Homeowners in California have several ways to convert their home equity into cash. One common…

Acceptable Work Visas for California Mortgage Loan Approval

Are you a nonpermanent U.S. resident with a work visa and want to buy a home in California? Do you have questions as to which work visas are eligible for mortgage qualification in California?

You’ve come to the right place!

As a California-based mortgage company, we do our best to educate borrowers on the path to mortgage approval and homeownership. Today, we will explain which work visas are eligible for mortgage loans in the Golden State, and what the application process involves.

Summary: A lot of temporary visa holders in California are fully eligible for mortgage financing. This includes specific visas like H-1B, L-1, E-1 / E-2, and TN. But like any other borrower, you will need to meet the mortgage lender’s minimum requirements for down payment, income, and other checkpoints.

What Are Work Visas?

Work visas are legal documents issued by the U.S. government that authorize certain foreign individuals to live and work temporarily in the country. Each visa type has specific eligibility requirements, duration of stay, and renewal options.

Work visas usually have an alphanumeric designator along with a more descriptive name. For instance, the H-1B visa is intended for “Temporary Workers in a Specialty Occupation,” while the L-1A is reserved for an “Intra-company Transferee” who holds an executive or managerial role.

Some of the most common types of work visas include:

- H-1B: Specialized occupations (e.g., engineers, scientists, IT professionals)

- L-1A/L-1B: Intracompany transfers for executives and managers

- O-1/O-2: Individuals with extraordinary ability in various fields (e.g., arts, entertainment, science)

- E-1/E-2: Treaty traders and investors from countries with trade agreements with the U.S.

- TN: Professionals from Canada and Mexico under NAFTA (now USMCA)

Visas Eligible for California Mortgage Financing

You do not need to be a U.S. citizen to qualify for a mortgage loan California. In fact, many foreign nationals and nonpermanent residents can qualify for a home loan in the Golden State.

But they must be able to (A) prove their residency status with an official work visa and (B) meet the minimum requirements for their chosen loan program.

According to the U.S. credit-reporting bureau Experian:

“The process of qualifying for a mortgage is similar to what U.S. citizens experience if you’re a permanent resident with a green card or a non-permanent resident with a work permit or valid work visa. That’s because a lawful resident of the U.S. is eligible for a mortgage on the same terms as a U.S. citizen, according to standards published by Fannie Mae and Freddie Mac—the government-sponsored enterprises that guarantee most mortgages originating in the U.S.”

