Home buyers in California who use an FHA loan to buy a house typically have…

Using Mortgage Discount Points When Buying a Home in California

Some home buyers in California choose to pay mortgage points at closing in exchange for a lower rate. This strategy can pay off over time, by reducing the monthly payments and the total interest paid in the long term.

But what is a mortgage discount point? And when does it make sense to pay them when buying a home in California? This guide has answers to these and other common questions.

Here are five things you should know right off the bat:

- Discount points are a way to reduce the interest rate on a mortgage loan.

- One point equals 1% of the loan amount and typically lowers the rate by 0.25%.

- Borrowers should determine whether or not it makes sense to pay them.

- You need to consider the monthly savings and how long you plan to keep the loan.

- This will help you determine the “break-even” where the points begin to pay off.

Paying Mortgage Discount Points in California

Borrowers in California often choose to pay points at closing in order to secure a lower interest rate on their mortgage loans. They’re also referred to as “discount points,” because you’re paying for a discounted or reduced interest rate.

With this strategy, you are giving the lender some cash upfront to get a lower rate over the long term. So it’s an upfront investment that could lower your long-term costs, depending on how long you stay in the home.

Within the context of mortgage lending, one “point” equals 1% of the loan amount. For instance, on a California home loan of $600,000, one point would come out to $6,000.

On average, a single discount point will reduce the mortgage rate by a quarter of a percent (0.25%). But this amount can vary, so be sure to ask your lender for specifics.

When Does It Make Sense to Do This?

We’ve covered the basic definition of a mortgage discount point: It equals 1% of the loan amount. It’s a way to reduce your interest rate and possibly enjoy significant savings over time.

Next, let’s do some basic mortgage math to illustrate when it makes sense to pay discount points — and when it doesn’t.

To decide if points will work to your advantage, you’ll need to determine the break-even point based on your specific loan parameters.

Definition: The break-even point is the amount of time it will take for the savings from a reduced monthly mortgage payment (due to the lower interest rate) to offset the upfront cost of those points.

At its core, determining the break-even point boils down to just two key pieces of information:

- How much you’ll save per month with the reduced interest rate (monthly savings).

- How much you’ll pay upfront for the discount points (total cost of points).

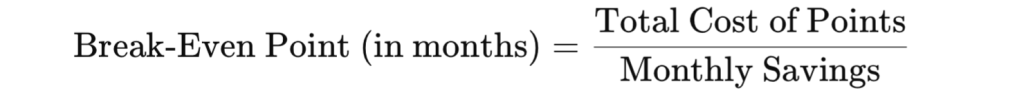

With these two numbers, you can calculate the break-even point using the simple formula:

This formula tells you how many months it will take for the savings from the lower monthly payments to equal the additional upfront cost. Once you know this, you can decide if paying points is worth it based on how long you plan to stay in the home.

This will make more sense if we plug in some realistic numbers. So let’s do that!

Example: Calculating the Break-Even Point

Here’s an example that shows how to calculate the break-even point:

- Loan amount: $600,000

- Initial interest rate: 7.2%

- Interest rate after paying two points: 6.8%

- Monthly payment without points: $3,404

- Monthly payment with points: $3,304

- Amount of money saved each month: $100

- Upfront cost of points: $12,000

- Break-even point: 10.8 years

In this scenario, paying two points lowers the monthly payment by $100. But it also costs the borrower $12,000 upfront.

The break-even point is 10.8 years. So, if the homeowner stays in the home for at least 10.8 years, they’ll end up saving money by paying points. But if they plan to move sooner than that, they might not recoup the cost.

Pros and Cons of Mortgage Discount Points

There are pros and cons to using mortgage discount points on a California home purchase. It’s basically a trade-off. You’re paying more money upfront to save thousands of dollars over the long term. So let’s explore both sides of this trade-off.

Pros: A Lower Interest Rate

When you buy discount points, you are essentially prepaying some of the interest that you would otherwise have to pay over the life of the loan. This lowers your interest rate, which in turn lowers your monthly mortgage payments.

The amount of interest rate reduction that you can get by buying discount points depends on a number of factors. These variables can include current market interest rates, the type of mortgage loan you are using, and the lender you choose.

Generally speaking, you can expect to lower your interest rate by about 0.25% for each point that you buy. Two points would reduce the rate by 0.5%, and so on.

A California homeowner who keeps the same mortgage loan for many years could save thousands of dollars in total interest charges by using points. You pay interest on each of your monthly payments. So when you secure a lower rate, the savings tends to accumulate over time. The longer you keep the loan, the more you can benefit.

Pro: Smaller Monthly Payments

Your interest rate is one of the four primary components that make up your monthly payments. In a typical home loan scenario in California, the mortgage payments are comprised of:

- The principal amount borrowed

- The interest rate assigned to the loan

- Property taxes assessed on the property

- Insurance-related costs

If you secure a lower interest rate by using mortgage discount points, you can also reduce the size of your monthly payments. And those savings will add up over time.

Con: Added Upfront Costs

The cost of points is typically expressed as a percentage of the loan amount, such as 1 point or 2 points. For example, if you have a $600,000 mortgage and you buy one point, you will pay $6,000 more at closing.

This additional upfront cost might be cost-prohibitive for some California home buyers, especially those who are already struggling to come up with a down payment.

If you only have enough money to cover your down payment and closing costs, then the point strategy probably won’t work for you. That’s because it would require you to pay extra at closing.

But if you can afford this extra upfront cost and plan to stay put for a while, points might work to your advantage.

Con: Might Not Pay Off if You Sell or Refinance

If you sell or refinance your home within a few years of buying it, you may not have enough time to recoup the cost of the points. We talked about the break-even point earlier. If a homeowner sells or refinances before reaching the break-even, they won’t realize any savings.

Again, the goal here is to save more money over the long term than the extra amount you pay up front to purchase points.

This strategy tends to work best for homeowners who are planning to stay put for a long period of time, or at least beyond five or six years. If you sell or refinance the home too soon, you could defeat the whole purpose of using discount points.

Con: Reduces Your Available Cash

Paying extra for points also reduces the amount of cash you have available for other expenses, such as a down payment, closing costs, furnishings, or home improvements.

The Key: Considering Your Long-Term Plans

Your long-term plans are the key to all of this.

Ideally, you would hold onto the loan long enough to reach your break-even point, accumulating savings thereafter. That’s the key to using the mortgage point strategy in California.

Additionally, you need to consider your cash reserves. When you pay points up front, you are reducing the amount of cash you have on hand.

If you have plenty of additional funds or reserves, this might not be a concern for you. On the other hand, if those extra points are going to wipe out your savings, you’ll want to tread carefully.

Want to learn more? We can show you a breakdown of your estimated monthly payments both with and without points, to identify the break-even point. Please contact our staff with your questions or to receive a quote.