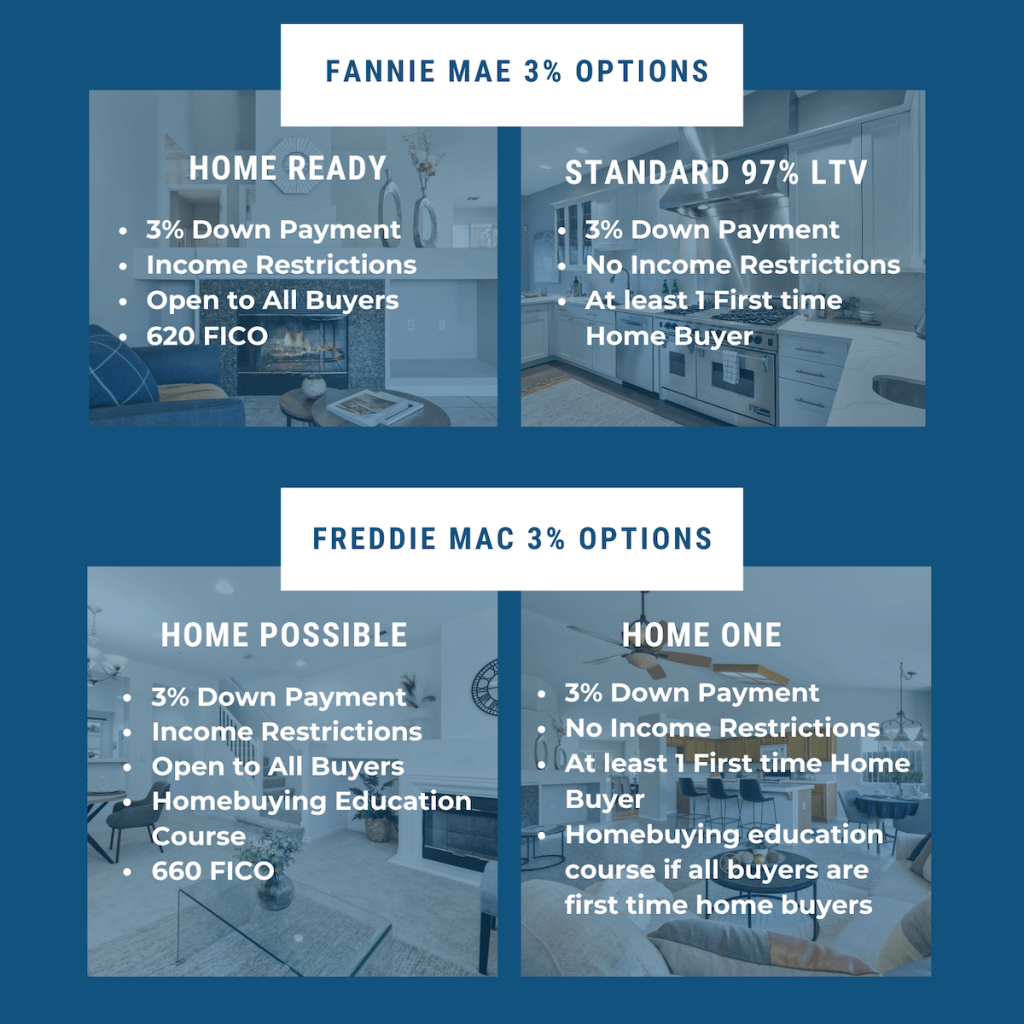

Fannie Mae and Freddie Mac both offer two different products with a down payment below 5%. But these programs can be a bit confusing, because they’re geared toward different types of borrowers.

The following graphic explains their key features and requirements.

So, conventional financing is another good option for home buyers in California who can only afford to put down 5% on a purchase.

Even if you use a “regular” conventional loan (that’s not part of the four programs outlined above), you could potentially qualify for 95% financing and a 5% down payment.

Option 3: Using a VA Home Loan With 100% Financing

If you are a military member or veteran buying a home in California, you might qualify for the VA loan program. This is another example of a government-backed mortgage. It’s managed by the U.S. Department of Veterans Affairs.

VA loans allow borrowers to buy a house with no down payment whatsoever. You could put 5% down if you wanted to, and that would reduce the size of your monthly payments. But it’s possible to finance up to 100% with a VA loan — a major benefit over other mortgage options.

Trade-Off: Mortgage Insurance for Smaller Investment

As with many things in the mortgage world, making a down payment of 5% comes with a trade-off.

The good news is that it allows California home buyers to buy a home with a relatively small investment. You don’t necessarily have to save up for many years to accumulate a 20% down payment.

The downside is that a down payment of 5% on a home purchase might require you to pay mortgage insurance. This is true for both conventional and government-backed home loans. The one exception is the VA loan program, which allows borrowers to finance up to 100% without paying mortgage insurance.

The FHA program requires insurance for all borrowers. And with conventional loans, private mortgage insurance (PMI) is usually required whenever a loan accounts for more than 80% of the home value.

One way to make a small down payment on a conventional loan while avoiding PMI is to use what’s known as a piggyback mortgage strategy. This is where you use two loans to finance the home purchase, with the remainder coming in the form of a down payment.

For example, a borrower might use the 80/15/5 piggyback strategy:

- First loan = 80% of the purchase price

- Second loan = 15%

- Down payment = 5%

With this strategy, you can buy a house in California with a 5% down payment while also avoiding mortgage insurance. So it’s something worth considering, if you have limited funds for the upfront investment.

Summary of Key Takeaways

We’ve covered a lot of important information in this guide. Here are seven key points you should take with you:

- It’s possible to buy a home in California with a down payment of 5%, or even lower.

- Some borrowers choose to put 20% down to avoid paying mortgage insurance (PMI).

- Additionally, jumbo loans sometimes require an upfront investment of 20%.

- But the average home buyer in California can get by with a smaller investment.

- The FHA loan program requires a minimum down payment as low as 3.5%.

- Some conventional loans allow you to finance up to 97% of the home’s value.

- Putting less money down might require you to pay mortgage insurance.

Have questions? Bridgepoint Funding offers a wide range of mortgage loan options and we serve the entire state of California. Please contact us if you have questions about minimum down payments or other financing-related topics.