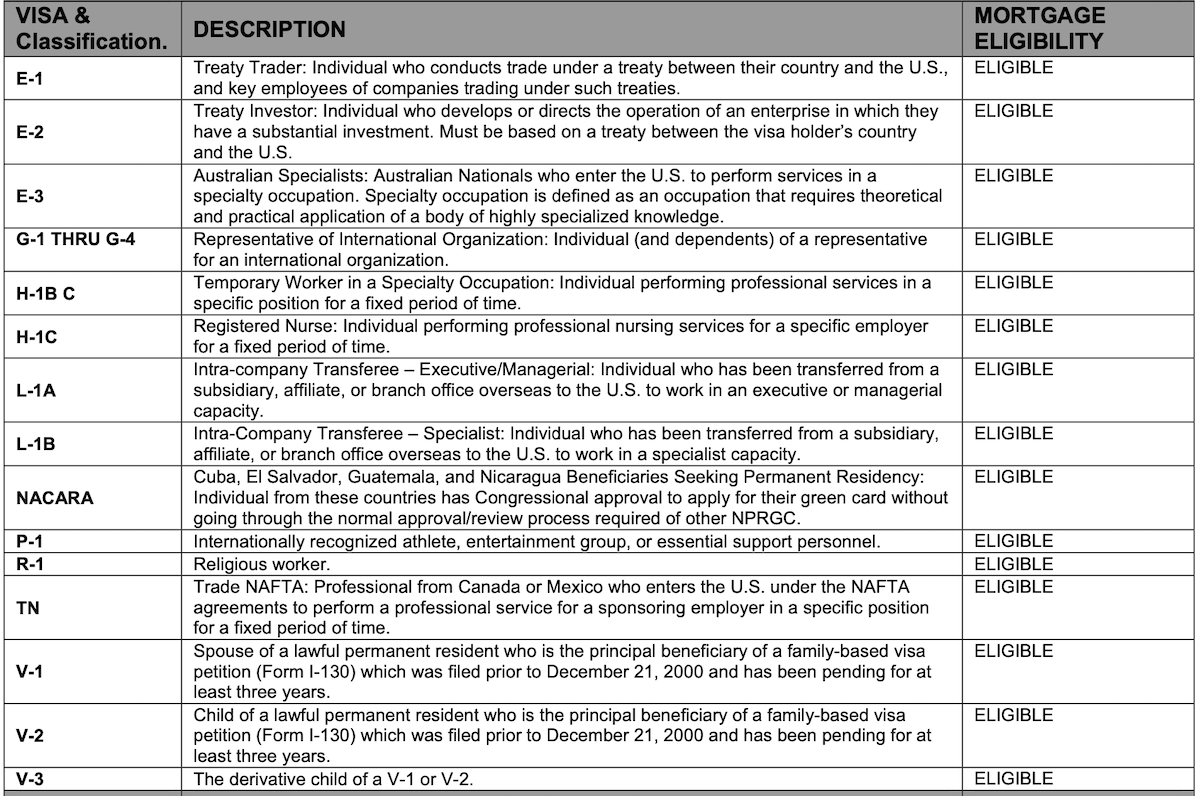

Work visas that are almost always eligible for a California mortgage loan include: E-1, E-2, E-3, G-1 through G-4, H-1B, H-1C, L-1A, L-1B, NACARA, P-1, R-1, TN, and V-1 through V-3.

The table below offers a more detailed description of these mortgage-eligible work visas:

Spouses and dependents of the above-listed visa holders could also qualify for a mortgage loan to buy a house in California, but only if the primary holder is also included on the loan.

For example, an L-2 resident (the spouse or dependent of an L-1A visa holder) might be eligible for mortgage financing if the L-1A holder is also named on the loan documents. Otherwise, the L-2 visa holder would likely be ineligible for financing.

Why Some Visas are Not Eligible

As you can see in the table shown above, many non-permanent U.S. residents with work visas can qualify for mortgage financing to buy a home in California.

But that doesn’t mean that all visas are acceptable. Some are ineligible and therefore not acceptable for mortgage underwriting and approval. Usually, this is because they are short-term in nature, or because the resident lacks job stability.

Temporary agricultural workers with the H-2A work visa fall into the ineligible category, as do other types of transient workers, temporary trainees, and cultural exchange participants.

It’s hard for mortgage lenders to verify and document a person’s income in some work visa situations. And as you probably already know, income verification is one of the most important parts of the mortgage qualification process. It shows that a borrower has the income needed to manage the monthly payment and repay the loan.

In summary, some work visas are acceptable for mortgage funding in California, because they are considered more stable with a higher likelihood of repayment. Other types of visas are less stable from an income standpoint and therefore not acceptable for financing purposes.

Income Stability and the Ability to Repay

When mortgage lenders consider loan applications, they review and verify a variety of factors. This can include everything from a borrower’s work history to their credit score—and more.

Non-permanent U.S. residents with work visas often do not have credit scores. In such cases, the lender will focus on the borrower’s work history, employment status, and income.

All borrowers who are seeking a mortgage loan in California need to have sufficient income to repay the loan. This is true for U.S. citizens and nonpermanent residents alike, and for all of the different mortgage products.

Borrowers also need to have enough money in the bank to cover their closing costs, which typically range between 2% and 5% of the home purchase price.

If your work visa is on the “eligible” list mentioned above—and you have enough income to cover your monthly payments and closing costs—you could very well qualify for a mortgage loan in the state of California.

Have questions? As a mortgage broker, we have access to multiple lenders and many different home loan products. We serve borrowers all across the state of California and frequently work with nonpermanent residents on work visas. Please contact us with your financing questions!