As a home buyer in California, you have many different options when it comes to…

Low Down Payment Options for First-Time Buyers in California

First-time home buyers in California often look for ways to make a low down payment when purchasing a house, making it a top priority. There are two main reasons for this:

- First-time buyers don’t have profits from a previous sale to put toward their purchase.

- California is the most expensive state in the U.S. in terms of average home prices.

When combined, this creates a situation where home buyers without a lot of money in the bank have to make a significant upfront investment. And that’s tall order for many people in the Golden State.

The good news: Despite common misconceptions, most first-time buyers in California don’t need to put 20% down on a home purchase. Some loan programs allow for a down payment as low as 3% to 3.5% (or even 0% if you’re in the military).

Down Payment Challenges for First-Time Buyers

Numerous surveys have shown that the down payment is the biggest obstacle to homeownership in the United States.

According to a report from the National Association of Realtors (NAR): “Saving for a down payment is the biggest obstacle to homeownership that first-time home buyers cite, and they’re looking for financial help.”

In California, buyers face even bigger challenges due to the relatively expensive nature of our real estate market. The median home price in California is currently around $790,000, compared to a national median of $360,000.

By extension, this means that the typical down payment among first-time buyers in California is a lot higher than in other states.

Mortgage Loans That Allow for a Low Down Payment

Before we continue, let’s clear up one of the most persistent myths about using a mortgage loan to buy a home in California.

A down payment of 20% is not always necessary. In fact, it rarely is.

Some first-time buyers in California choose to invest 20% or more to avoid paying mortgage insurance (more on that in a moment). And some borrowers who use jumbo loans to purchase high-end properties have to put 20% down to offset the higher risk.

But for a typical buyer in California, a down payment of that size usually isn’t necessary.

According to the NAR report cited earlier, the typical down payment among home buyers nationwide is closer to 6% — rather than 20%.

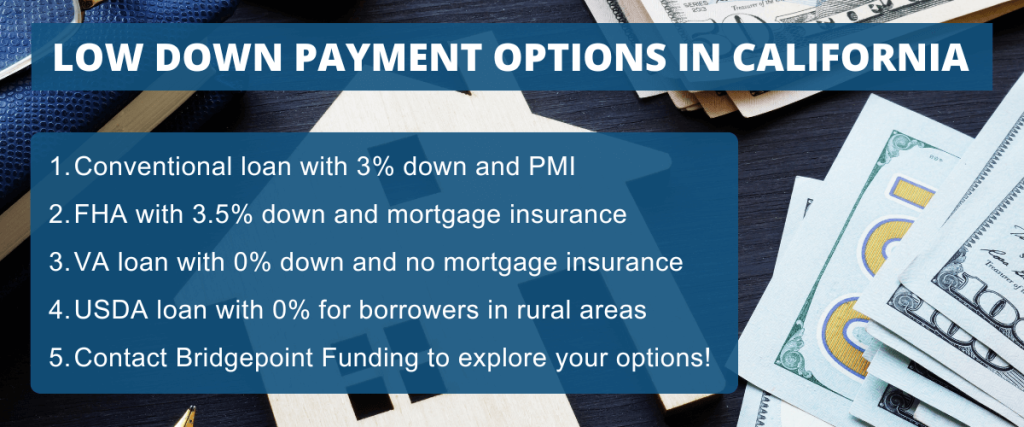

Here are some of the mortgage products and programs that allow you to make a relatively low down payment when buying your first home in California.

1. A conventional loan with a 3% down payment and PMI

A conventional mortgage loan is one that is not insured or backed by the government. This is an important distinction, because it separates these traditional or “regular” loans from the FHA and VA programs mentioned below.

First-time home buyers in California can often qualify for a conventional mortgage loan with as little as 3% down. That’s because Freddie Mac and Fannie Mae, the government-sponsored entities that purchase mortgages from lenders, allow for a loan-to-value ratio of up to 97%.

- Freddie Mac’s “Home Possible” product allows for just 3% down.

- Fannie Mae’s “HomeReady” product also allows for a 3% investment.

(You can learn more about both of these products in this related guide.)

But there’s one important caveat. First-time buyers who make a low down payment in the 3% range usually have to pay for private mortgage insurance, or PMI. This cost is added onto your monthly payments. PMI is usually required when the loan-to-value (LTV) ratio exceeds 80%.

Bottom line: Conventional loans with low down payments allow you to buy a home in California sooner rather than later, by reducing the amount of money you have to save.

2. An FHA loan with 3.5% down and mortgage insurance

The Federal Housing Administration (FHA) home loan program allows borrowers to put down as little as 3.5% on a home purchase. Because of this feature, FHA loans are particularly popular with first-time buyers in California.

To be clear, you don’t have to be a first-time buyer to qualify for this program. You could get a VA loan even if you have owned a house in the past.

But this program is especially well-suited to California first-time buyers seeking a low down payment financing option. In fact, that group makes up the bulk of borrowers who use this program.

Last year, more than 80% of FHA loans originated in the U.S. went to first-time buyers.

3. Using a VA loan to finance the entire purchase price

Are you a military member in good standing, or a veteran with an honorable discharge? If so, there is a good chance you are qualified for a VA-guaranteed mortgage loan.

This is another way for first-time buyers to make a low down payment on a California home purchase. In fact, eligible borrowers who use this program can finance up to 100% of the purchase price. That means they could avoid making a down payment entirely.

But not just anyone can qualify for this program. The Department of Veterans Affairs (VA) home loan program is limited to military members, veterans, and certain surviving spouses.

Active-duty military members can be eligible for this program with as little as 90 days of continuous service. National Guard and Reserve members can qualify after six years, or after serving 90 days on active duty.

VA loans allow first-time buyers to purchase a home with little to no money down. Borrowers can also avoid paying mortgage insurance, which is usually required when a person makes a low down payment.

If you’re currently serving or served in the past, you owe it to yourself to research the VA loan program. It offers benefits you won’t find with other mortgage options.

4. A USDA home loan with zero money down

First-time buyers in rural parts of California who meet certain income requirements could also qualify for the USDA home loan program.

Guaranteed by the U.S. Department of Agriculture, these loans are geared towards low- to moderate-income families purchasing homes in eligible areas. They allow borrowers to finance the entire purchase price with no money down, but have income restrictions and location requirements.

According to the USDA.gov website: “Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing.”

The income requirements for USDA home loans can vary based on household size, location, and other parameters. To find the limits for your area and other requirements, visit the USDA single family housing website.

What a Low Down Payment Looks Like in California

As mentioned above, the lowest down payment range available to most first-time buyers in California is 3% to 3.5%. These numbers represent the minimum investment for (A) the Freddie Mac and Fannie Mae 97% LTV mortgage programs and (B) the FHA loan program.

Here’s what a down payment in that range would look like for different home prices.

| Home Price | Down Payment (3% – 3.5%) |

|---|---|

| $400,000 | $12,000 – $14,000 |

| $500,000 | $15,000 – $17,500 |

| $600,000 | $18,000 – $21,000 |

| $700,000 | $21,000 – $24,500 |

| $800,000 | $24,000 – $28,000 |

| $900,000 | $27,000 – $31,500 |

| $1,000,000 | $30,000 – $35,000 |

The median house value in California is currently around $790,000. At that price point, even a relatively “low” down payment of 3% to 3.5% could add up to more than $20,000.

This is why so many first-time home buyers in California seek assistance to cover the upfront expense. Sometimes, people just need a little boost to clear the down payment hurdle. And this often comes in the form of gift money, as explained below.

Using Gift Money From a Third-Party Donor

First-time home buyers in California often struggle to come up with the funds needed to cover their down payments and closing costs. We can see the reason for this in the table above.

The good news is that most of the mortgage loan programs available these days allow for some flexibility when it comes to the down payment funding sources. For example, a home buyer could use money provided by a family member or other approved donor to cover their upfront expense.

A down payment gift could help you achieve your dream of homeownership sooner rather than later. With this strategy, a family member or close friend donates money to support your home buying aspirations. The funds can be applied to the down payment, the closing costs, or both.

Bottom line: By combining a low down payment mortgage with gift money from a third party, first-time buyers in California can greatly reduce their upfront, out-of-pocket expense.

Benefits of Making a Smaller Investment

There are pros and cons to making a small down payment. We covered the main disadvantage already. It requires you to pay for mortgage insurance, in most cases.

But there are plenty of upsides as well, and they include the following:

- Clearing obstacles: The low down payment options listed above minimize what is usually the biggest hurdle to homeownership, the upfront investment.

- Preserving your savings: Putting less money down also allows you to keep more money in the bank. You could use it to cover your first few mortgage payments, moving-related expenses, furniture, etc.

- Buying a home sooner: A smaller down payment can also shorten the path to homeownership by reducing the required upfront investment. It could mean the difference between saving for two years versus five years.

We Can Help You Explore Your Options

This article underscores the importance of exploring all of your financing options, when buying your first home in California. And we’ve really only scratched the surface here.

As a home buyer, you have many different loan options and features to choose from. The important thing is to choose the right financing option for your particular needs.

As a mortgage broker, we work with many different lenders who offer a broad range of home loan options. So, if you are seeking a low down payment mortgage program to buy your first home in California, there’s a good chance we can help you.

Please contact our staff if you have questions or would like to apply for a loan. We are located in the San Francisco Bay Area but serve borrowers all across the state!